Next 1000x Crypto to Buy After Bitcoin’s November Stress Test

What to Know:

- Bitcoin’s November selloff showed that DeFi and core crypto infrastructure are tougher than they look, boosting the case for real utility 1000x plays.

- Bitcoin Hyper ($HYPER) brings SVM execution and ultra low latency smart contracts to Bitcoin, aiming for high speed wrapped $BTC DeFi on a modular Layer 2.

- PEPENODE ($PEPENODE) reshapes meme coins with a mine to earn virtual node system that rewards engagement instead of blind speculation.

- Cardano ($ADA) keeps building as a research driven base layer, supported by Hydra scaling and new exposure through the Brave wallet.

Bitcoin’s November crash looked painful on the charts. Prices swung double digits in days, and every social media chart wizard acted like the sky was falling.

But under the surface, something more interesting happened.

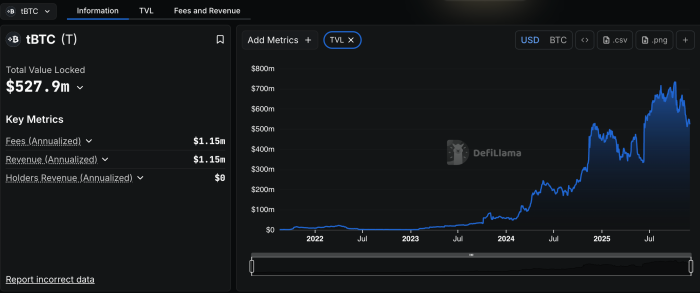

DeFi infrastructure held. Trades cleared. Liquidations worked. Yield strategies kept running. There were no chain meltdowns or domino style collapses like in previous cycles.

It was boring in the best possible way.

That resilience matters. It shows that capital is finally shifting to systems that actually work during volatility. Not the hype coins that vanish after one bad weekend, but the rails that keep the market running when the heat turns up.

If you think the next 1000x crypto to buy is the project that survives these stress tests, then you’re already looking past the usual noise.

You want speed, strong security assumptions, and tech stacks that do not explode the moment gas fees spike.Below are three new crypto projects that match that idea.

Bitcoin Hyper ($HYPER) as a bold Bitcoin Layer 2 execution engine. PEPENODE ($PEPENODE) as a mine to earn twist on memecoins. And Cardano ($ADA) as the slow and steady research chain that keeps shipping L2 capacity.

1. Bitcoin Hyper ($HYPER) – First Bitcoin L2 With SVM Execution

Bitcoin Hyper ($HYPER) calls itself the first Bitcoin Layer 2 that runs the Solana Virtual Machine.

In simple terms, it tries to bolt Solana level performance onto Bitcoin’s settlement layer. Bitcoin keeps its security. $HYPER provides the speed.

Instead of waiting for Bitcoin’s ~10 minute blocks and dealing with its limited scripting, $HYPER sends execution to a real time SVM Layer 2.

The setup is modular: Bitcoin L1 for settlement, one trusted sequencer for ordering, and an SVM execution layer that targets sub second confirmations and very low fees. It gives DeFi on Bitcoin a Solana style user experience.

Bitcoin Hyper wants wrapped $BTC to feel like a real DeFi asset. Fast payments. Tiny fees. Swaps, lending, and staking inside SVM contracts.

Even NFTs and gaming rails through Rust based SDKs. SPL compatible tokens make it easy for Solana builders to join the ecosystem.

The market seems to like the idea. The presale has already raised over $28M, and you can buy $HYPER now for just $0.013365.Staking begins right after TGE, and presale stakers get a 7 day vesting window. It’s set up for long term participation instead of quick flips.

If you think Bitcoin’s next big move comes from fast, programmable liquidity built on Bitcoin instead of moving away from it, Bitcoin Hyper is a strong high beta bet on that future.

For more context on this project, check out Bitcoin Hyper price prediction and see what the future holds.

Join the $HYPER presale now.

2. PEPENODE ($PEPENODE) – Mine‑to‑Earn Memecoin With Node Economics

November reminded everyone that most meme coins still trade like lottery tickets taped to a roller coaster.

