Solana (SOL) Price: ETF Inflows Reach $1.1 Billion as Token Bounces Off Key Support

TLDR

- Solana bounced off the $120 support level after sharp losses during the Asian trading session

- Daily trading volume exploded by 278% to reach $6.3 billion, representing 9% of SOL’s market cap

- SOL ETFs attracted $10 million in new assets from Monday to Thursday last week, bringing total assets to $1.1 billion

- On-chain metrics show strong network activity with weekly active users hitting 5.1 million and transaction volumes reaching 764.9 million

- Technical indicators suggest SOL could drop to $97 if the $120 support level fails to hold

Solana’s price tested a critical support level at $120 over the weekend as markets reacted to unexpected tariff announcements from President Donald Trump.

Solana (SOL) Price

Solana (SOL) Price

The cryptocurrency fell to a session low of $118 during the Asian trading session on Sunday before quickly recovering. The sharp price movement came after Trump threatened to impose 100% tariffs on Canada if the country struck a deal with China.

Trading activity increased dramatically during the sell-off. Daily volume jumped 278% to $6.3 billion, accounting for 9% of Solana’s total market cap.

The Crypto Fear and Greed Index dropped from 54 to 29, reflecting growing uncertainty among investors. Market participants remain cautious about the near-term outlook as trade tensions continue to affect cryptocurrency prices.

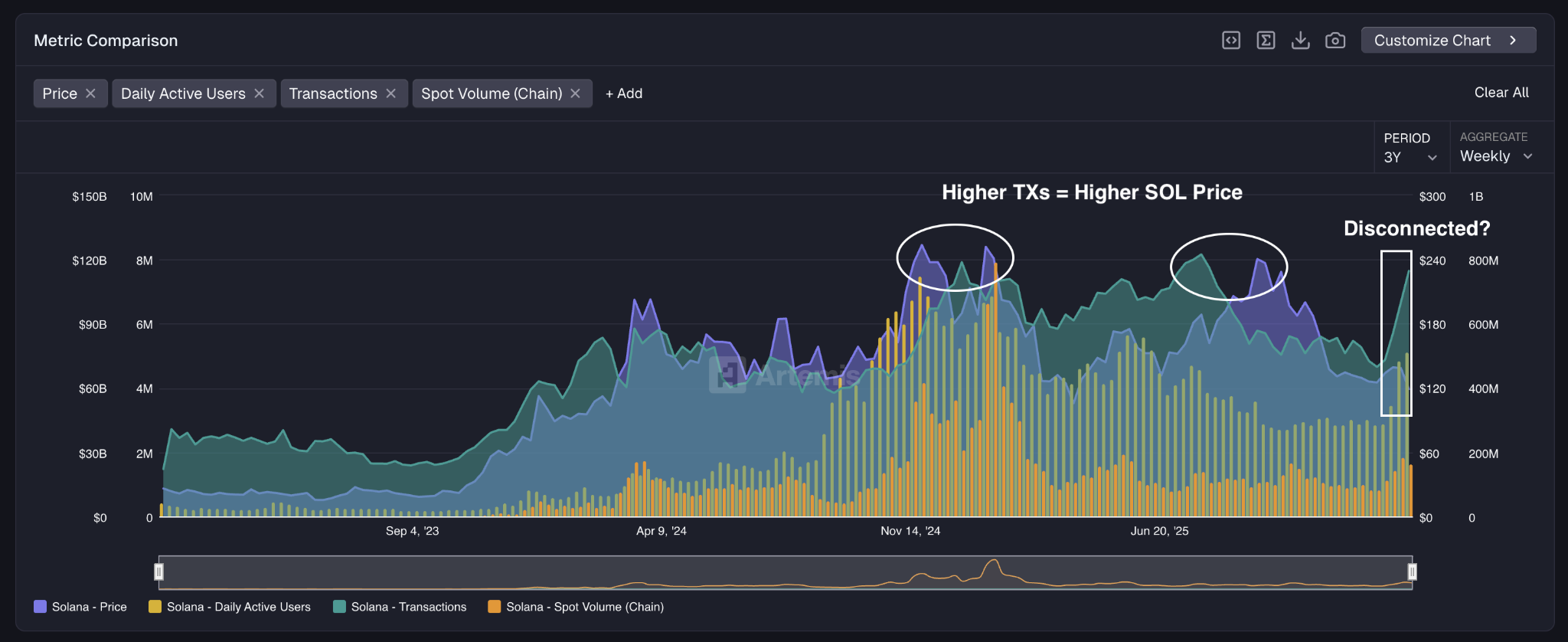

Despite the price decline, Solana’s network fundamentals showed strong growth. Weekly active users reached 5.1 million last week, up 4% from the previous week and marking the highest level since June 2025.

Transaction volumes also increased substantially. The network processed 764.9 million transactions last week, up 64% from 466 million transactions in late December.

Network Activity vs Price Action

The current transaction volume levels match those seen when SOL traded above $200 in previous months. This creates a disconnect between network usage and token price.

Source: Artemis

Source: Artemis

Historical data shows that similar transaction volumes corresponded with SOL trading at $253 in November 2024 and $240 in September 2025. The gap suggests the current price may not reflect the network’s actual usage and adoption.

Institutional interest in Solana remains steady. SOL ETFs received $10 million in inflows from Monday to Thursday last week. Total ETF assets now stand at $1.1 billion.

Technical Outlook

The $120 level has proven to be a key support zone for SOL. Buyers have stepped in to defend this price point multiple times.

The Relative Strength Index on the daily chart fell below its 14-day moving average. This indicates that selling pressure has increased in recent sessions.

If SOL breaks below $120, the next support level sits at the lower bound of a descending price channel. A failure to hold that level could push the price toward $97, which would be the lowest point since April 2025.

Resistance currently sits at $145. Solana has faced selling pressure each time it has attempted to break above this level.

The 4-hour chart showed a sell signal during Sunday’s Asian session decline. However, buying pressure returned quickly once the price hit $120.

A move above $125 would signal a potential trend reversal. This could open the path for SOL to test $130 and then $145.

Current market sentiment favors continued downside pressure. The combination of macroeconomic uncertainty and trade tensions continues to weigh on cryptocurrency prices across the board.

Transaction volumes on Sunday confirmed the $120 level as a highly contested area. The outcome at this price point will likely determine Solana’s direction in the coming sessions.

The post Solana (SOL) Price: ETF Inflows Reach $1.1 Billion as Token Bounces Off Key Support appeared first on CoinCentral.

You May Also Like

XRP Ignites As Spot Volume Skyrockets

Cloud mining is gaining popularity around the world. LgMining’s efficient cloud mining platform helps you easily deploy digital assets and lead a new wave of crypto wealth.