XRP under pressure but not broken yet in the Ripple crypto price outlook

The market is defensive but not capitulating as the Ripple crypto price trades near key technical levels, with bears in control but still lacking capitulation-style momentum.

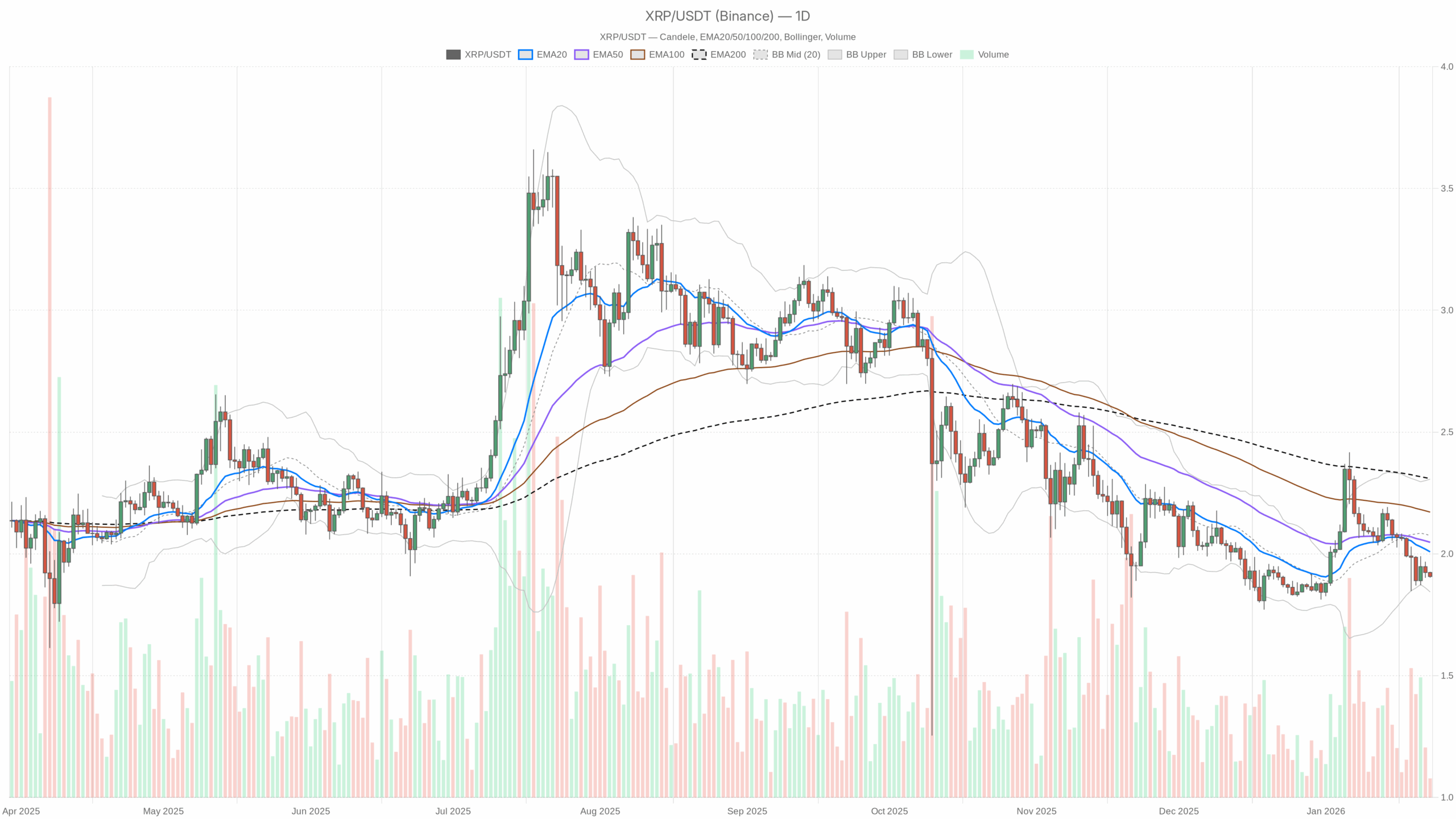

XRP/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

XRP/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

Daily Timeframe (D1) – Main Scenario: Bearish Bias, Controlled Pullback

The dominant scenario on the daily is bearish. Price is below the 20-day, 50-day, and 200-day EMAs, momentum is soft, and the regime tag is outright bearish. However, XRP is not in full breakdown territory yet; it is trading near short-term support with volatility contained.

EMA Structure (D1)

– Price: $1.91

– EMA 20: $2.01

– EMA 50: $2.05

– EMA 200: $2.31

All three EMAs are above price, and the 20-day is below the 50-day, with both well below the 200-day. That is a textbook short- to medium-term downtrend inside a larger, still-intact long-term uptrend. In practice, this means rallies into the $2.00–2.05 band are currently more likely to attract sellers than fresh breakouts. Bulls need to reclaim the 20-day EMA first to show they are back in the game.

