Saylor’s MSTR Stock Hammered By Bitcoin Sell-Off: How Low Can Bitcoin Go?

The latest Bitcoin sell-off has once again reminded investors how tightly traditional equities tied to crypto can move with the BTC price. As Bitcoin crypto retraced from recent highs, Strategy shares followed almost tick for tick, wiping out weeks of gains in just days.

With BTC failing to hold key resistance levels and seasonal weakness approaching, traders are now asking a familiar but uncomfortable question. How low can Bitcoin go this time, and what does it mean for Strategy shares heading into year-end?

Bitcoin Technicals Signal Deeper Pullback Risk

From a technical perspective, the current move in Bitcoin price is far from unusual. On the 4-hour timeframe, BTC was rejected at the key resistance level defined by the 200 EMA and SMA. That retest occurred near the $94K region, where sellers stepped in aggressively and rejected a price lower.

(Source – TradingView)

The rejection has opened the door for a retest of the previous swing low around $80K. Historically, the period leading into Christmas has been one of Bitcoin’s weaker seasonal windows, with lower liquidity and reduced risk appetite. A move toward $80K by late December would align with historical norms.

Momentum indicators also warned of trouble early. A bearish divergence in the RSI signaled weakening buying pressure even as the BTC price pushed higher, as we noted previously. That divergence has now reversed, confirming that bulls were losing control.

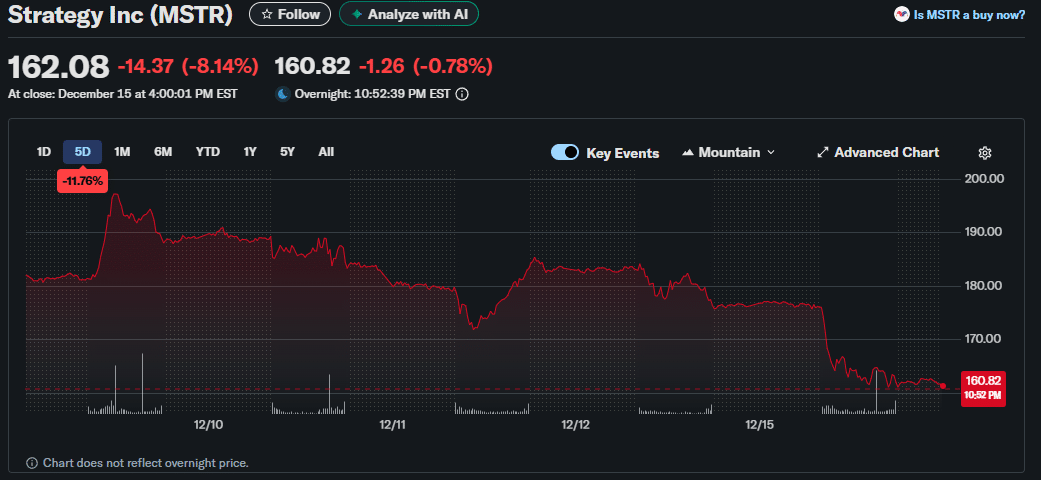

(Source – YahooFinance)

Since Strategu shares behave like a high-beta proxy for Bitcoin crypto price, this technical weakness directly feeds into MSTR stock volatility.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Why Strategy Shares Are Getting Hammered?

