Best Meme Coins to Buy – AIC, DOGE, PEPENODE, SHIB, PEPE

Crypto markets are facing another period of uncertainty as the US Senate delays the Clarity Act until 2026, leaving regulatory questions unresolved. Bitcoin has seen modest declines as investors await clearer guidance on how digital assets will be classified and monitored.

Despite the short-term turbulence, institutional activity in altcoins continues, with XRP and Solana seeing notable inflows through ETFs over the past month. Traditional financial institutions are gradually integrating crypto, with major banks now offering trading, custody, and deposit services for digital assets.

Alongside these developments, some traders are turning their attention to smaller, high-potential tokens, with the best meme coins to buy gaining traction as speculative yet popular options.

Top Meme Coins for 2026: High-Potential Tokens to Buy Today

Meanwhile, exchanges like Binance and Coinbase are formalizing operations under global regulatory frameworks, signaling a shift toward responsible market practices. In this environment, retail and growth-oriented investors are exploring alternative opportunities, including meme coins.

Source – Binance via X

The evolving market structure highlights both risks and possibilities for diverse strategies. Awareness of tokenomics and platform credibility has become more critical than ever.

As prices fluctuate, strategic accumulation could offer advantages. For those looking beyond mainstream assets, below are the best meme coins to buy that are currently at attractive entry points.

AI Companions (AIC)

AI Companions, a token on the BNB Chain, drives the development of next-generation personalized virtual partners (often called AI companions). The token attracts a rapidly expanding community seeking highly interactive and customized online experiences.

$AIC token’s performance since launching late last year has been impressive, especially relative to other tokens that entered the market during the same period.

Although it currently trades well below its all-time high of $0.58, the AI-focused meme coin has still achieved remarkable overall growth exceeding 450%. The present trading level appears to represent an accumulation phase ahead of its potential next rally.

Dogecoin (DOGE)

The Dogecoin price prediction has faced a noticeable decline this week, dropping about 4% as sellers controlled short-term trading. At the time of writing, the meme token was changing hands near $0.132, marking the weakest showing among major meme assets.

Recent market data indicate $DOGE adoption levels remain below key resistance points, highlighting continued selling pressure and limited bullish momentum.

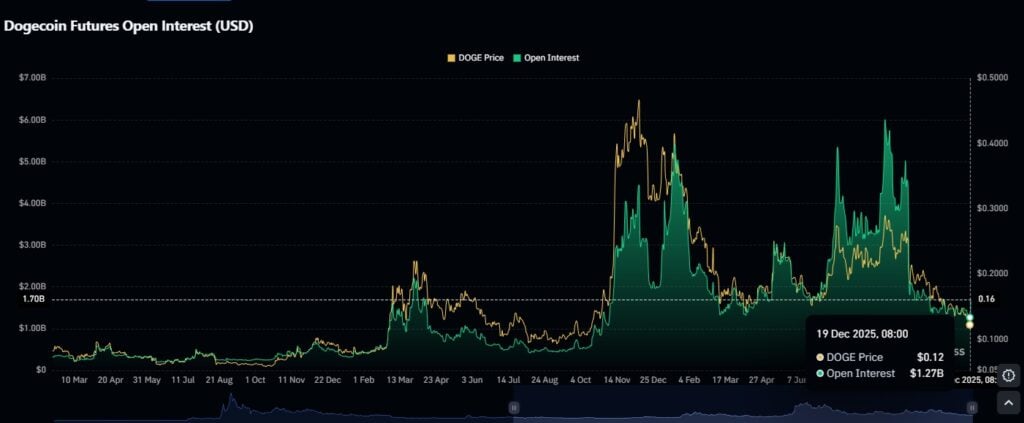

Source – CoinGlass

Interest in Dogecoin has contracted sharply since the October 10 flash crash, with futures Open Interest (OI) declining roughly 71%, from $4.4 billion to $1.27 billion on Friday. Nevertheless, with OI remaining subdued, it may be challenging for $DOGE to maintain the current recovery momentum.

Pepenode (PEPENODE)

Pepenode is generating attention as a unique crypto project that simplifies access to virtual mining for anyone with an internet connection. With only 19 days left in its ICO, the platform has already raised nearly $2.5 million.

Users begin by purchasing basic nodes with the $PEPENODE token and can upgrade rigs, expand server rooms, and combine equipment to increase daily output. Rewards are paid in popular meme coins such as Pepe and Fartcoin.

The system also incorporates deflationary mechanics, with 70% of each upgrade purchase burned, while presale staking and a referral program offer additional earning opportunities. By removing traditional barriers to mining, Pepenode provides a gamified and accessible entry point into cryptocurrencies.

With its innovative approach and accessible design, Pepenode is gaining recognition as one of the best meme coins to buy for those seeking fun, low-barrier, and rewarding crypto experiences. To take part of the $PEPENODE token presale, visit pepenode.io.

Shiba Inu (SHIB)

Shiba Inu has shown signs of recovery as the broader crypto market begins to stabilize, performing well on short-term charts. The community’s activity drove a 3.9 million percent surge in the burn rate, destroying 21.6 million $SHIB tokens within 24 hours.

Despite this significant burn, the price has remained relatively steady, largely influenced by macroeconomic factors such as Japan’s recent interest rate decision. The memecoin’s ongoing burn strategy continues to reduce total supply, supporting long-term scarcity.

Market sentiment is improving as traders gain more certainty, allowing Shiba Inu to regain momentum. These developments highlight $SHIB as one of the best crypto to buy now for investors interested in community-driven projects.

Pepe (PEPE)

Pepe coin has shown strong bullish momentum over the past 24 hours, emerging as one of the top performers in the crypto market. After a period of volatility that saw its price dip, $PEPE rebounded sharply, posting nearly 7% gains and demonstrating resilience.

Its current market capitalization sits at around $1.7 billion, a significant discount compared to previous highs near $11–12 billion, suggesting potential for notable upside. Trading volume has surged, supported by active engagement from large holders, reflecting growing interest and liquidity.

With nearly 500,000 holders soon to be reached, the community continues to expand steadily. Analysts highlight that Pepe’s discounted price levels combined with increasing adoption position it as a promising option for long-term investors.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Crucial Fed Rate Cut: October Probability Surges to 94%

Hedera (HBAR) Price Today, Chart & Market Cap | Live HBAR to USD Converter