Top Crypto Gainers to Buy Today, January 22 – Sandbox, MYX Finance, Canton

Highlights:

- Top crypto gainers today include the SAND, MYX, and CC, all showing impressive growth.

- The Sandbox is seeing strong whale activity, pushing the price up by 13% today.

- MYX Finance continues its bullish momentum, with key resistance near $6.55 but a possible breakout ahead.

The crypto market is displaying a positive trend today, as Bitcoin has surged above the $90,000 mark again. Major altcoins such as Ethereum, BNB, XRP, and Solana also slightly recovered. Meanwhile, the overall market cap and trading volume surged to $3.04 trillion and $135 billion, respectively. This broad market rally, however, saw some tokens record significant gains. In the section below, we will discuss the top crypto gainers to buy today, such as The Sandbox, MYX Finance, and Canton.

Top Crypto Gainers to Buy Today

1. The Sandbox (SAND)

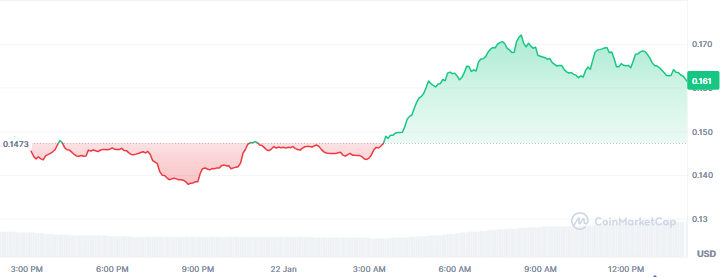

The Sandbox has emerged as the top crypto gainer today, with a surge of 13% over the last 24 hours. This latest rally coincides with its ongoing rally, which has seen the altcoin surge by 30% and 45% on the weekly and monthly charts. Currently, the price is hovering around $0.1607 with a market cap of $440 million.

Source: CoinMarketCap

Source: CoinMarketCap

The Supply Distribution data provided by Santiment demonstrates interesting insights regarding whale activity in The Sandbox’s market. Between January 15 and Thursday, whales with 10 million to 100 million SAND tokens (drawn by the blue line) and 100,000 to 1 million SAND tokens (drawn by the red line) received a total of 94.39 million SAND tokens.

Source: Santiment

Source: Santiment

Meanwhile, wallets holding between 1 million and 10 million tokens (marked with the yellow line) sold 14.87 million tokens within the same time. This implies that the larger whales have taken advantage of the price plunge, and the middle-range holders might have suffered a capitulation.

2. MYX Finance (MYX)

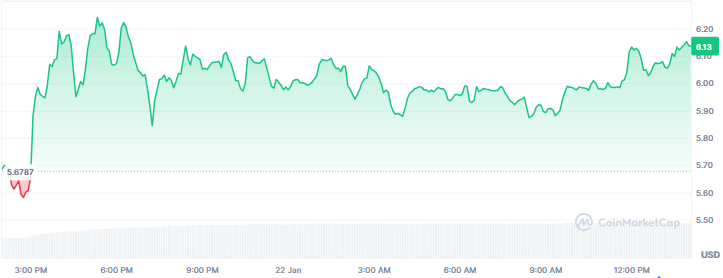

After surging by more than 80% over the past month, MYX Finance is back in the spotlight again today. MYX is trading at around $6.15, up 12% on the daily chart. In addition, its market cap and trading volume have surged by 1.52 billion and $23 million, respectively.

Source: CoinMarketCap

Source: CoinMarketCap

MYX Finance displays a robust rally on the daily chart as the bullish momentum continues to build. Currently, the price has faced resistance around the $6.55 region, leading to a minor pullback. The next resistance lies around the $7.2 region, where the price faced stiff rejection in early January.

Source: TradingView

Source: TradingView

Moreover, indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) support an upward rally. The MACD line is on the verge of crossing above the signal line, which shows robust buying pressure. The RSI is hovering around 65 levels, suggesting a further upward journey before reaching the overbought region.

3. Canton (CC)

Canton is trading at $0.1490 after recording a gain of 11% to appear on the list of the top crypto gainers over the last 24 hours. Canton’s price has remained up by more than 70% for the past 30 days and 13% in the last week.

Source: CoinMarketCap

Source: CoinMarketCap

Canton Network is gaining serious momentum, and 45% of social media conversations revolve around its ecosystem. The rising popularity is influenced by the increasing institutional presence and ecosystem building. Notably, the Send app and Canton Network are in the spotlight of this movement, providing high levels of user engagement and value.

Moreover, 35% of the discussions are about earning CC tokens by participating in different activities in the ecosystem. This indicates the interest of the community in reward systems. The rest of the discussion, 15%, focuses on the capabilities and functionality of the Send app and Canton Wallet, showing the increasing popularity of the user experience.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

RFK Jr. may have perjured himself with key vaccines claim: newly revealed emails

ai.com Launches Autonomous AI Agents to Accelerate the Arrival of AGI