Crypto ETPs rebound with over $1 billion in weekly inflows prior to latest price slump: CoinShares

Global crypto investment products managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares witnessed net inflows of $1.07 billion last week, according to CoinShares' data.

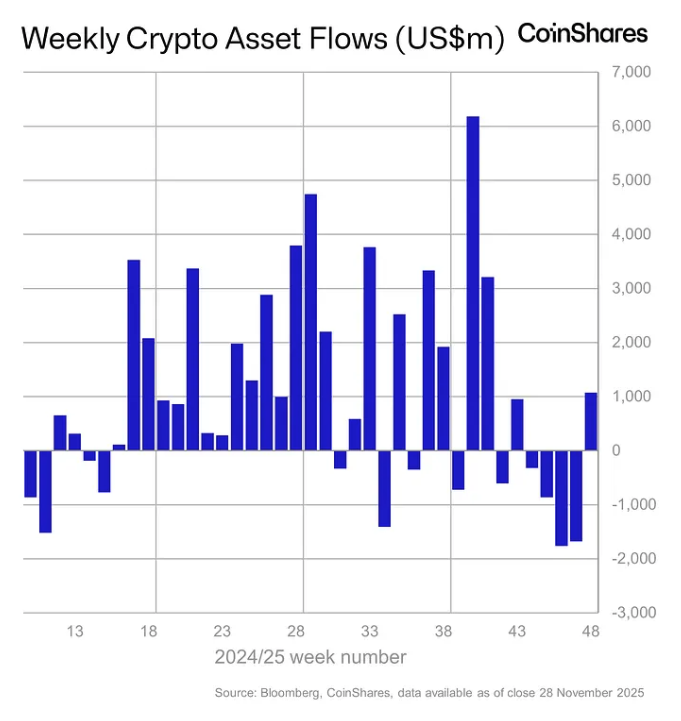

That marked a turnaround in sentiment following four consecutive weeks of net outflows totaling $5.7 billion, helped by hopes of an imminent U.S. rate cut following comments from FOMC member John Williams stating monetary policy remains restrictive, CoinShares Head of Research James Butterfill noted in a new report.

However, that came before bitcoin dropped by more than 5% early Monday, with the broader crypto market seeing amplified losses amid reports that the Bank of Japan is considering rate hikes in December. It also wasn't enough to prevent a negative month overall, with a total of $3.2 billion exiting global crypto funds during November.

Meanwhile, crypto ETP trading volumes fell to around $24 billion last week, in stark contrast to the record $56 billion the week before — likely due to the U.S. Thanksgiving holiday, Butterfill noted.

Weekly crypto asset flows. Image: CoinShares.

US dominates despite holiday lull

Despite the Thanksgiving holiday, the U.S. continued to dominate weekly flows, with crypto funds in the country adding $994 million alone last week. Digital asset investment products in Canada and Switzerland also notched notable inflows of $97.6 million and $24.6 million, respectively, while Germany was one of the only countries where crypto funds witnessed net outflows, with $55.5 million worth of redemptions.

Bitcoin-based ETPs again led the flows in terms of the underlying asset, adding $461 million last week, with investors reversing bets on further price declines as indicated by the $1.9 million outflows in short-bitcoin ETPs, Butterfill argued.

The U.S. spot Bitcoin exchange-traded funds generated $70.1 million worth of net inflows last week amid the holiday lull, according to data compiled by The Block. That was led by around $230.5 million of inflows into Fidelity's FBTC, offset by substantial outflows from other funds.

Ethereum products also fared better, witnessing net inflows of $308 million globally last week, with the U.S.-based spot Ethereum ETFs accounting for $312.6 million, offset by outflows in other regions.

Meanwhile, XRP-based funds logged a record $289 million in weekly inflows, with their six-week streak now representing 29% of total assets under management — a surge likely tied to the recent U.S. spot ETF launches, Butterfill said.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

You May Also Like

Valour launches bitcoin staking ETP on London Stock Exchange

Optum Golf Channel Games Debut In Prime Time