Gold’s Digital Rally Signals Dollar Pressure as Tokenized Gold Surges

The market for tokenized gold is expanding in step with rising demand for physical bullion, highlighting a broader shift toward traditional safe-haven assets as geopolitical tensions and trade uncertainty push investors away from the US dollar. On Monday, Tether disclosed that its Tether Gold, XAUt, now represents more than half of the entire gold-backed stablecoin market, with a total value topping $2.2 billion. End-of-year data show 520,089 XAUt tokens in circulation, each backed one-for-one by physical gold held in reserve. The development underscores a growing appetite for crypto-native wrappers that offer liquidity while anchoring themselves to tangible assets.

Key takeaways

- XAUt dominates the gold-backed stablecoin space, making up more than 50% of the market and surpassing $2.2 billion in aggregate value, with 520,089 tokens circulating at the end of Q4.

- Gold’s rally intensified as Comex reached new price levels, with the precious metal eclipsing $5,000 per troy ounce for the first time in a rally that year, underscoring demand for bullion as a hedge against currency risk.

- Central banks stepped up bullion purchases in 2025, adding a net 220 tonnes in Q3, a sign of diversification away from dollar-denominated reserves toward stores of value outside the traditional financial system.

- The US Dollar Index has been in a downtrend, shedding about 9.4% in 2025 and sliding to fresh lows in early 2026, a backdrop that supports safe-haven assets, including tokenized gold wrappers.

- Bitcoin (BTC) has yet to supplant gold as a hedge against debasement; analysts suggest gold remains the preferred safe haven for long-term investors, even as crypto narratives around digital gold grow.

Tickers mentioned: $BTC, $XAUt

Market context: The confluence of dollar weakness, rising bullion demand and the expansion of tokenized assets is shaping liquidity flows and risk sentiment across crypto markets, with investors weighing non-dollar stores of value as macro uncertainty persists.

Why it matters

The rapid expansion of tokenized gold underscores a pragmatic use case for crypto-native assets: liquidity and transferability combined with a tangible reserve. XAUt’s outsized position within the gold-backed stablecoin market signals increasing investor trust in custodied physical gold as the backing asset for digital tokens. This is particularly salient as investors seek to diversify away from the dollar while maintaining on-chain exposure that can be more easily traded across borders and custodial environments than vault-held bullion alone.

From a macro vantage point, the dollar’s weakness has been a persistent theme. The US Dollar Index (DXY) has faced a multi-year dismantling in some cycles, with central banks worldwide continuing to accumulate gold as a hedge against currency risk. World Gold Council data show a robust third-quarter surge in central-bank purchases, a 220-tonne net acquirement, illustrating how reserve managers are balancing safety with yield in an uncertain environment. That shift dovetails with the tokenized-gold narrative: as physical gold flows into official reserves, retail and institutional participants are turning to digital wrappers to gain efficient exposure to bullion without the frictions of custody and cross-border logistics.

Bitcoin’s role in this environment remains a debated matter. While proponents have long argued that BTC can serve as a digital hedge against debasement, its actual flow under real-world risk conditions has been uneven. An industry analysis contends that Bitcoin has fallen short of delivering on its promise as a debasement hedge, leaving gold as the more reliable long-run store of value for many investors. The diverging paths of BTC and XAUt reveal a nuanced landscape where digital and physical hedges coexist, each appealing to different risk appetites and governance preferences.

