Driven by events, we review the key governance trends and integration trends in February

Author: Tulip King , Crypto KOL

Compiled by: Felix, PANews

Key insights:

- Increased market sensitivity: Markets react similarly to different events. While the content of events varies (from risk parameter adjustments to technical integrations), broader market sentiment and liquidity conditions play a leading role in shaping prices.

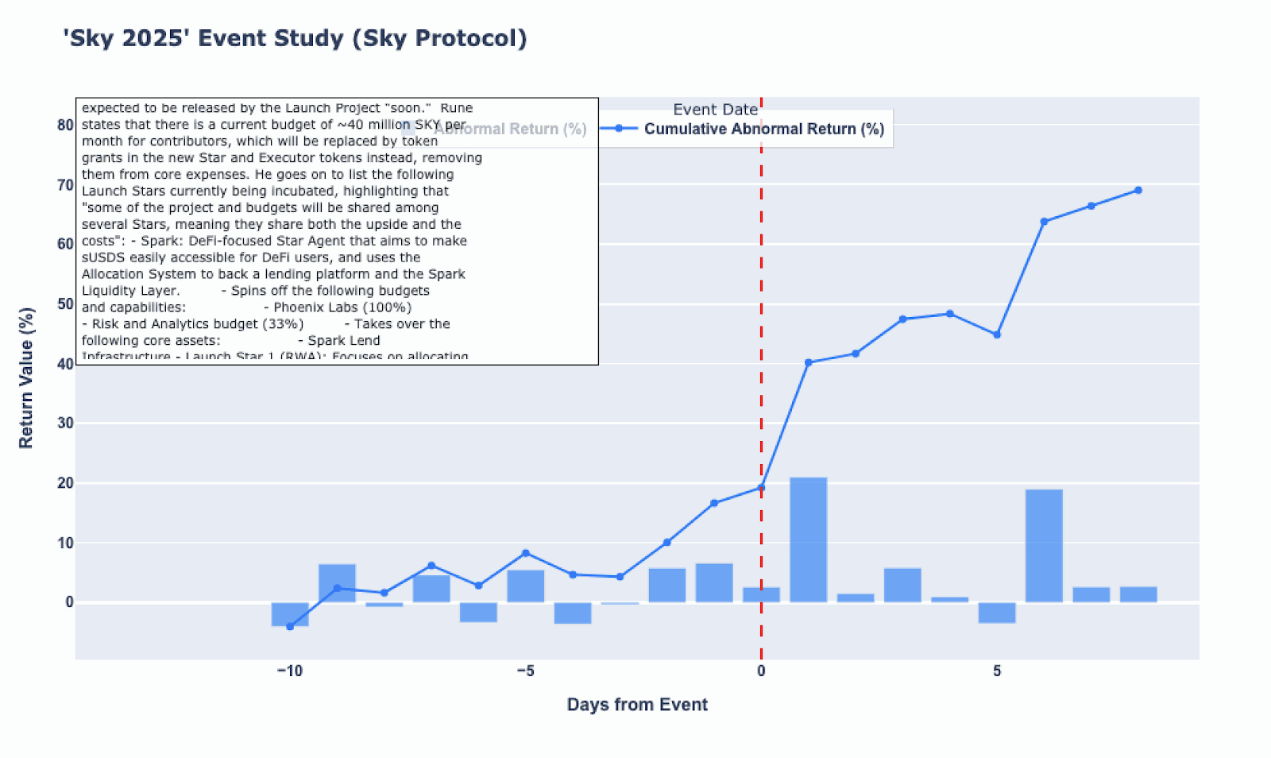

- Governance as a core driver: A significant portion of events were related to governance proposals and execution decisions, particularly around Maker and its related protocols (including Sky Protocol). The market’s cautious yet consistent response to these proposals highlights investors’ focus on long-term risk management and strategic capital flows. Governance dynamics are seen as an indicator of future stability and growth.

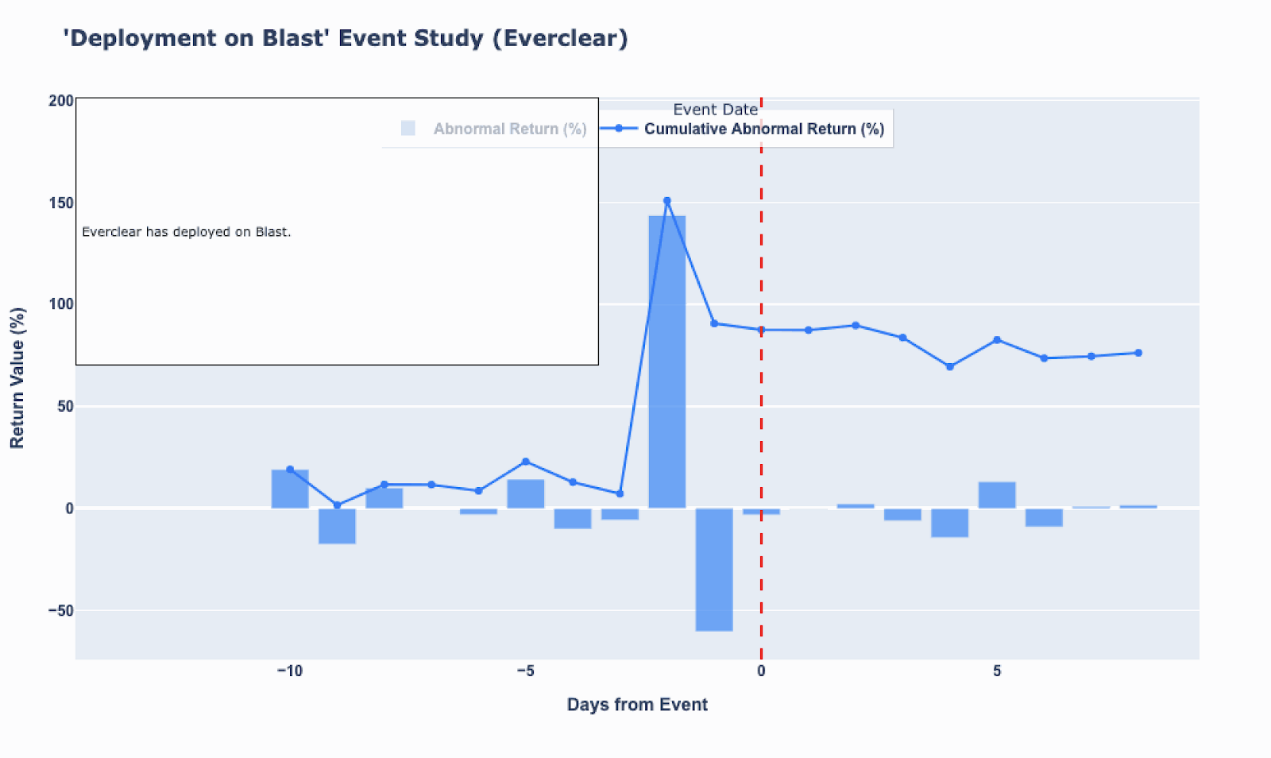

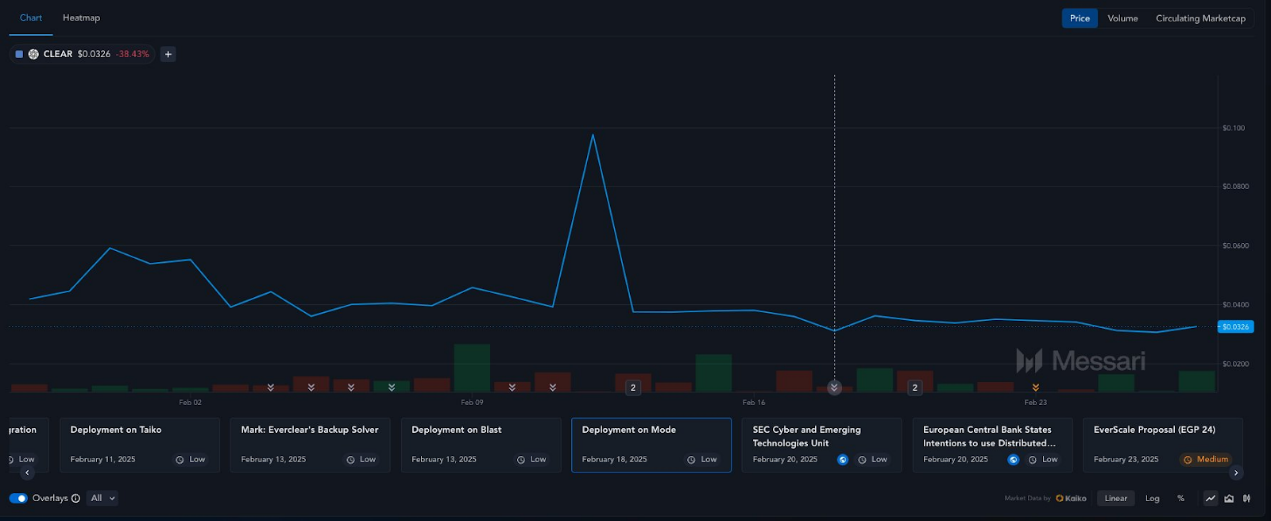

- Integrations and expansions are equally important: Technical announcements such as Everclear integration, Onyx’s smart wallet, and Virtuals’ AI staking initiatives have also generated a response comparable to governance dynamics. This consistency suggests that business expansions that are expected to improve network efficiency and cross-chain liquidity are equally influential and strengthen the market’s overall risk-reward assessment during this window.

Weekly Theme

This week, the market’s attention has been focused on governance and risk management proposals, reflected in the recurring implementation proposals and adjustments to key protocol parameters. Discussions on cutting core fees, changing liquidity parameters, and modifying stability fees are more than just routine updates; they reflect a general desire among investors to make sound decisions that balance short-term tactical and long-term strategic positioning.

Another important theme is technology integration and ecosystem expansion. Announcements about integration with new networks (such as Linea, Polygon, Chain XCN Ledger) and new products (such as AI staking and smart wallet deployment) show that market participants are actively rewarding projects that enhance interoperability and operational efficiency, driving optimism about future network scalability.

Finally, there is another potential narrative about expected pricing behavior. As many events are concentrated around mid-February, the price increase before the event and the rapid stabilization after the event suggest that the news may be partially digested by the market before it is officially released. This expectation trend reinforces the view that regardless of the specific event, the overall market environment is in a passive mood, and each event is expected to trigger similar adjustments.

Key assets

Maker and Sky Protocol: Maker stands out for its regular announcements of key governance events, including execution proposals and parameter adjustments. Sky Protocol is often mentioned alongside Maker, showing consistent outlier reactions, highlighting the importance investors place on governance narratives and systems for capital flow.

Everclear: Everclear has gained market attention through its integration announcement and EverExpansion program. The steady response around Everclear’s integration events shows that investors are enthusiastic about cross-chain interoperability and expect that these technical collaborations will improve liquidity management and enhance operational efficiency.

Virtuals Protocol and Onyx: Virtuals Protocol enters the AI staking space, and Onyx announces the launch of a smart wallet, marking its emergence as an asset driving innovation. Unique product enhancements show that in addition to governance, investors are looking at tokens that operate innovative, diversify their risk exposure, and expect long-term usability improvements that translate into continued value growth.

Looking ahead

In the coming week, it is recommended to remain vigilant to the development of improved governance structures and risk management frameworks. As the protocol finalizes adjustments and new proposals enter the voting phase, pay attention to voting sentiment and liquidity changes, which may have broader impacts on market stability. Pay close attention to announcements from Maker and Sky Protocol as they continue to adjust risk parameters and develop their capital flow systems.

On the technical side, continue to watch for announcements related to cross-chain integrations and innovative product releases, such as further updates from Everclear and progress on on-chain liquidity channels. These developments may not only drive incremental gains, but may also fundamentally change network dynamics. Investors should monitor whether these initiatives begin to exceed market expectations or trigger a repricing of risk relative to Bitcoin.

Furthermore, the observed anticipatory behavior suggests that the market may be pricing in advance. This means that any deviations or surprises in upcoming announcements may trigger a more volatile re-rating. Investors may consider focusing on assets that can take advantage of stable governance frameworks and improve with innovative operations.

in conclusion

The market paradigm in February is defined by governance-driven recalibrations and integration/extension events. Abnormal return trends show that the market’s reaction is similar regardless of the event category (whether it is an adjustment of risk parameters or the launch of a technological innovation), suggesting a broader, more systematic sensitivity to major events. This highlights the importance of tracking governance proposals and innovation-driven events, as they jointly shape investor sentiment and asset pricing in a seemingly homogenous manner.

For investors and market participants, it is important not to view these events in isolation. Instead, understand that the crypto ecosystem is currently in a phase where programmatic realignment (governance changes) and operational advancements (integrations and product enhancements) are tightly intertwined. Therefore, it is recommended to fully understand governance votes and integration updates, especially for assets such as Maker, Sky Protocol, Everclear, Virtuals Protocol, and Onyx, as they are at the core of the market's evolving narrative.

By focusing on both governance stability and technological innovation, stakeholders can better predict future market trends and identify assets with long-term upside potential. This comprehensive perspective can guide investors not only in judging immediate price reactions, but also in evaluating which projects will lead the next stage of the crypto market's development.

Related reading: MakerDAO’s sudden emergency governance proposal: borrowing limits and collateral ratios rise together, is it a defense or a power struggle?

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Cashing In On University Patents Means Giving Up On Our Innovation Future