Dogecoin Price Prediction As BOJ Keeps Rates Unchanged

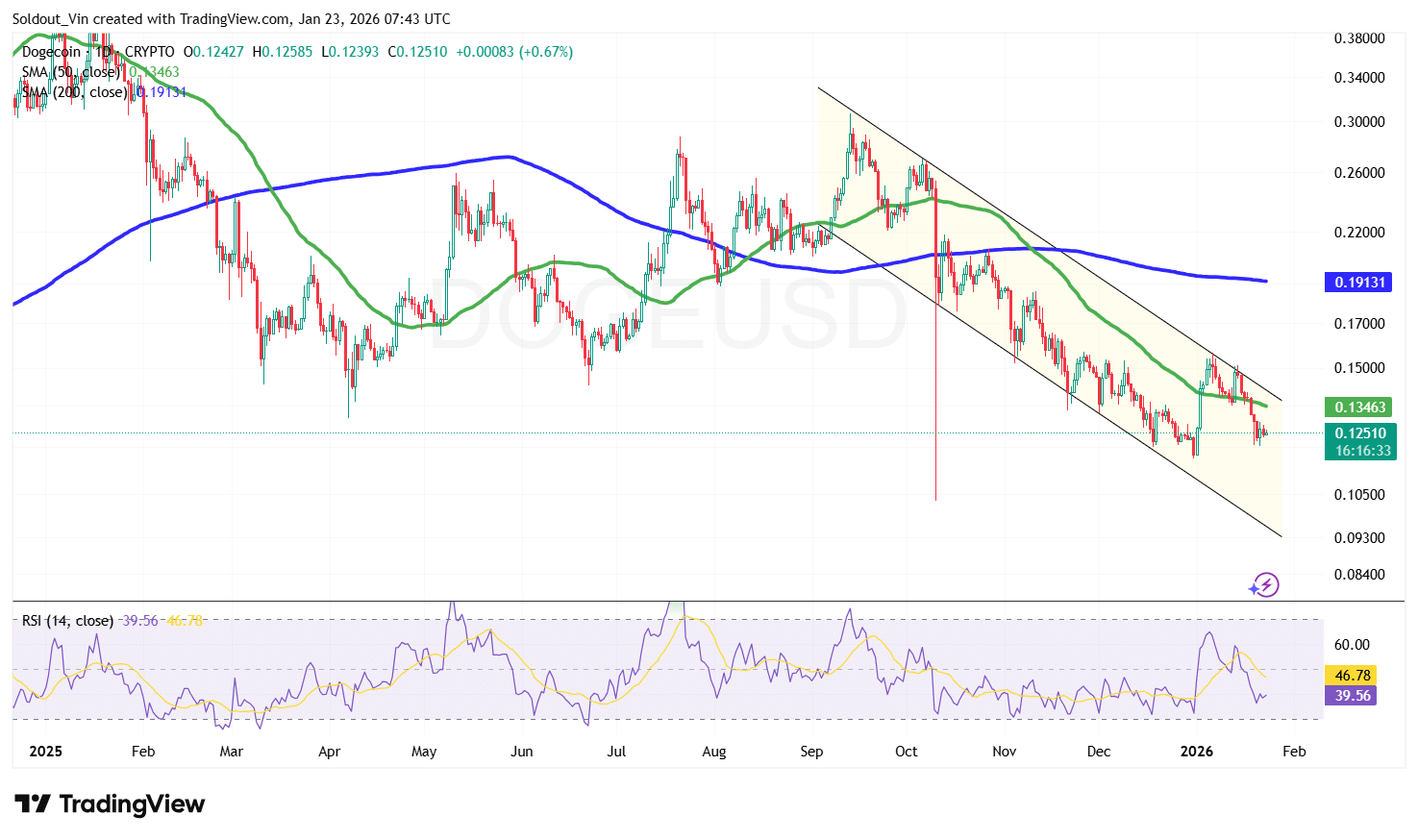

Dogecoin is on a weekly losing streak, down over 10% as it trades within a falling channel. The pattern signals a continued selling pressure, with each recovery attempt failing to generate meaningful follow-through.

