Bitcoin (BTC) Price: Why February Could Change Everything for Investors

TLDR

- Bitcoin’s February performance has historically been strong, with the week ending Feb. 21 showing a median 8.4% return since 2016

- Network economist Timothy Peterson says February often outperforms October’s seasonal gains, with mid-month periods showing 7% weekly returns

- Early February performance in 2018, 2022, and 2025 correctly predicted bearish years, with 2025 showing a 5% decline in the first three weeks

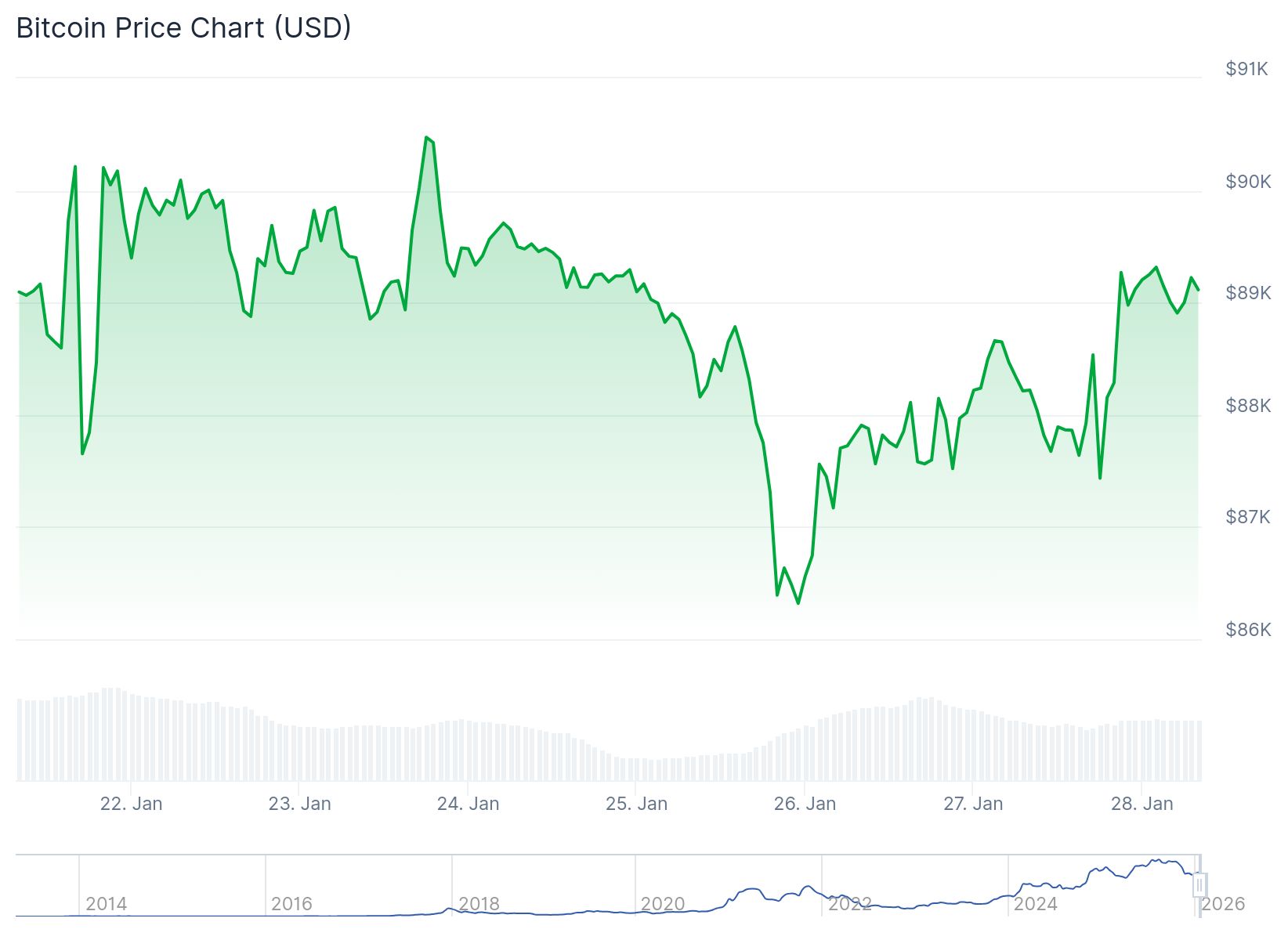

- Bitcoin currently trades around $88,000, remaining flat in 2026 with only 1% gains year-to-date

- Long-term models predict Bitcoin’s 2026 price ceiling could reach between $210,000 and $300,000 based on historical decay channel patterns

Bitcoin has gained just 2.2% in monthly terms, but historical data suggests a bullish turn could arrive in February. The cryptocurrency trades around $88,000 as investors await signals from the Federal Reserve.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Network economist Timothy Peterson analyzed Bitcoin’s performance patterns dating back to 2016. His research shows February consistently delivers better returns than the popular “Uptober” trend. The week ending February 21 has produced a median return of 8.4% across multiple years.

Bitcoin closed higher 60% of the time during this specific period. Peterson attributes this pattern to macroeconomic factors rather than crypto-specific catalysts.

Mid-February coincides with the release of full-year corporate earnings reports. Companies typically provide forward guidance during this window. Optimistic outlooks from corporations tend to push investors toward riskier assets.

Peterson pointed to the two-week stretch from February 7 to 21 as particularly strong. This period has shown median weekly returns of 7% or higher.

Early February Performance as Market Indicator

The first three weeks of February have served as a reliable signal for the rest of the year. Peterson examined correction years to identify patterns. In 2018, Bitcoin gained 4% during early February before finishing the year lower.

The cryptocurrency fell 3% in early 2022, another down year. In 2025, Bitcoin declined 5% in the first three weeks of February and continued lower through the year.

Bitcoin’s 2026 performance mirrors this bearish pattern. The cryptocurrency has managed only 1% gains year-to-date. This underwhelming start comes despite a weaker U.S. dollar, which typically benefits digital assets.

Market volatility remains elevated but appears to be easing. Peterson suggested Bitcoin could rebound if stress indicators like the CBOE volatility index continue cooling off.

Long-Term Price Projections

Bitcoin researcher Sminston With maintains a bullish outlook for the current cycle. Using the Bitcoin Decay Channel model, With estimates Bitcoin’s 2026 top price between $210,000 and $300,000. The model does not predict exact timing but has proven reliable for price band estimates.

Momentum indicators show Bitcoin turning positive despite recent corrections. Sina, author of the Bitcoin Intelligence Report, noted that consolidation since early January has preserved the broader market structure.

The recent sell-off aligned with the Nasdaq’s decline following renewed U.S. tariff tensions. This suggests a news-driven event rather than fundamental weakness in Bitcoin.

XWIN Research observed that Bitcoin remains in consolidation rather than a clear downtrend. Elevated long-term bond yields are limiting price expansion. However, the Realized Cap continues rising, indicating new capital entering the network through spot purchases.

Bitcoin currently trades at $88,079 as investors watch the Federal Reserve’s two-day meeting. Markets expect policymakers to keep interest rates unchanged when they announce their decision Wednesday.

The post Bitcoin (BTC) Price: Why February Could Change Everything for Investors appeared first on CoinCentral.

You May Also Like

Renowned Author Robert Kiyosaki Addresses Controversy Over Bitcoin Statements

Perp Traders Prioritize Capital Efficiency As On-Chain Infrastructure Matures