DOGE May Rally, Yet Ozak AI Forecast Is Attracting Whale-Level Millionaire Strategies

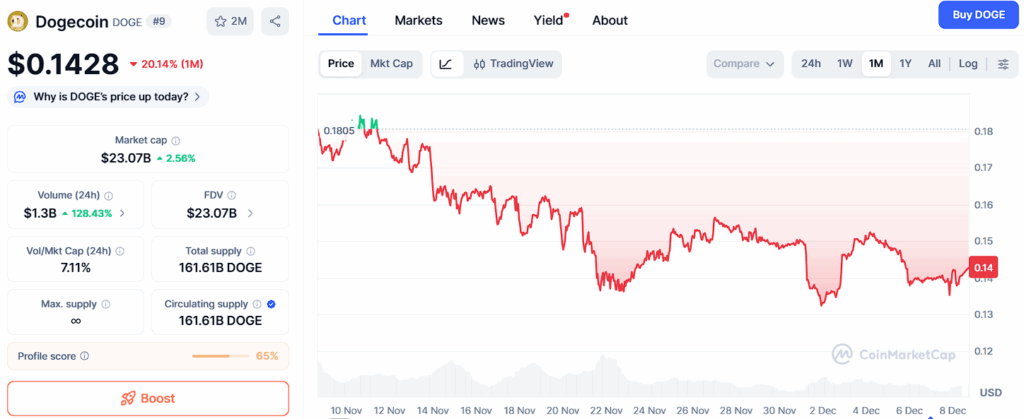

Dogecoin continues to show renewed strength as traders anticipate another notable rally during the upcoming market expansion. Its strong community presence, increasing liquidity, and recurring meme-cycle momentum keep DOGE in the spotlight, especially with fresh optimism emerging around its current structure near $0.1428.

Yet despite DOGE’s improving outlook, analysts note that whale wallets are beginning to rotate heavily into Ozak AI (OZ)—a project now considered one of the strongest millionaire-level setups heading into 2025 and 2026. With its real-time intelligence engine, millisecond predictive capability, and autonomous multi-chain AI systems already functioning before launch, Ozak AI introduces a growth model fundamentally different from cycle-dependent meme assets, making it a top choice for high-net-worth investors seeking exponential upside.

Dogecoin (DOGE)

Dogecoin trades around $0.1428 and continues forming a stable accumulation pattern supported by consistent buying interest. Support at $0.1380 anchors the trend, while deeper demand zones at $0.1325 and $0.1270 preserve long-term strength during volatility.

DOGE begins entering bullish continuation territory once the price challenges resistance at $0.1480, with higher breakout levels at $0.1550 and $0.1620 historically triggering acceleration phases across previous meme-driven surges. This structure supports the idea that DOGE can still deliver powerful upside—yet analysts highlight that DOGE remains highly dependent on hype cycles and community engagement. Ozak AI, however, operates with real-time utility that grows independently of sentiment, and this difference explains why whales are allocating early.

Ozak AI (OZ)

Analysts focusing on long-term high-ROI setups consistently place Ozak AI above traditional meme assets because it launches with a fully functioning AI ecosystem. The platform uses millisecond-speed predictive models to interpret market shifts, while HIVE’s ultra-fast 30 ms market signals feed execution-grade insights directly into Ozak AI’s real-time core. SINT-powered autonomous agents then execute strategies instantly based on cross-chain conditions, forming a continuously learning system that evolves as more data flows through the network.

This compounding intelligence effect sets Ozak AI on an exponential growth trajectory. Instead of relying on hype, it generates value from performance, prediction accuracy, integration potential, and system-wide usage—a profile that historically aligns with early-cycle millionaires and long-term breakout assets.

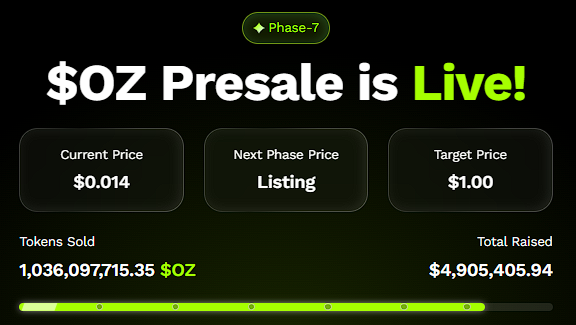

Ozak AI Presale

The Ozak AI Presale surpassing $4.9 million marks a major milestone in early accumulation behavior. What stands out most is the type of participants joining the presale. Whale wallets, early-cycle strategists, and high-net-worth participants are allocating significantly earlier than usual, often shifting capital from DOGE, SHIB, and even mid-cap altcoins to capture Ozak AI’s early-stage valuation. This pattern closely mirrors accumulation phases seen in earlier cycle winners that went on to deliver 50x–100x returns once their ecosystems expanded.

Analysts emphasize that tokens launching with real-time, fully operational utility—not post-launch development roadmaps—historically outperform narrative-driven assets by a wide margin. Ozak AI fits this profile with near-perfect alignment.

Ozak AI Takes the Lead in 2025–2026 Millionaire Strategies

DOGE may still deliver solid returns in the next bull market, and its loyal community ensures that it remains relevant during peak liquidity phases. But Ozak AI’s intelligence-driven architecture introduces something fundamentally different: compounding value, real-time performance, multi-chain predictive capability, and autonomous execution—all functioning before exchange listings.

This combination explains why analysts and whale-level strategists rank Ozak AI as the superior millionaire-building asset of the next cycle. While DOGE may rally, Ozak AI is viewed as the project with the most explosive, sustainable, and technology-backed growth potential heading into 2025 and 2026 — making it the clear frontrunner for life-changing ROI.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

- Website: https://ozak.ai/

- Telegram: https://t.me/OzakAGI

- Twitter: https://x.com/ozakagi

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this Press Release does not represent any investment advice. TheNewsCrypto recommends our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this Press Release.

You May Also Like

The Channel Factories We’ve Been Waiting For

SOLANA NETWORK Withstands 6 Tbps DDoS Without Downtime