ETH Price Prediction: What If Ethereum Never Dips Again? The “Infinite Demand Loop” Theory Goes Viral

The market is talking about an “infinite demand loop” where ETF inflows, heavy staking, and constant gas burn keep eating away at supply.

For traders hunting the best crypto to buy now, that story is already powerful on its own. For more aggressive investors, it is also a signal to look at payment focused DeFi project plays that can sit in front of this demand wave.

One of the loudest whispers in that group is Remittix, a PayFi token that wants to plug Ethereum style demand directly into real world payouts. Before we get to why Remittix is attractive serious investment and a Black Friday 200% bonus crowd, it is worth looking at how this “never dipping again” idea fits into any legitimate Ethereum price prediction.

Ethereum Price Prediction and the “Infinite Demand Loop”

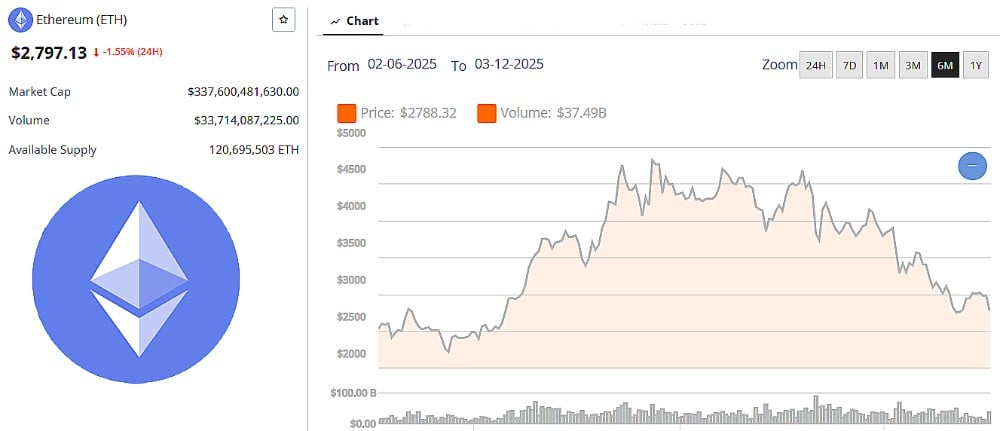

Any believable Ethereum price prediction starts with the current structure on chain. In the last three months ETH has traded as high as $4700 and seldom slipped below the $3,000 support zone. When it has, buyers have fiercely defended the $2,600 zone. Staking ratios keep rising, and gas fees from DeFi and NFT activity continue to burn ETH, which slowly shrinks the liquid supply – while demand from users and builders stays firm.

In this environment, the “infinite demand loop” describes a feedback cycle where new sources of demand steadily squeeze ETH’s supply. In this model, spot Ethereum ETFs attract fresh capital and lock those coins, taking millions of ETH off the market. At the same time, more holders stake ETH to earn yield on the proof-of-stake network, with roughly 30% of the total supply now locked in validators according to recent on-chain research.

On top of that, Ethereum’s EIP-1559 fee mechanism permanently burns a portion of every transaction fee, and this has destroyed millions of ETH since its introduction and occasionally pushed the asset into net deflation. Put together, ETF inflows, staking, and gas burn all reduce the amount of ETH that’s freely tradeable, while user demand for block space and long-term exposure either holds steady or grows.

Advocates of the “infinite demand loop” theory, believe that despite day-to-day volatility, demand for Ethereum is constant and growing – meaning the long term prognosis for ETH is permanently bullish. Price source: Brave New Coin ETH market data.

Supporters of the “infinite demand loop” argue that this structural supply squeeze underpins a long-term bullish Ethereum price prediction, even if short-term volatility and macro shocks still cause sharp drawdowns along the way.

Remittix and the Real World Side of the Demand Loop

Remittix enters that conversation as a payments first DeFi project that aims to turn on chain demand into bank payouts for people who actually move money. The team has released a mobile wallet, pushed it live in Q3, and now runs an active beta where community users test features in real conditions.

Live numbers show why urgency is building. The current RTX price is $0.119, more than 687 million tokens have already been acquired, and the amount raised has passed $28.3 million with over 30,000 buyers involved. The next stage of the presale will see the price move to $0.123, which means every day on the sidelines makes the entry window smaller and less generous for late arrivals.

Security-focused investors are also watching the trust side. The Remittix team has completed full verification with CertiK, which is widely seen as the top name in blockchain security, and the project holds the number one slot on the CertiK leaderboard for pre-launch tokens. Few early-stage crypto plays in the payments niche can show that level of scrutiny plus a live wallet and an aggressive growth push at the same time.

Remittix followers often highlight points like:

-

The product vision focuses on turning crypto balances into real bank payouts in many countries through a single, simple app.

-

The mobile wallet is already in live beta with community testers who help refine the user experience before wider rollout.

-

Verification and ranking from CertiK signal a higher level of technical and security review than most early-stage DeFi projects receive.

-

The token is positioned as a payments-first asset with low fee routes that can benefit directly when the broader Ethereum ecosystem stays busy.

For investors who believe the Ethereum price prediction story but want more than a passive hold, Remittix is starting to look like the standout way to front-run that demand loop.

Discover the future of PayFi with Remittix by checking out the project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

FAQs

What is the “infinite demand loop” behind the latest Ethereum price prediction trend?

The loop describes a cycle where ETF inflows, staking, and gas burn steadily reduce liquid ETH supply while user demand holds or grows. Many analysts believe this structure supports a long term bullish Ethereum price prediction, even if short term dips still appear.

How do ETFs affect Ethereum price prediction in 2025 and into 2026?

Spot ETFs give institutions and retail investors a simple way to buy ETH through traditional brokers. When these funds show strong net inflows, they remove coins from the market and often strengthen a positive Ethereum price prediction for the coming years.

Why are some traders calling Remittix the best crypto to buy now in payments?

Remittix combines a live wallet, active beta testing, a focus on low fee bank payouts, and full verification plus a top ranking from CertiK. The current price near $0.1166, and strong fundraising figures create a clear scarcity story that many investors find hard to ignore.

Is Remittix only for DeFi experts or everyday users as well?

The project is designed for both. Traders can buy RTX as an early stage crypto investment in a payments focused DeFi project, while everyday users get a wallet that aims to make sending money across borders feel as simple as using a normal banking app.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

You May Also Like

Obscura Brings Bulletproofs++ to the Beldex Mainnet for Sustainable Scaling

Ondas Holdings (ONDS) Stock: Why Analysts Just Raised Their Price Target to $12