SOL At $126 Vs Digitap ($TAP) Visa Card Story — Spending Beats Trading As Best Crypto Presale December

As December 2025 unfolds, crypto markets are delivering a familiar lesson in a different form: volatility tests conviction, but utility preserves confidence. With Solana (SOL) sliding back to the $126 level despite a year of major technical upgrades, many retail investors are rethinking the traditional “buy and wait” approach.

The focus is shifting away from pure price appreciation and toward assets that can be used, not just held. In this environment, projects offering immediate, real-world functionality are beginning to stand out. One of the most discussed examples in December is Digitap ($TAP), an omni-banking protocol built to stabilize, spend, and extract value from crypto holdings during uncertain market conditions.

Solana’s Pullback Highlights a Market Rotation

Solana’s journey through 2025 has been anything but quiet. The network expanded its user base, increased real economic activity, and made tangible progress on reliability with upgrades such as the Firedancer validator client. From a fundamentals perspective, the chain is stronger than it has ever been.

Yet price action often tells a different story. Trading near $126, SOL has retraced alongside the broader market despite its progress. This disconnect reflects a saturation effect rather than a failure of technology. Early-cycle gains have cooled, and capital that once chased speed and throughput is becoming more selective.

Solana price chart. Source: Coingecko

For long-term believers, Solana remains a credible infrastructure bet. But for investors managing risk in the short to medium term, holding a volatile asset through a choppy December requires patience and a tolerance for drawdowns. As a result, many are exploring ways to remain active in crypto without being fully exposed to market swings.

From Holding to Using: Why Utility Is Gaining Ground

Investors are no longer content with watching charts while assets sit idle. With stablecoins now representing hundreds of billions in market value, the question has shifted from storage to access.

This shift has opened the door for payment-focused platforms that bridge on-chain value with everyday spending. Rather than competing with Layer 1s on speed or decentralization metrics, these platforms focus on usability. It is within this context that Digitap has gained traction, particularly among those searching for hidden crypto gems that prioritize function over hype.

Digitap’s core proposition is straightforward. Users can hold stablecoins to preserve purchasing power, then spend those assets instantly using a Visa-linked card. There is no need to time the market or wait for favorable price moves. Value is realized through use, not speculation.

How Digitap Turns Spending Into an Advantage

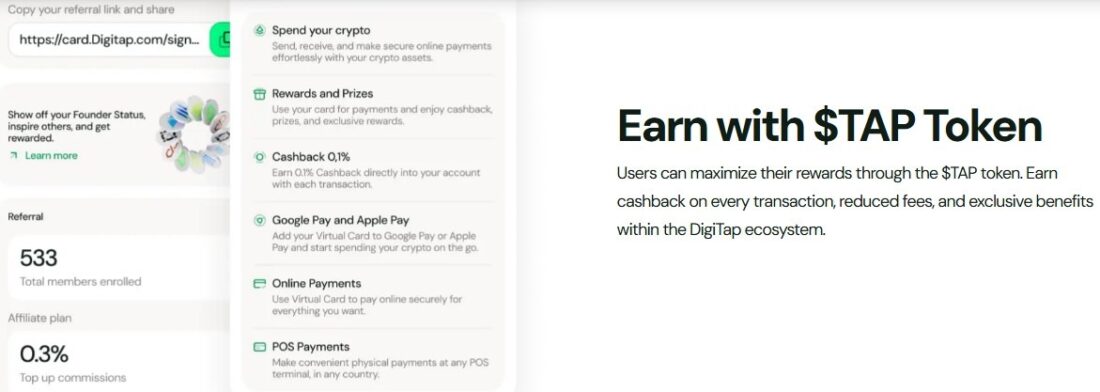

Digitap distinguishes itself by making spending productive. Instead of treating payments as an endpoint, the platform integrates them into its token economy. Each transaction made with the Digitap Visa card generates cashback rewards in $TAP, aligning daily expenses with participation in the ecosystem.

More importantly for investors, Digitap’s reward model is not inflationary. Rather than minting new tokens endlessly, the protocol uses a portion of transaction-related revenue to buy back $TAP from the open market. A share of these tokens is permanently removed from circulation, while the remainder supports staking rewards.

This structure creates a link between real-world usage and token demand. In practical terms, it means that whether the market is rising or falling, spending activity continues to support the ecosystem. For users, this offers a way to stay active in crypto without relying on favorable price movements. It is this design that has placed Digitap among discussions of crypto presales with real utility, especially as investors look for defensive strategies during periods of uncertainty.

A Different Kind of Hedge in a Volatile Market

Traditional trading strategies depend heavily on timing. Buying SOL at $126 with hopes of a rebound requires confidence not just in the asset, but in the market environment. When volatility persists, purchasing power can erode quickly.

Digitap approaches the problem differently. By encouraging users to hold stable assets and extract value through spending and rewards, the platform effectively sidesteps short-term price risk. This has resonated with investors who want exposure to crypto innovation without the constant stress of price swings.

As a result, the $TAP presale has drawn interest from participants who might otherwise remain sidelined. In conversations around the best crypto presales 2025, Digitap is increasingly referenced as a project aligned with how users actually behave during downturns.

Why the $TAP Presale Is Gaining Attention

Presales often rely on future promises. Digitap’s appeal lies in its present functionality paired with forward-looking economics. The platform’s infrastructure is designed around payments, not abstract use cases, and its token model reflects that focus.

With entry pricing below projected listing levels, early participants are positioning themselves ahead of broader market exposure. For investors evaluating the best crypto to invest in today, the appeal is less about short-term price spikes and more about adoption-driven growth.

In a landscape where volatility remains the norm, Digitap is positioning itself as a practical alternative. By transforming stablecoin spending into a value-generating activity, it provides a distinct approach to navigating uncertain markets.

As 2025 comes to a close, the narrative is no longer just about which asset will rise next. It is about which platforms deliver value now. Digitap stands out as the top crypto to invest in.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post SOL At $126 Vs Digitap ($TAP) Visa Card Story — Spending Beats Trading As Best Crypto Presale December appeared first on Live Bitcoin News.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

S2 Capital Acquires Ovaltine Apartments, Marking Entry into the Chicago Market