Ether ETFs Set New 19-Day Inflow Record as Blackrock Drives Bitcoin ETF Gains

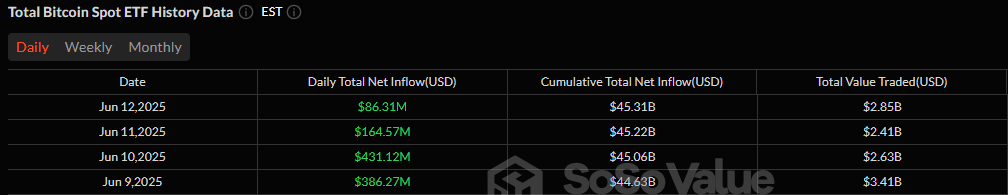

Bitcoin exchange-traded funds (ETFs) marked a fourth straight day of inflows totaling $86 million, while ether ETFs pushed their historic inflow run to 19 consecutive days, pulling in another impressive $112 million.

Crypto ETF Momentum Builds With Bitcoin and Ether Funds Posting Strong Inflows

The inflow optimism continued to sweep the crypto ETF markets on Thursday, June 12, as both bitcoin and ether funds continued attracting capital, signaling resilient investor appetite despite mixed trading activity.

Bitcoin ETFs notched their 4th consecutive day of inflows, drawing in $86.31 million overall. But the day was anything but straightforward. Blackrock’s IBIT carried the day with a $288.33 million inflow, while Grayscale’s GBTC chipped in with a modest $5.89 million.

Bitcoin 4-day inflow numbers. Source: Sosovalue

Bitcoin 4-day inflow numbers. Source: Sosovalue

These gains were heavily counterbalanced by a $197.19 million outflow from Fidelity’s FBTC and another $10.73 million exit from Ark 21Shares’ ARKB, making the day a tale of 2 halves. Total value traded for bitcoin ETFs hit $2.85 billion, with net assets closing at $130.26 billion.

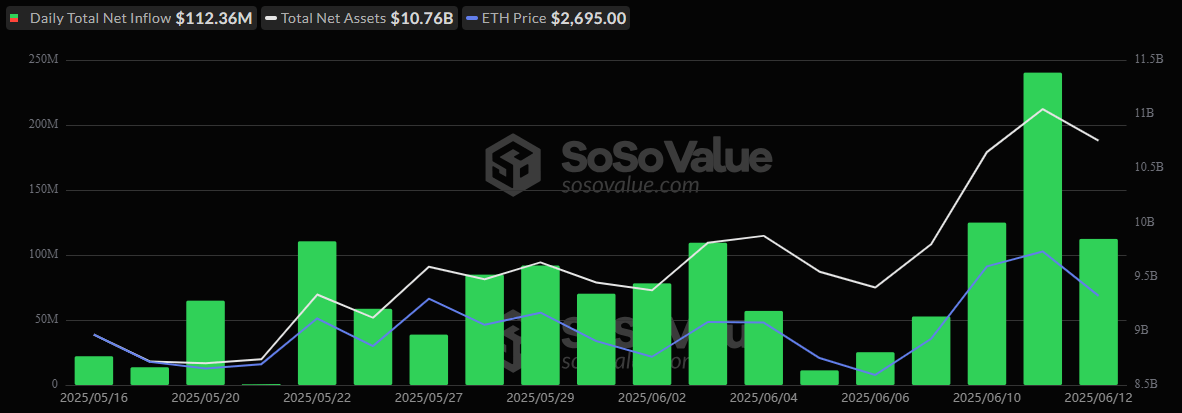

Meanwhile, ether ETFs continue to defy gravity, extending their record-breaking inflow streak to a 19th straight day. The sector saw a robust $112.36 million inflow, led overwhelmingly by Blackrock’s ETHA, which absorbed $101.53 million.

Ether ETFs 19-Day Inflow Run. Source: Sosovalue

Ether ETFs 19-Day Inflow Run. Source: Sosovalue

Fidelity’s FETH followed with a healthy $10.83 million addition. Trading volume remained elevated at $503.99 million, with total net assets climbing to $10.76 billion.

As crypto ETFs maintain their positive momentum into June, the market signals renewed institutional confidence in both bitcoin and ether products, setting the stage for a potentially strong summer ahead.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!