Best Crypto to Buy Now: Solana Price Prediction, Next Crypto to Explode

Solana continues to sit at the center of market attention as traders monitor its structure, short-term outlook, ETF flows, and long-term targets.

The past week delivered fresh volatility for SOL, but the latest rebound, combined with new ETF inflows, brings renewed strength to the chart.

With momentum returning, many traders now look at Solana alongside the best crypto to buy now as they plan their next moves.

This update breaks down the current setup, the reaction to key levels, the latest ETF developments, and what traders should prepare for in the coming days.

While SOL offers a high-performance Layer 1 opportunity, smart money is also rotating into high-alpha presale plays centered on the Bitcoin Layer 2 narrative for potentially outsized returns.

Bitcoin Hyper (HYPER) has emerged as a top candidate for the next crypto to explode, already raising around $28.9 million in its presale.

Source – Cilinix Crypto YouTube Channel

Solana Sees Major ETF Rebound After Vanguard Sparks New Inflows

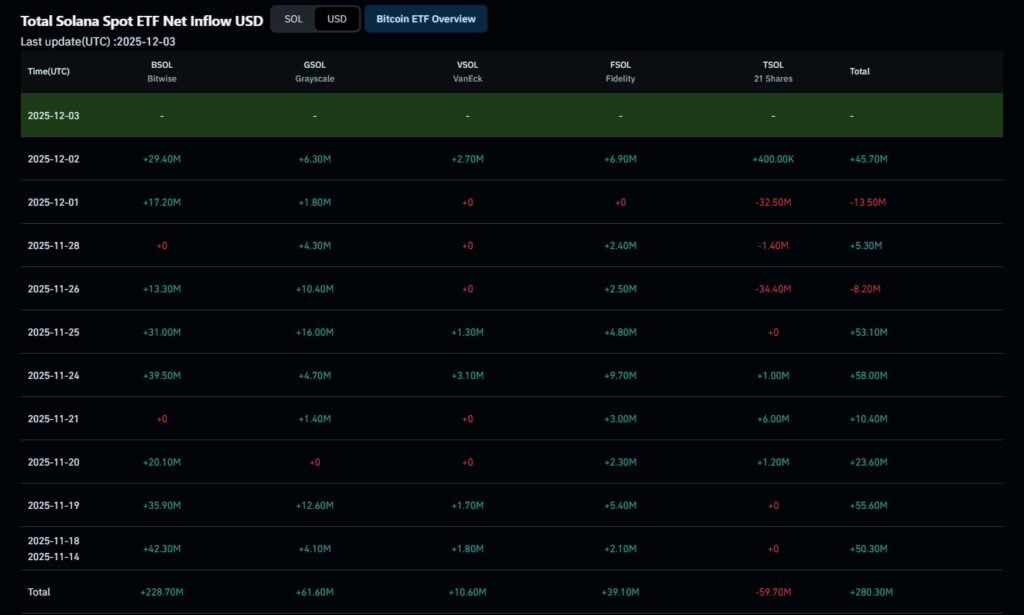

The Solana ETF narrative took a hit last week when the Bitwise Spot Solana ETF recorded its first outflows. That tone shifted yesterday when new inflows doubled the prior week’s losses.

Solana brought in roughly $45 million in fresh inflows in a single day, showing that momentum has turned strongly positive again.

This reversal likely came after news that Vanguard, the world’s second-largest asset manager, will open its brokerage platform to allow trading of select third-party crypto ETFs.

Vanguard controls enormous capital, so any move that expands access to crypto ETFs can influence flows across the entire market and boost credibility for the asset class.

Data from SolanaFloor and several dashboards show the scale of this surge and highlight strong institutional demand.

Total cumulative inflows for Solana ETFs now sit above $280 million and are rapidly approaching $400 million, with Bitwise’s BSOL driving most of the momentum and reaching $574 million in assets under management.

The inflows come from multiple issuers, not just one. Daily ETF data shows consistent green inflow days from Bitwise, Grayscale, Fidelity, and VanEck. On days when one issuer records outflows, inflows from the others offset the weakness, keeping Solana’s total ETF flow firmly positive.

This broad and resilient demand structure shows growing confidence in Solana’s long-term outlook and strengthens its position as the most successful non-Bitcoin, non-Ethereum ETF product launched in the past two years.

Solana Price Prediction

Solana (SOL) moved with the broader market, confirming a short-term bullish structure after successfully defending the support zone near $123, which matched the lows from November 21.

This defense, fueled by strong volume and SOL closely tracking Ethereum’s structure, shows clear buyer interest. However, the upward move pushed SOL straight into a heavy resistance cluster between $141 and $144.

The $144 level is critical, acting as the Point of Control since March 2024 and aligning with the 30-day rolling VWAP.

As SOL tapped this resistance, the short-term setup began to favor a pullback. Lower-timeframe charts showed bearish divergence, and four single-print imbalances sit below the current price, increasing the chance of a retracement.

A dip toward $132 looks like the most realistic near-term scenario, giving SOL room to stabilize and fill liquidity before attempting another push. Traders also need to note that funding rates have shifted back into positive territory, meaning long positions now incur funding costs.

Despite short-term pullback risk, the higher-timeframe outlook remains intact. SOL built a strong local bottom at $123, and the price still trades inside a dominant range between $123 and $180.

The first major target sits at $150 to $152, which completes the fair value gap above current price, with the next decision level at the range top between $175 and $180. Traders should treat these levels as key decision zones.

A breakout above $180 and a retest of $200 would require a strong shift in fundamentals; without that shift, the range structure remains dominant.

Solana Rally Fuels Bitcoin Hyper Presale Surge

Now that Bitcoin is steadying, confidence is rotating back into the crypto ecosystem and Bitcoin Hyper is benefiting. The project is closing in on $29 million raised in its presale as whale buyers support the “Bitcoin Renaissance” idea.

It is worth noting that while retail traders worried about Monday’s drop, on-chain data shows some whale wallets buying more $HYPER. This behavior signals that they see value here even during choppy market conditions.

Bitcoin Hyper’s pitch stays simple but ambitious. It is a Bitcoin Layer-2 network that uses the Solana Virtual Machine (SVM) to process transactions alongside Bitcoin’s main chain.

The goal is to keep Bitcoin’s security and add Solana’s speed so everyday DeFi tools like lending and borrowing can run smoothly on Bitcoin.

The development team also built smart tokenomics. They set $HYPER’s supply at 21 billion as a nod to Bitcoin and offer 40% APY staking rewards to encourage people to hold through the launch.

The next few weeks look clear. Macro headwinds continue to fade at the same time Bitcoin’s price begins to rise again. When that happens, traders usually look for higher-risk projects in presale, especially with $HYPER priced at only $0.013365.

This is also where Borch Crypto steps in, calling Bitcoin Hyper the best crypto to buy now because of its early price and strong fundamentals.

Investors who want to buy $HYPER at this stage can go to the Bitcoin Hyper presale website. Buyers can use SOL, ETH, USDT, USDC, BNB or a credit card.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Zuckerberg denies Instagram was built to hook children