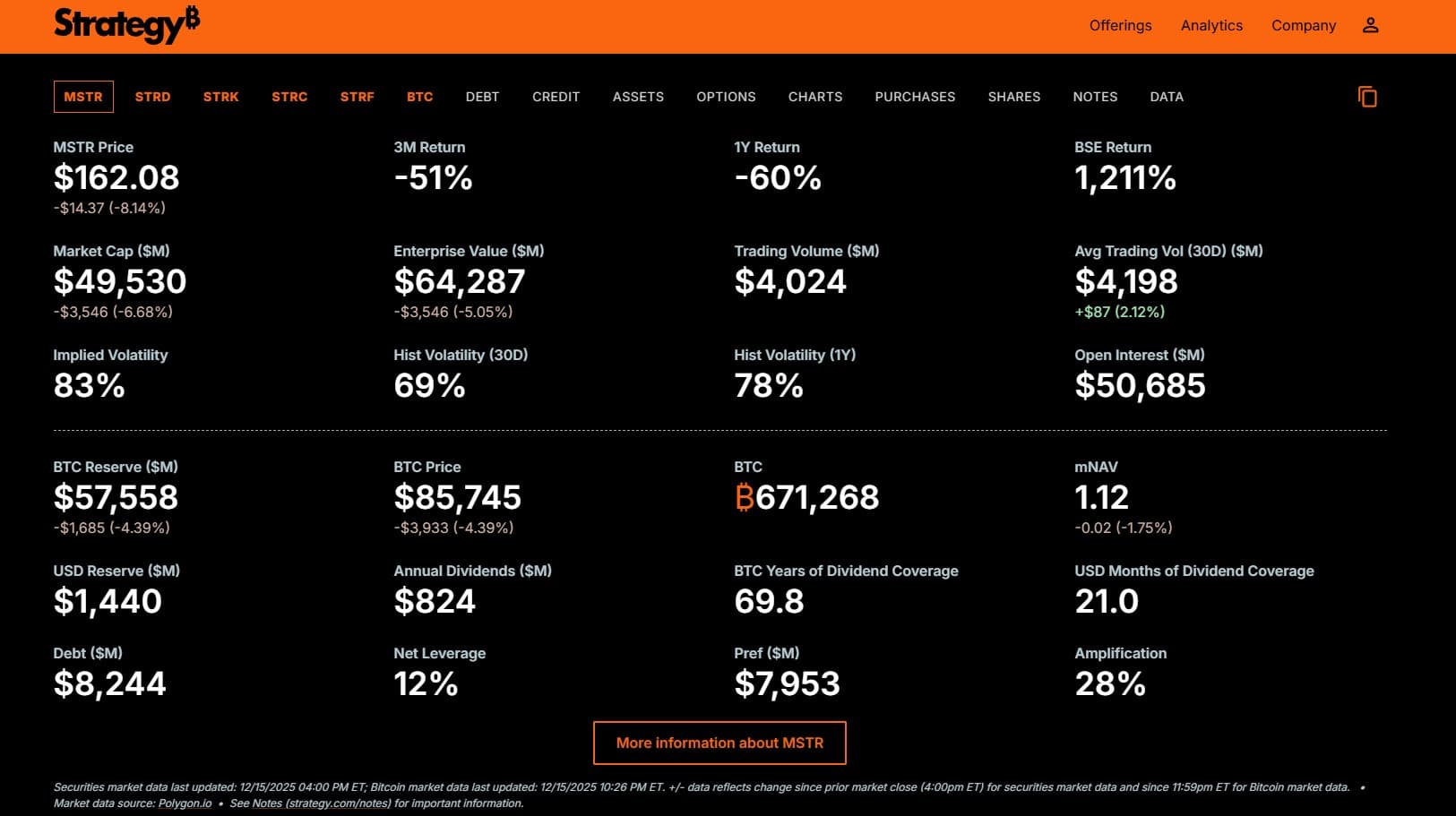

Strategu shares are under heavy pressure because the company has effectively transformed into a leveraged Bitcoin vehicle. While Strategy is technically a software firm, its balance sheet tells a very different story. The firm holds 671,268 BTC, valued at just over $50Bn, with an average purchase price of $74,972 per Bitcoin.

Just 24 hours ago, Michael Saylor added another 10,645 BTC, spending nearly $1 billion at an average price of $92,098. This aggressive accumulation reinforces the company’s long-term Bitcoin thesis but also tightens the correlation between MSTR stock and the BTC price.

Unlike a spot Bitcoin ETF, Strategy funds its purchases through a mix of equity issuance and convertible debt. Use capital markets to accumulate Bitcoin faster than traditional investors can, then allow BTC price appreciation to outpace dilution over time. When Bitcoin rises, Strategy shares often outperform, and Bitcoin per share is getting higher.

But if Bitcoin stays low for too long, then the downside is amplified.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

mNAV, Convertible Notes, and the Hidden Risk Ahead

Here is where things are getting serious. The most delicate part of Strategy’s model revolves around mNAV, or market net asset value. Basically shows the strategy’s net asset value relative to the Bitcoin reserves it holds.

When mNAV exceeds 1, Saylor can issue convertible notes, and with the proceeds, he can buy more Bitcoin. Since those convertible notes have a maturity date, he is effectively taking on cheap debt to buy more Bitcoin, so Bitcoin-per-share is increasing. When the maturity date arrives for those convertible notes, investors can elect to convert them into shares, realizing the profit difference if the price of Strategy shares is higher.

(Source – Strategy)

The last purchase was made at approximately 1.12 mNAV, which is close to 1. What happens when mNAV reaches one or below? This is where things get interesting.

When mNAV falls below 1, it indicates that the Strategy’s shares are offering Bitcoin at a price below the market price. And this is where nobody wants to issue notes or sell shares at a discount. First, share dilution will increase, and Bitcoin per share will decline; second, this effectively means Saylor is selling Bitcoin at a discount.

Unable to raise additional capital, he will face a tough decision: either sell Bitcoin to cover debt or issue new convertible notes, which would lead to further dilution. This will lead to more debt and, in turn, more issuance or Bitcoin sales.

This is possible only if the Bitcoin price remains low for an extended period, which we haven’t seen so far. A recent post by Saylor secured $1.4Bn in USD for such expenses, leaving ample room to keep the machine operating.

DISCOVER: 10+ Next Crypto to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Cardano price rebound amid 3rd consecutive rate cuts in December.

- What is the future of ADA?

The post Saylor’s MSTR Stock Hammered By Bitcoin Sell-Off: How Low Can Bitcoin Go? appeared first on 99Bitcoins.

You May Also Like

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise

Gold continues to hit new highs. How to invest in gold in the crypto market?