With sellers maintaining control and the price continuing its downtrend, DOGE is now hovering near a key demand zone around $0.13, which has served as strong support throughout the decline.

DOGE has edged down over the last 24 hours to trade at $0.125 as of 02:43 a.m. EST, with trading volume dropping by over 42% to $768 million, indicating reduced trading activity today.

The drop is in tandem with the broader crypto market, which has fallen over 2% to a market capitalization of $3.1 trillion. Most of the crypto tokens remained unchanged after the Bank of Japan kept interest rates unchanged as expected.

Bank of Japan Holds Rates, Investors Remain Cautious

The Bank of Japan kept interest rates steady on Friday and raised its economic and inflation forecasts, signaling its readiness to continue hiking still-low borrowing costs.

As widely expected, the Japanese central bank maintained short-term interest rates at 0.75% by an 8-1 vote.

The only dissenter, Takata, argued that the price stability target had largely been achieved and that price risks were skewed to the upside.

In its updated forecasts, the bank left its core inflation projections for fiscal years 2025 and 2027 unchanged at 2.7% and 2% respectively. A tenth nudged up the 2026 forecast to 1.9%.

As a result, the Japanese yen fell against the US dollar, which was trading at 158.64 yen, up from 158.42 yen.

The S&P 500 climbed 0.5% to 6,913.35, extending its rally after U.S. President Donald Trump called off tariffs on European countries that he said opposed his calls for U.S. control of Greenland.

The Dow Jones Industrial Average rose 0.6% to 49,384.01, and the Nasdaq composite gained 0.9% to 23,436.02.

Dogecoin Price Faces Downtrend Pressure

Dogecoin is trading around $0.12–$0.13, holding just above short-term support at $0.12, where buyers have stepped in after the latest leg lower within the broader downtrend.

This period of sideways movement follows a sustained decline from the $0.28–$0.30 area, where selling pressure intensified, pushing the DOGE price into a prolonged corrective phase.

Demand has emerged near the $0.10 zone, slowing downside momentum and stabilizing the Dogecoin price.

Dogecoin price is trading below the 50-day Simple Moving Average (SMA) near $0.13, which is currently acting as dynamic resistance. Price also remains well under the 200-day SMA around $0.19, which supports the overall bearish bias.

Momentum indicators reflect this cautious setup. The Relative Strength Index (RSI) is hovering near 39–45, currently at 39.56, below the neutral 50 level. This indicates weak momentum, though not deeply oversold, leaving room for a potential relief bounce if buying interest increases.

DOGE/USD Chart Analysis Source: TradingView

DOGE/USD Chart Analysis Source: TradingView

DOGE Price Risks A Sustained Drop

Based on the daily DOGE/USD chart, the Dogecoin price could continue to drop. On the downside, failure to break above channel resistance could lead to another pullback, with $0.12 acting as immediate support. A loss of this level may expose the $0.10 demand zone, where buyers previously stepped in to defend the price.

Conversely, a short-term move toward the $0.14–$0.15 zone is possible, as the upper channel boundary aligns with prior rejection levels and the falling 50-day SMA.

A decisive breakout above the channel, followed by a sustained move above $0.15, would be the first technical signal that bearish pressure is weakening. A more meaningful trend shift would likely require reclaiming the $0.19–$0.20 region near the 200-day SMA.

An analysis by popular crypto analyst on X, Ali Martinez, shows that DOGE has formed a falling wedge pattern on the weekly chart, which could result in a long-term breakout.

For Dogecoin to realistically transition into a sustained recovery phase, it would need a confirmed break in structure, potentially marked by higher lows and a daily close above key resistance levels.

Related News:

You May Also Like

Relax, Core v30 Won’t Kill Bitcoin

United States Building Permits Change dipped from previous -2.8% to -3.7% in August