Best Crypto Presales to Buy In 2026 – Crypto Volt Top Picks

The total cryptocurrency market capitalization has declined 1.16% over the past 24 hours, bringing it to $2.93 trillion, while trading activity remains robust with a 24-hour volume of $100.9 billion.

Most large-cap assets have slipped, reflecting a generally cautious market sentiment. Many investors, however, view this pullback as a healthy correction and an opportunity for strategic accumulation ahead of potential gains.

With growing optimism for the year ahead, attention is turning to new crypto projects offering unique features. This article highlights a selection of these promising ventures and explains why they are considered among the best crypto presales to buy.

Top Crypto Presales to Buy Amid Positive Q1 2026 Market Trends

For Q1 2026, the outlook for risk assets, including crypto and equities, appears cautiously optimistic, supported by the Fed’s focus on maintaining or gradually expanding liquidity.

With US midterm elections scheduled for November 2026, policymakers are expected to prioritize market stability, reducing the likelihood of abrupt regulatory shocks and boosting investor confidence.

Industry analysts share this positive sentiment, with Alice Liu, Head of Research at CoinMarketCap, predicting a crypto market rebound in February and March 2026 based on improving macro indicators.

Should these economic tailwinds materialize, the market could shift from consolidation to a rapid upswing, creating fertile ground for growth.

This environment presents strategic opportunities for early investors to explore emerging projects, including several of the top crypto presales to buy now, positioning themselves for potential long-term gains as the year unfolds.

HyperSui (HYPESUI)

HyperSui is a next-generation decentralized exchange built natively on the Sui blockchain, combining spot trading, swaps, and perpetual contracts in a single platform. Its token serves multiple functions, including governance, trading fee payments, and liquidity incentives.

By integrating perpetual trading infrastructure similar to established layer 2 platforms, HyperSui is designed to scale alongside Sui’s expanding DeFi ecosystem. As adoption of the Sui network grows, the platform’s utility naturally increases with higher trading volumes and demand for liquidity.

HyperSui emphasizes practical, long-term value for users, enabling active participation in governance and rewards rather than speculative trading alone. The project presale has already raised around $3 million.

Source – Crypto Volt YouTube Channel

BasePerp (BPERP)

BasePerp is a utility-focused DeFi project specializing in decentralized perpetual trading. The platform uses its tokens to offer trading incentives, fee discounts, and governance over key protocol parameters, including fees and risk controls.

Market makers also benefit from liquidity incentives, encouraging active participation in the ecosystem. Built natively on the Base blockchain, it provides lower fees and faster trade execution compared to traditional alternatives.

By combining efficient infrastructure with user-driven governance, BasePerp creates a sustainable environment for traders and liquidity providers. Its focus on perpetual trading positions it as a standout project for investors seeking both practical use and long-term growth.

Bitcoin Hyper (HYPER)

Bitcoin Hyper is the most promising Layer 2 solutions for Bitcoin, offering unmatched speed and scalability for transactions.

With nearly $30 million raised during its presale, the project is steadily building a comprehensive ecosystem that includes a dedicated wallet, explorer, bridge, staking, and even meme-based applications.

Its solid tokenomics allocate significant resources to development, marketing, and exchange listings. The system’s infrastructure ensures that transactions are executed reliably and efficiently, enhancing user confidence.

High presale participation and consistent updates indicate strong interest among investors. As a result, Bitcoin Hyper is capturing attention as one of the best crypto presales to buy, combining innovative technology with practical utility.

Visit Bitcoin Hyper

Maxi Doge (MAXI)

Maxi Doge combines meme culture with a structured token system designed for long-term engagement and ecosystem participation. The project has already raised $4.3 million, with each token priced at $0.0002745, offering users up to 70% staking rewards.

Its utility extends beyond simple trading, incentivizing holders to actively engage in the network while supporting future integrations and roadmap initiatives. Maxi Doge is structured to reward long-term holding, making it more than a typical meme coin.

By emphasizing ecosystem utility and engagement, Maxi Doge positions itself as a sustainable project in the crypto space. This focus on incentives and functionality has made it one of the best meme coins to buy.

Visit Maxi Doge

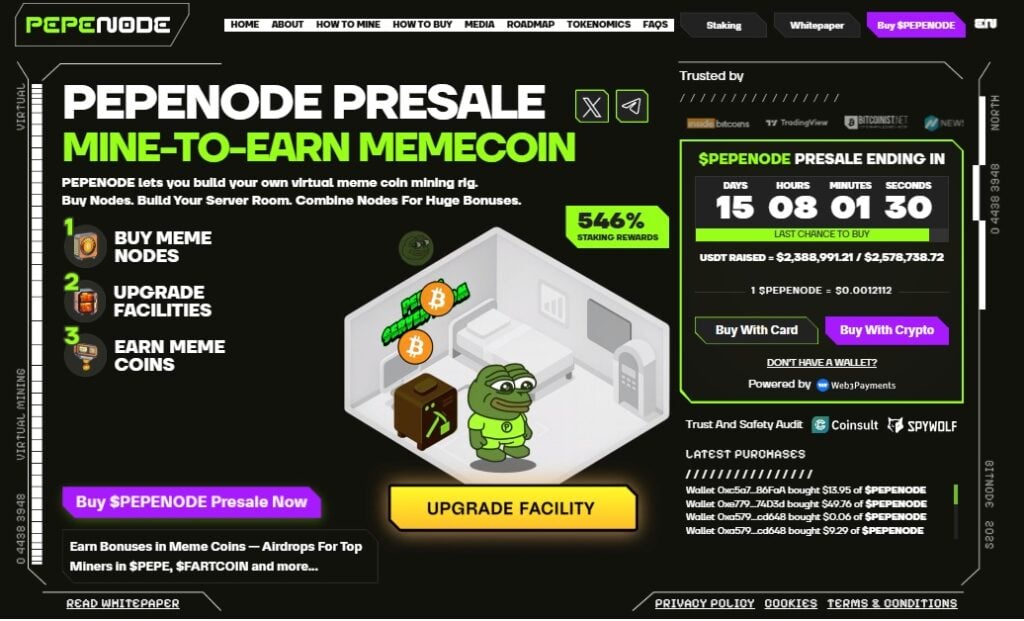

Pepenode (PEPENODE)

Pepenode is an innovative memecoin, offering a unique “mine-to-earn” experience that stands out in the crypto space. Early supporters can acquire $PEPENODE tokens, which are then used to build virtual mining rigs in customizable server rooms.

The platform gamifies the mining process, allowing users to strategically combine and upgrade nodes to maximize yield and compete on leaderboards. With only $2.3 million raised so far, Pepenode has just 15 days remaining before the presale concludes.

Its tokenomics are structured to support staking, community rewards, and ongoing protocol development, ensuring both engagement and sustainability. The presale also offers staking with up to 540% APY, making it one of the best crypto presales to buy now.

Visit Pepenode

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

PayToMe.co and Nixxy Inc. (NASDAQ: NIXX) Advance AI Financial Infrastructure Across Global Telecom Rails

Snowball Money and REI Network Integrate Web3 Identity