Octra co-founder responds to "overvaluation in public offerings" criticism: Complete technology and operational network support the latest valuation.

PANews reported on December 10th that Delphi Labs COO Kevin Simback questioned the rationale behind Octra's public offering at a $200 million valuation . He stated that over a year ago, they completed a $4 million seed round, and he estimated the valuation at that time to be at most $40 million. Now, with the valuation more than five times larger, and a TGE just a few months later, there is "almost no real demand."

In response, Octra co-founder Alex stated that he did not know Kevin Simback. He emphasized that Pre-seed's low valuation was due to the team only having a white paper and initial concept at the time, representing a typical risk premium; however, the project has now completed sandbox testing, possesses complete mathematical documentation, an open-source PoC, and a fully functional network that has been running stably for several months, thus justifying the increased valuation.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

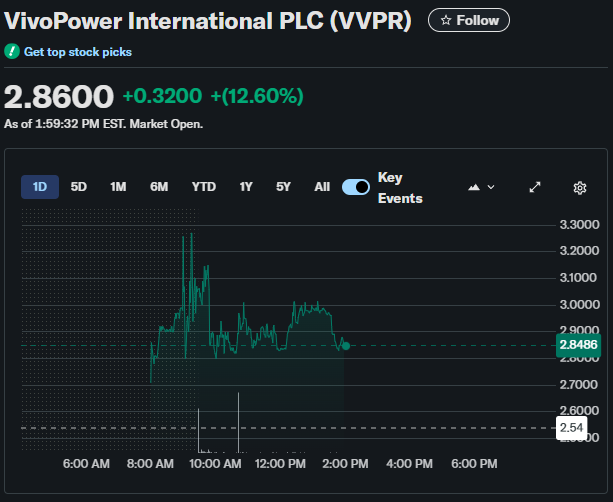

VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally