Solana (SOL) Tumbles 6%: Can Bulls Halt the Freefall, or Do Bears Truly Hold the Reins?

- Solana is trading within the $133 range.

- SOL’s trading volume has jumped by over 126%.

With a 2.57% loss, the crypto market is floating in red, and the assets are losing momentum. The neutral sentiment is hanging across the market, as the Fear and Greed Index value is holding at 45. All the major assets are moving downward, unable to escape the bear trap. Among the altcoins, Solana (SOL) has posted a 6.12% loss.

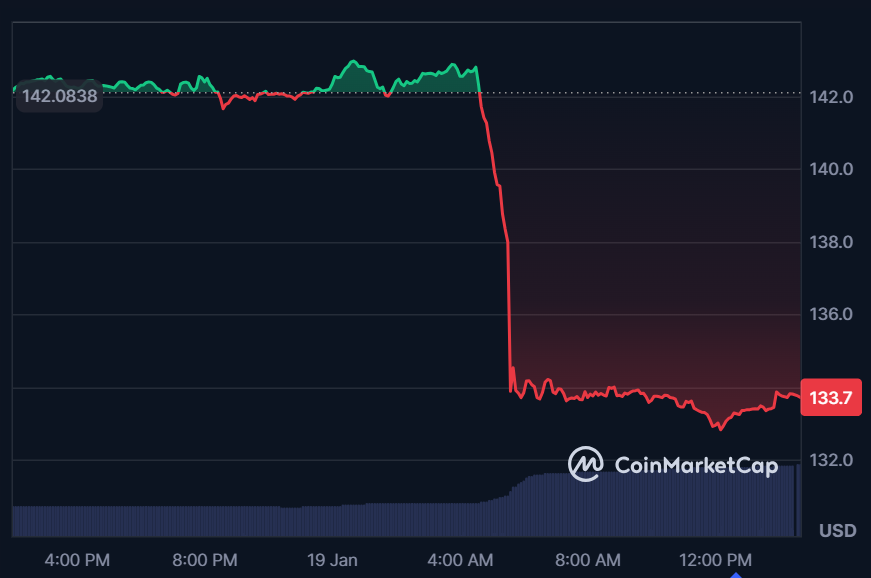

In the early hours, Solana traded at a high range of $143.06, and the sudden bearish pressure has triggered the price toward a bottom of $132.82. Currently, Solana is trading at around $133.73, with its daily trading volume jumped by 126% to $5.1 billion. The SOL market has witnessed a 24-hour liquidation of $60.89 million.

SOL price (Source: CMC)

SOL price (Source: CMC)

The recent price graph of Solana hints at a downtrend. With the formation of the death cross, the price slips to the support at $130.21. Breaking past this level might push for a deeper slide below the $127.10 mark. On the upside, if SOL bulls regained power, the price could rise to $136.47. With extended gains, the golden cross would take place, potentially eyeing its subsequent resistance at around $139.68.

Solana Momentum Slips as Indicators Lean Negative

SOL’s Moving Average Convergence Divergence (MACD) line and signal line have fallen below the zero line, reflecting a bearish shift. The asset currently trades below its longer-term average, showing downward strength. A crossover above zero brings in early signs of a potential trend reversal.

SOL chart (Source: TradingView)

SOL chart (Source: TradingView)

Besides, the Chaikin Money Flow (CMF) indicator resting at -0.11 points out that there is selling pressure in the Solana market. The capital is flowing out of the asset, with the bears having the upper hand. Unless the value moves back above zero, the downside momentum may persist.

The daily Relative Strength Index (RSI) of Solana is settled at 25.55 indicates that it is in the oversold territory. As strong selling pressure is present, it can signal a potential bounce if the buyers step in. Moreover, Solana’s Bull Bear Power (BBP) value is stationed at -11.28 suggests strong bearish dominance. Significantly, the sellers are firmly in control, with heavy downside pressure and limited bullish strength in the near term.

Top Updated Crypto News

Dogecoin (DOGE) Faces Turbulence After a 7% Slip: Can It Hold Key Support Zones?

You May Also Like

Why Multicoin Capital’s Kyle Samani Is Leaving Crypto for AI and Robotics

SUI Price Rebounds Above $1 as HashKey Enables Trading Support

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more