Another Dogecoin ETF Has Gone Live For Trading, How Did It Perform?

The US crypto market has welcomed a new entrant as 21Shares rolls out its Spot Dogecoin ETF, giving investors another avenue to engage with the infamous dog-themed meme coin. Trading kicked off amid a mix of curiosity and caution, with on-chain data already showing how much the DOGE ETF has performed so far.

21Shares Launches Dogecoin ETF

In a press release on Thursday, January 22, 21Shares announced the official launch of its Spot Dogecoin ETF, TDOG, which began trading on NASDAQ the same day. The new ETF provides investors with direct exposure to Dogecoin through a fully backed, regulated, and transparent vehicle. Each ETF share is also backed 1:1 by DOGE held in institutional-grade custody.

Notably, the launch of the new TDOG ETF brings the total number of US Dogecoin ETFs to three, joining Grayscale’s GDOG and Bitwise’s BWOW. 21Shares is also the only ETF provider endorsed by House of Doge, the official corporate arm of the Dogecoin foundation, highlighting the global asset manager’s close ties to the meme coin.

As one of the largest crypto ETF issuers, 21Shares continues to expand its crypto product lineup with the introduction of TDOG. This follows the investment company’s previous ETF offerings, including TSOL, a Solana ETF released in November 2025; ARKB, a Spot Bitcoin ETF launched in January 2024; and TETH, an Ethereum ETF introduced in July of the same year. Together, these products demonstrate 21Shares’ commitment to providing institutional-grade access to high-demand digital assets.

Federick Brokate, Global Head of Business Development at 21Shares, highlighted DOGE’s large and active global community, calling it a unique digital asset with constantly growing use cases. He added that the new TDOG ETF will give investors regulated, physically backed exposure through a familiar ETF structure they know and trust.

Marco Margiotta, the CEO of House of Doge, also shared comments on the recently launched 21Shares ETF. He said that TDOG is a step toward making Dogecoin easier to access through traditional financial systems. He also disclosed that House of Doge’s partnership with 21Shares will help more people get involved as the Dogecoin ecosystem grows.

How 21Shares Dogecoin ETF Has Performed So Far

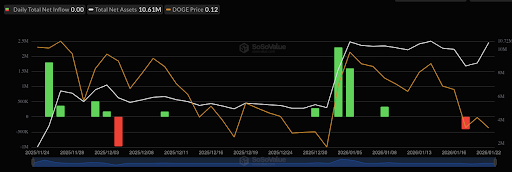

Contrary to expectations, 21Shares’ recently launched Dogecoin ETF saw weak performance on the first day of trading, signaling investors’ lack of interest in the investment product. Data from SoSoValue shows that TDOG experienced no inflows on January 22 and instead declined by about 0.07%. Despite it being the second day of trading, the DOGE ETF has still not registered any flows.

This lackluster performance has been observed across all Dogecoin ETFs this week. Grayscales’ GDOG and Bitwise BWOW have reported zero inflows over the last week. The last time GDOG saw positive activity was on January 8, when it received around $333,083 in investments. Before that, the ETF recorded its highest inflows on January 2, totaling roughly $2.3 million. Since its launch in November 2025, GDOG ETF inflows have been unstable, with more days of inactivity than significant investment.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Nomura Alters Fed Rate Cut Prediction for 2025