Crypto.com Develops Internal Market Maker to Boost Prediction Markets

Introduction

Crypto.com is enhancing its trading infrastructure by establishing an internal market-making team aimed at supporting its prediction markets. The move aligns with regulatory compliance and focuses on improving market liquidity amidst ongoing scrutiny of outcome-based trading practices within crypto and traditional finance sectors.

Key Takeaways

- Crypto.com is actively recruiting a quant trader to help facilitate contracts tied to event outcomes on its prediction platform.

- The company states its internal trading activities are fully disclosed to US regulatory authorities and are consistent with market fairness principles.

- Similar strategies are employed by other platforms like Kalshi and Polymarket, which also utilize professional liquidity providers to sustain trading volumes.

- The adoption of market makers by prediction markets emphasizes the importance of liquidity provisioning in the evolving industry landscape.

Tickers Mentioned

Tickers mentioned: None

Sentiment

Sentiment: Neutral

Price Impact

Price impact: Neutral, as the expansion aims to enhance liquidity without immediate influence on asset prices.

Market Context

Market context: The move reflects broader industry efforts to institutionalize prediction markets while balancing regulatory compliance and market integrity.

Rewritten Article Body

Crypto.com is taking significant steps to bolster its prediction market operations by forming an internal market-making team. According to recent reports, the company is actively recruiting a quantitative trader tasked with facilitating contracts linked to outcomes of sports events on its prediction platform. This development signals Crypto.com’s commitment to providing a seamless trading experience while maintaining compliance with federal regulations.

Source: BloombergThe recruitment has brought attention to the practice of exchanges facilitating trading against customer orders—a structure that can raise potential conflicts of interest in outcome-based markets. Despite this, Crypto.com asserts that its internal trading operations are fully transparent to US regulators and operate under strict compliance standards.

A company spokesperson explained to Cointelegraph that Crypto.com’s internal trading team is designed to increase competition and liquidity on its platform. They emphasized that all market-making activities, whether internal or external, adhere to the same rules, ensuring fairness and transparency. The company highlighted that their internal market maker does not have privileged access to proprietary data or customer order flow, maintaining an equitable trading environment.

Crypto.com clarified that it does not depend on proprietary trading for revenue, instead earning fees from retail customers for access to digital assets. This approach aligns with its risk-neutral, fee-based business model aimed at providing secure and fair trading conditions.

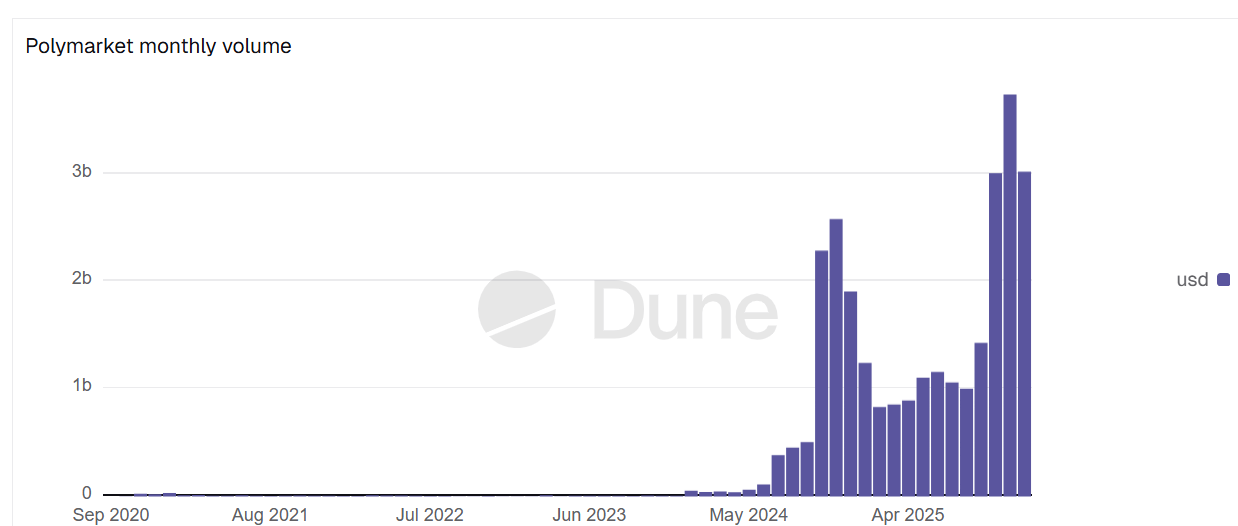

Other prediction platforms, including Kalshi and Polymarket, have also adopted similar liquidity strategies by employing professional market makers. Kalshi, a regulated event-contract exchange, has engaged Susquehanna International Group for market-making services since 2024, facilitating higher trading volumes. Meanwhile, Polymarket, which gained prominence during the US presidential election for accurate event predictions, is reportedly establishing an internal market-making team to support its expanding operations.

Source: Dune

Source: Dune

This article was originally published as Crypto.com Develops Internal Market Maker to Boost Prediction Markets on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Trump criticized the unusual phenomenon of "good news not driving prices up" and warned dissidents not to even think about taking the helm of the Federal Reserve.

Is Doge Still The Best Crypto Investment, Or Will Pepeto Make You Rich In 2025