RSI (D1)

– RSI 14: 40.9

RSI sitting just under 41 shows weak momentum but not panic. XRP is in the lower half of its momentum range, which fits a pullback or early downtrend phase rather than a climax sell-off. Bears have the edge, but there is room for both a bounce and a further bleed; the market is not at an obvious exhaustion point yet.

MACD (D1)

– MACD line: -0.02

– Signal: 0.00

– Histogram: -0.03

MACD is mildly negative and below its signal with a small negative histogram. This confirms the downside bias but speaks to grinding weakness rather than a strong directional push. Momentum is against the bulls, yet bears are not showing explosive strength either.

Bollinger Bands (D1)

– Mid-band (20SMA proxy): $2.08

– Upper band: $2.31

– Lower band: $1.84

– Price: $1.91

XRP trades close to the lower band but not hugging it. That is typical of a controlled downtrend or consolidation near the lows rather than an oversold band-walk. The gap between $1.84 and $2.31 is moderate: volatility is not crashing, but it is not expanding either. The market is cautious, not capitulating.

ATR & Volatility (D1)

– ATR 14: $0.08

A daily ATR of about 8 cents on a $1.91 asset is relatively modest. The recent move has bled lower without wild swings, which matches the story of a market in risk-off mode but not in panic. Moves can still be sharp if liquidity thins, but for now the tape is orderly.

Pivot Levels (D1)

– Pivot point (PP): $1.91

– R1: $1.92

– S1: $1.90

Price is sitting right on the daily pivot at $1.91. The immediate intraday structure is tight: a 2-cent band between S1 and R1. That shows short-term indecision around this level. It is a balance point where either side could gain control on the next move.

Hourly Timeframe (H1) – Weak, Flat, and Bearish by Regime

The hourly chart confirms the bearish bias, but it also shows a market that has gone a bit numb: small ranges, flat momentum, and price pinned around the same levels for several candles.

EMA Structure (H1)

– Price: $1.91

– EMA 20: $1.92

– EMA 50: $1.93

– EMA 200: $1.98

Price is just under the 20- and 50-hour EMAs and clearly below the 200-hour. That is short-term bearish alignment. However, the distance between price and the short EMAs is tiny, which signals consolidation more than a strong trend leg. Sellers are still in control, but they are not driving price aggressively lower.

RSI (H1)

– RSI 14: 41.1

Hourly RSI mirrors the daily: weak, but not washed out. Intraday momentum leans bearish, yet it is not stretched. This is the kind of environment where repeated small bounces can fail near resistance rather than form a clean vertical move.

MACD (H1)

– MACD line: -0.01

– Signal: -0.01

– Histogram: 0.00

MACD on the hour is essentially flat. That supports the view of directionless drift around current prices. It does not give bulls or bears a strong timing edge; structure and levels matter more than momentum here.

Bollinger Bands (H1)

– Mid-band: $1.92

– Upper band: $1.93

– Lower band: $1.90

– Price: $1.91

Bands are narrow and price is near the middle. Volatility is compressed, which often precedes a move. However, there is no clear directional tilt on this timeframe. The squeeze itself is the story: traders can expect expansion eventually, but should not guess direction purely from this.

ATR & Pivot (H1)

– ATR 14 (H1): $0.01

– Pivot: $1.91 (R1 = $1.91, S1 = $1.91 – effectively flat)

Hourly ATR at just a cent underlines how tightly XRP is trading. The flat pivot structure shows price is clustering around one level. That is typically the calm before either a break lower in line with the daily downtrend or an attempt to mean-revert toward the short EMAs above.

15-Minute Timeframe (M15) – Execution Context Only

The 15-minute chart is there to refine entries and exits, not to define the bias. It echoes the same story: gentle bearish drift, low volatility, and no decisive intraday trend.

EMA Structure (M15)

– Price: $1.91

– EMA 20: $1.91

– EMA 50: $1.92

– EMA 200: $1.93

Price is glued to the 20-EMA, slightly under the 50- and 200-EMAs. That is a mild bearish skew but with very little slope, which points more to a sideways-to-down grind than a trend leg. Any scalp-level rallies into $1.92–1.93 are likely to run into overhead supply while the daily remains bearish.

RSI & MACD (M15)

– RSI 14: 40.7

– MACD line: 0.00, Signal: 0.00, Histogram: 0.00

RSI again sits in the low 40s, confirming the same soft-bearish tone in the very short term. MACD is completely flat, and signals on this timeframe are noise-dominated right now. The edge comes from higher timeframes and key price levels, not from 15-minute oscillators.

Bollinger Bands & ATR (M15)

– Mid-band: $1.91

– Upper band: $1.92

– Lower band: $1.90

– ATR 14: $0.01

Very narrow bands and a 1-cent ATR confirm a compressed tape. For very short-term traders, this often means waiting for a break and retest rather than forcing trades inside the chop.

Market Context – Risk-Off and Heavy on BTC

Beyond XRP itself, the broader crypto backdrop leans defensive:

– Bitcoin dominance: ~57.5% – capital is clustered in BTC, typical when the market is in risk management mode.