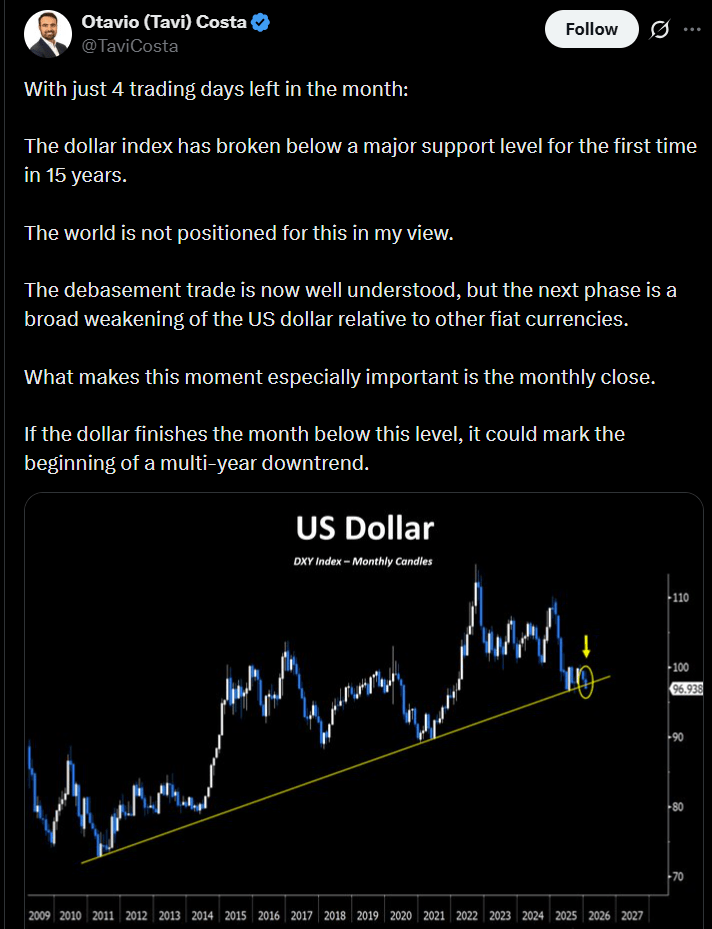

The US Dollar Index falls below 97.00. Source: BloombergThe dollar story is intertwined with gold momentum. After a year in which the DXY slid more than 9% and extended losses into the new year, several analysts suggest that the breakdown of a long-term support trend line may be followed by a period of broader devaluation against other fiat currencies. In this frame, tokenized gold products like XAUt offer a way to monetize bullion exposure with on-chain settlement, while still anchoring value in a widely recognized physical asset. The narrative is not purely about crypto; it is about diversifying reserve exposure in a global economy where currency stability has become fragile in the eyes of many institutions.

Source: Otavio Costa

Source: Otavio Costa

In terms of investor behavior, the question remains whether the market will see continued inflows into tokenized gold vehicles as central banks’ appetite for bullion remains elevated. If the dollar continues to weaken and safe-haven demand persists, tokenized gold could gain additional traction as a bridge between traditional assets and on-chain liquidity. Yet the broader crypto market must still contend with the volatility that has characterized digital assets in recent cycles, as well as evolving regulatory narratives that could influence how tokenized commodities are treated from a compliance and taxation standpoint.

As the debate over debasement and inflation persists, market participants will be watching how the XAUt vessel evolves—whether it maintains its dominant market share, expands its reserve backing, or faces new competition from other tokenized gold issuances. The underlying dynamics are not just about a single stablecoin or a single asset class; they reflect a broader search for resilient stores of value in an increasingly interconnected and sometimes unsettled financial landscape.

What to watch next

- Updates on XAUt token circulation and the gold reserves backing it, particularly any quarterly disclosures from Tether.

- Central-bank gold demand trends in late-2025 and early-2026, and whether the 220-tonne third-quarter figure is part of a sustained shift.

- Changes in gold prices and the Comex market floor, including any sustained breaches of key resistance levels for bullion traders.

- Regulatory developments regarding stablecoins and tokenized commodities, including potential ETF-related dynamics that could influence investor flows.

Sources & verification

- Tether’s disclosure on XAUt issuance and backing (gold reserve one-for-one per token) and the claim that XAUt accounts for over half of the gold-backed stablecoin market.

- World Gold Council data showing net central-bank gold purchases, including 220 tonnes in Q3 2025.

- Bloomberg reporting on the US Dollar Index movements and current level trends.

- CoinMarketCap page for Tether Gold (XAUt) market capitalization and token count.

- Beleggers Belangen analysis on Bitcoin’s role as a debasement hedge compared to gold.

Tokenized gold gains traction as bullion demand rises and the dollar weakens

The surge in tokenized gold signals a pragmatic intersection of traditional assets and digital infrastructure. As investors seek safe-haven assets amid geopolitical and trade uncertainties, tokenized wrappers like XAUt provide a familiar risk profile with the added advantages of programmable liquidity and cross-border settlement. The fact that XAUt now represents more than half of the gold-backed stablecoin market—backed by a physical bullion reserve—adds a layer of credibility to tokenized commodities as an investable subset of the crypto market. This dynamic is occurring amid a broader trend: bullion demand among official sector holders is climbing, while the dollar’s strength weakens, prompting a shift in reserve composition that could favor non-dollar hedges over the medium term.

Bitcoin (BTC) has been a focal point in crypto debates about hedging and store of value. While proponents argue that digital scarcity and decentralization offer an alternative to traditional deployments, the asset’s real-world flow has yet to demonstrate a consistent, broad-based shift away from gold as a hedge. An evaluation by Karel Mercx of Beleggers Belangen concluded that BTC has fallen short of delivering a robust debasement hedge, reinforcing the ongoing preference for gold among long-term investors. The juxtaposition of BTC with XAUt reflects the evolving toolbox investors use to navigate macro risk, with tokenized commodities occupying a middle ground between physical assets and on-chain liquidity.

As policy makers, institutions and households alike reassess the role of money, the intersection of dollar weakness and bullion diversification appears to be a persistent theme. The dollar’s slide, the expansion of bullion reserves, and the growth of tokenized assets are not isolated phenomena; they are interconnected pieces of a broader repositioning in global financial markets. For traders and savers, this environment encourages careful evaluation of risk-on versus risk-off exposures, liquidity needs, and the potential for regulatory clarity to shape the trajectory of tokenized commodities like XAUt in the months ahead.

https://platform.twitter.com/widgets.js

This article was originally published as Gold’s Digital Rally Signals Dollar Pressure as Tokenized Gold Surges on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SHIB Price Analysis for February 8