XRP Price Reclaims $2 As Bulls Return—Is A 10% Bounce Possible This Week?

The post XRP Price Reclaims $2 As Bulls Return—Is A 10% Bounce Possible This Week? appeared first on Coinpedia Fintech News

XRP price opened the year with a sharp rally of over 20%, outpacing larger majors like Bitcoin and Ethereum. However, the momentum didn’t stay one-way for long. As Bitcoin dipped, the XRP price plunged from above $2 to near $1.80 within hours before buyers stepped in. Even after the bounce, XRP remains stuck in a tug-of-war between dip buyers and overhead sellers. This is keeping the near-term outlook uncertain and highly sensitive to the next market-wide move.

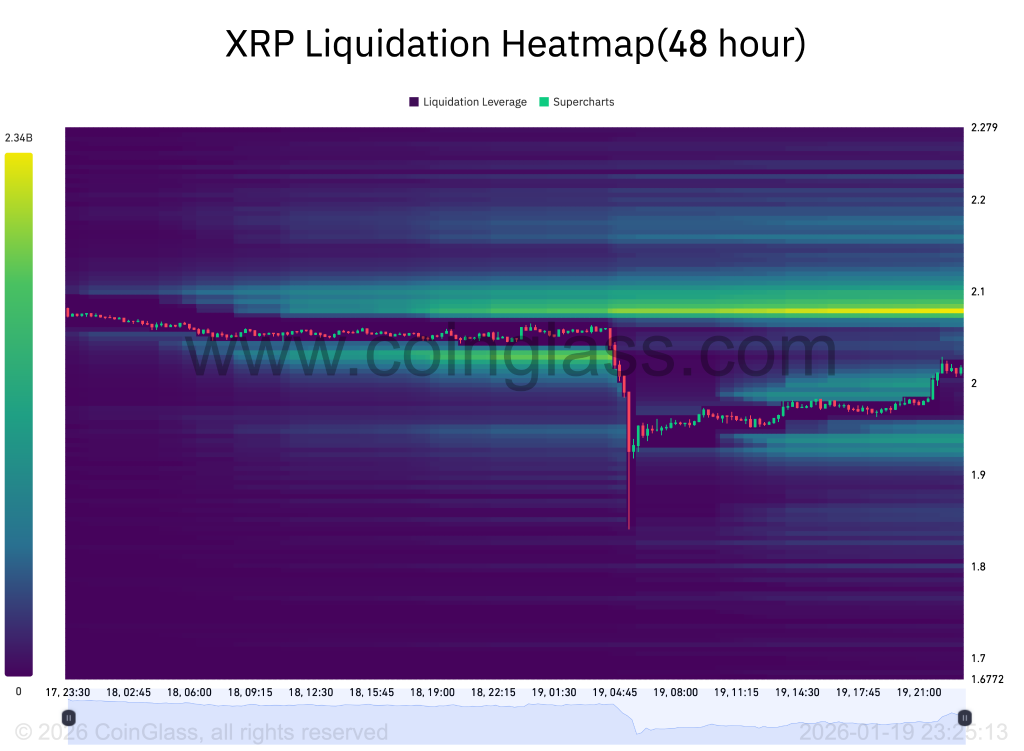

XRP Liquidation Heatmap Shows Where Volatility Could Spike Next

The 48-hour heatmap from Coinglass shows a thick liquidation band sitting just above the price at around $2.1. XRP is trading near $2.00–$2.02, so a push into $2.06–$2.10 is the first “squeeze zone” where shorts can get forced out, and price can accelerate.

The earlier liquidation sweep drove XRP close to $1.70–$1.75, suggesting a chunk of downside leverage has been flushed. Still, if $2 fails again, the next meaningful liquidity pocket sits around $1.90, followed by a deeper magnet zone near $1.80. Above $2.10: higher odds of a fast wick/extension, and below $1.90: opens a path toward $1.80 as stops and late longs get hit.

XRP Open Interest: Leverage Reset, But It’s Rebuilding

XRP open interest remains well below the earlier peak, but the latest data shows a small dip in recent sessions. This suggests traders are trimming leverage rather than adding aggressively. This pullback likely reflects post-volatility deleveraging after the sharp intraday drop, where late longs were forced out or chose to cut risk.

It may also be driven by profit-taking after XRP reclaimed the $2 handle, as short-term traders closed positions instead of pressing for continuation. Macro uncertainty and Bitcoin-led swings can further reduce appetite for holding high leverage through choppy conditions.

The impact is two-sided. On the positive side, lower open interest reduces “crowding,” which can limit liquidation cascades and help XRP stabilize. On the flip side, cooler leverage can make upside moves less explosive, shifting rallies into a slower grind unless spot demand steps in.

What’s Next for the XRP Price?

XRP’s derivatives setup points to controlled volatility, not a one-way breakout. The slight dip in open interest reduces crowding, which can help the price base above the $2 handle. It also means the upside may be grindier unless fresh leverage or spot bids return. From the liquidation map, the first upside magnet sits around $2.06–$2.10—a clean push through that zone can trigger a squeeze toward $2.15–$2.20.

However, repeated rejection near $2 with leverage rebuilding would raise breakdown risk. If XRP slips below $1.90, liquidation pockets could pull the price toward $1.80, with a deeper sweep possible into the mid-$1.70s if selling accelerates.

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

Hyperliquid price continues lower bearish targets $19.75