PEPENODE ($PEPENODE) wants to change that with a mine to earn model that rewards users for running virtual nodes and being active, not just watching charts.

The core of the system is a virtual mining setup with tiered node rewards. Engagement produces tokens and higher tier nodes lead to better performance. Users track progress through a dashboard that looks more like a simple DeFi mining UI than a standard meme page.

For a project still in presale, traction is strong. $PEPENODE has raised over $2M so far, with tokens priced at $0.0011731.

The official staking program offers 578% APY, while the node reward system works as a soft yield tool, sending new supply toward active community members instead of random speculators.

Most meme coins depend on hype loops, influencers, and luck. PEPENODE brings back a touch of early DeFi mining energy. It’s gamified, but with actual rules and transparent dashboards.If you want meme upside without wandering around blindfolded, this one deserves a spot on your radar.

To dive deeper into the project, you can also check out PEPENODE price prediction and see how 2026 looks like for this memecoin.

Join the PEPENODE presale.

3. Cardano ($ADA) – Research‑Driven Base Layer With Hydra Scaling

Bitcoin Hyper tries to improve Bitcoin from the outside.

Cardano ($ADA) does the opposite. It builds its base layer slowly and scientifically, with formal methods and a layered design. Its Ouroboros proof of stake system aims for proof of work level security while staying energy efficient.

Cardano separates settlement and computation. This lets developers create more complex smart contracts without overloading the base chain.

Hydra adds Layer 2 scaling on top, letting apps run high throughput activity off chain and anchor back to the mainnet when needed.The ecosystem has been expanding in the background. Brave wallet integration now gives $ADA exposure to more than 85M users.

This brings a steady flow of potential new holders and dApp users into the Cardano world. At the same time, institutions continue exploring DeFi, identity, and real world asset ideas on Cardano.

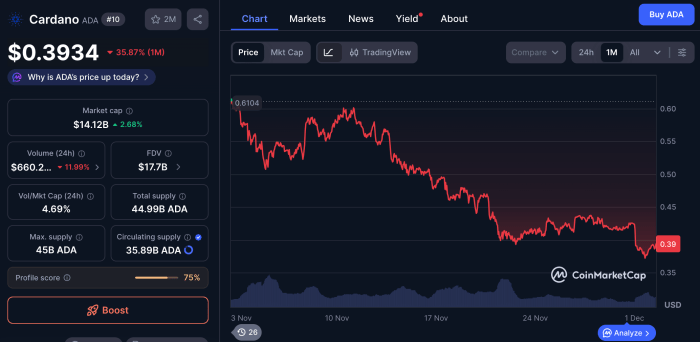

$ADA is currently trading around $0.3934, giving the network a relatively steady valuation as development keeps moving.

Cardano isn’t the loudest chain. It doesn’t shout about transactions per second every week. But its mix of formal verification, Hydra scaling, and massive user distribution makes it one of the more durable large cap platforms.

If your thesis favors slow cooking infrastructure that wins long term, ADA still belongs in the conversation.

Buy Cardano from Binance now.

Bitcoin’s November dip was more than a price correction. It was a live stress test. And the winners were the projects that kept working while everything else shook.

Recap: Bitcoin Hyper ($HYPER) pushes fast DeFi execution on Bitcoin. PEPENODE ($PEPENODE) upgrades memes with node based rewards. Cardano ($ADA) keeps compounding with research driven tech and new scaling layers.If Bitcoin’s future growth comes from tools that keep running during chaos, these three offer very different but very real ways to position early.

This article is for informational purposes only and doesn’t constitute financial, investment, or trading advice. Always do your own research (DYOR) before investing in crypto.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/news/next-1000x-crypto-to-buy-defi-recovers-after-bitcoin-crash

You May Also Like

‘Scam’ claims spread after Trump’s Super Bowl crypto donation pitch

VIPRE Security Group Positioned as a Leader in the SPARK Matrix™: Enterprise Email Security, 2025 by QKS Group