XRP Price Analysts Say ETF Inflows and Oversold RSI Point to $5 Rally

TLDR

- Weekly RSI near historic lows signals potential XRP price trend reversal.

- Monthly support at $1.80–$2.30 continues to absorb selling pressure.

- Spot ETF inflows show growing institutional accumulation.

- Break above $2.30–$2.50 could open a path toward $3.5–$5.0

XRP price is drawing renewed attention as technical indicators and institutional data converge near key long-term levels. Analysts point to deeply oversold momentum, defended macro support, and rising ETF inflows as signals of a potential trend shift. If confirmation follows, upside targets between $3.50 and $5.00 are being monitored across multiple timeframes.

RSI Signals Historical XRP Price Reversal Zone

According to analyst Good Evening Crypto, the weekly XRP against the USD chart shows the Relative Strength Index falling to 33, among the lowest readings in years. Historical data highlights several prior instances where similar RSI conditions marked major cycle bottoms. These periods, including 2017–2018 and the 2022 bear market low, preceded extended multi-month rallies.

SOURCE: X

Meanwhile, price remains compressed near long-term range lows, yet without aggressive expansion in selling volume. This divergence suggests capitulation conditions rather than active distribution. He noted that a decisive weekly close above recent swing highs would strengthen reversal confirmation. Initial upside levels are placed near $3.50–$4.00, with further extension possible if momentum builds.

Monthly Support Holds as XRP Price Builds Base

Additionally, analyst Mikybull Crypto’s monthly XRP chart highlights a well-defined support band between $1.80 and $2.30. This zone has absorbed repeated downside attempts since early 2025, forming higher lows on a macro timeframe. Large-volume candles continue to defend this range, reinforcing its role as a structural base.

SOURCE: X

In addition, momentum indicators on the monthly chart show constructive divergence. Pullbacks have occurred on declining volume, pointing to reduced sell pressure. Mikybull Crypto explains that a sustained monthly close above $2.30–$2.50 would neutralize bearish scenarios. Such a move could unlock a measured advance toward $5.00–$8.00, based on the height of the broader consolidation range.

ETF Inflows Add Institutional Support

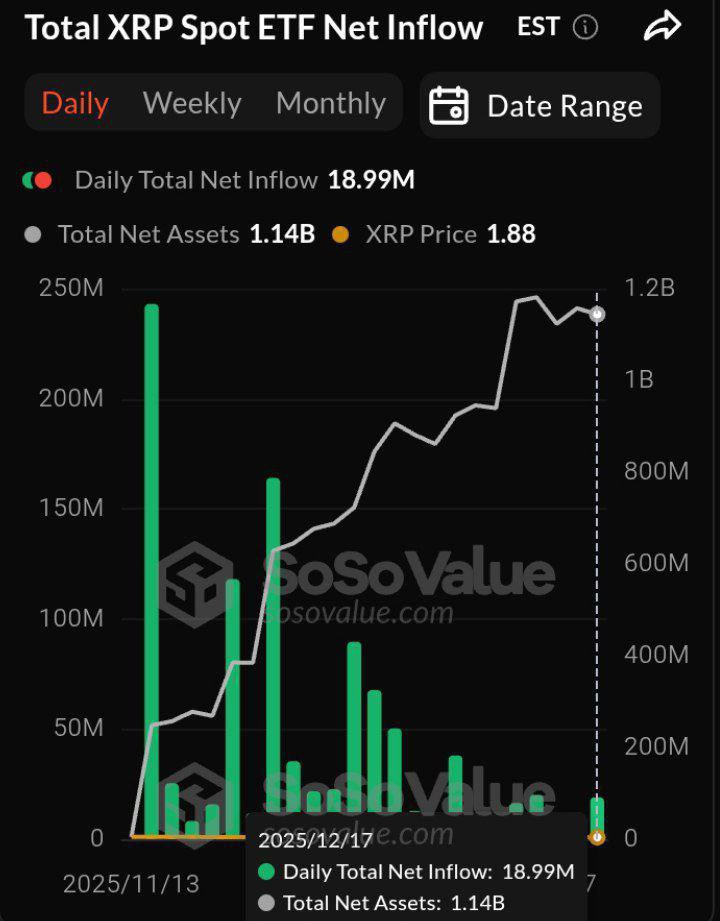

Moreover, analyst Amonyx highlighted growing institutional interest in XRP spot ETFs. Data from SoSoValue shows a notable single-day net inflow of $18.99 million on December 17, 2025. Total ETF assets have now reached approximately $1.14 billion, reflecting steady accumulation during periods of price consolidation.

SOURCE: X

Furthermore, the divergence between rising ETF holdings and sideways price action is notable. Historically, similar patterns in other digital assets have preceded supply-driven rallies. The analyst noted that persistent inflows often reduce available liquidity while signaling confidence among larger participants. Short-term projections based on these flows place potential recovery targets near $3.00–$4.00 if demand continues.

Confluence Builds Near Key Levels

Taken together, technical exhaustion signals, defended macro support, and institutional accumulation present a rare confluence for XRP. Each dataset points to diminishing downside momentum despite extended consolidation. While confirmation remains required through higher closes, risk conditions appear more balanced than earlier in the year.

As market participants monitor broader crypto trends, XRP price action near current levels may define the next directional phase. Analysts emphasize patience and confirmation, yet the alignment of weekly, monthly, and flow-based indicators suggests that current ranges carry increased strategic importance.

The post XRP Price Analysts Say ETF Inflows and Oversold RSI Point to $5 Rally appeared first on CoinCentral.

You May Also Like

DOGE ETF Hype Fades as Whales Sell and Traders Await Decline

The Digital WOW Explains How AI Is Affecting Digital Marketing