– Total market cap: ~$3.1T, down ~1.2% in 24h – a modest but market-wide pullback.

– Fear & Greed Index: 24 (Extreme Fear) – sentiment is cautious and reactive.

In that environment, altcoins like XRP rarely lead sustainable rallies unless Bitcoin stabilizes and flows rotate back into risk. So even if the XRP chart finds technical support, follow-through will depend heavily on whether the macro tape stops leaking lower.

Bullish Scenario for Ripple Crypto Price

For a constructive XRP story from here, buyers need to defend the lower band region and start regaining lost ground step by step. The broader trend still allows for mean reversion higher if key supports hold.

Bullish path:

1. Hold Above $1.84–1.90

The first order of business is to keep daily closes above the lower Bollinger Band around $1.84 and above S1 support near $1.90. That would frame the current action as a controlled pullback rather than the start of a deeper slide.

2. Reclaim Short-Term EMAs

A sustained push back above the $2.00–2.05 zone (D1 EMA 20 and EMA 50) with RSI climbing back toward the mid-50s would mark a clear shift. That would show buyers have absorbed supply and are willing to chase price higher instead of just picking bottoms.

3. Momentum Turn

On the daily, traders would want to see MACD flatten and cross upward with the histogram turning positive, confirming that downside momentum is spent. On H1 and M15, price trading consistently above their respective 200-EMAs would add confirmation that the short-term trend has flipped.

4. Upside Targets

If those conditions line up, the logical upside magnet becomes the $2.30–2.31 area, which is both the daily upper Bollinger Band and close to the 200-day EMA. That is where the broader market will reassess whether this is just a mean reversion bounce or the start of a new leg higher.

What invalidates the bullish scenario?

A clean daily close below $1.84 with expanding ATR and RSI breaking under 35 would undercut the bullish case. That would indicate that the pullback is morphing into a more aggressive downtrend, with volatility expanding to the downside instead of stabilizing.

Bearish Scenario for Ripple Crypto Price

The current structure favors bears, but they still need a catalyst. Right now, they have control without dominance. Price is weak but not falling apart, and volatility remains compressed.

Bearish path:

1. Lose $1.90 Support and Lower Band

The first step would be a breakdown below $1.90, ideally with price starting to slide along or beneath the lower Bollinger Band near $1.84. Coupled with a pickup in daily ATR, that would mark a regime change from an orderly pullback to an active downtrend.

2. Momentum Rolls Over Further

Daily RSI dipping toward the low 30s and MACD accelerating deeper negative with a growing red histogram would show bears seizing real momentum. On H1, repeated failures at the 20- and 50-EMAs, with price pinned below the 200-EMA, would confirm that rallies are being sold consistently.

3. Follow-Through in a Weak Macro Tape

If broader crypto continues its risk-off behavior – BTC dominance grinding higher, total cap bleeding, sentiment stuck in Extreme Fear – altcoins like XRP can easily overshoot to the downside. In that environment, markets often ignore intermediate supports and gravitate toward higher time-frame zones. For XRP, that implies room for a deeper retrace below current levels before serious dip-buying comes back.

What invalidates the bearish scenario?

If XRP can push back above $2.05 and stay there, with daily RSI reclaiming the 50–55 area and MACD flattening, the bear case weakens significantly. Bears do not need to be fully squeezed, but once price is above both the 20- and 50-day EMAs, a simple continuation-downtrend narrative stops making sense for the Ripple crypto price.

Where This Leaves Traders

Across all timeframes, the message is consistent: the Ripple crypto price is in a controlled, low-volatility downtrend with a bearish bias but no capitulation. Daily and hourly structures both lean lower, while 15-minute action shows cramped ranges and no clear edge.

In this kind of environment:

– Trend-followers will generally favor a bearish stance while price stays below the daily 20- and 50-EMAs.

– Mean-reversion traders may watch the $1.84–1.90 region for evidence of a defended floor, but need to respect the fact that the dominant regime is still bearish.

– Short-term traders should be aware that ATR is compressed across timeframes; volatility can expand abruptly, especially if macro headlines shake the broader crypto market.

Uncertainty is elevated. Sentiment is fearful, liquidity is thinner, and XRP is parked at a technical inflection area rather than at a clear breakout or breakdown. The key over the next few sessions is whether buyers can turn this from an orderly drift lower into a genuine base-building process above $1.84. Until they do, the benefit of the doubt stays with the bears, but only cautiously.

If you want to monitor markets with professional charting tools and real-time data, you can open an account on Investing using our partner link:

Open your Investing.com account

This section contains a sponsored affiliate link. We may earn a commission at no additional cost to you.

This analysis is for informational and educational purposes only and is not investment, trading, or financial advice. Markets are volatile and unpredictable; always do your own research and consider your risk tolerance before making trading decisions.

You May Also Like

Momentous Grayscale ETF: GDLC Fund’s Historic Conversion Set to Trade Tomorrow

The UA Sprinkler Fitters Local 669 JATC – Notice of Privacy Incident