Aptos RPC for Builders: Faster Infrastructure for Aptos Crypto Projects

Aptos has rapidly emerged as one of the most scalable, developer-friendly Layer-1 blockchains in Web3 - built on the Move programming language and designed for low-latency, high-throughput applications. With parallel execution, fast finality, and a growing ecosystem of DeFi, gaming, payments, and real-world apps, demand for reliable Aptos RPC access has never been higher.

Whether you're building automation tools, DeFi protocols, on-chain analytics, trading systems, or an Aptos block explorer, production-grade performance ultimately depends on the RPC infrastructure you’re connected to.

Public Aptos RPC endpoints are great for experimentation but they quickly fail under real-world workloads. That’s where a high-performance, dedicated RPC provider becomes essential.

About Aptos

Aptos is a high-performance Layer-1 blockchain built by former Diem engineers and designed around the Move smart contract language. Its architecture introduces several innovations that allow it to scale without compromising safety:

Parallel Execution (Block-STM)

Aptos uses a unique parallel execution engine that can process many transactions simultaneously, dramatically increasing throughput.

Sub-Second Finality

Transactions confirm almost instantly, enabling real-time use cases like gaming, trading, payments, and social apps.

Move Language Safety

Move’s resource-based structure enforces strict safety guarantees, preventing many errors common in Solidity ecosystems.

Rapidly Growing Ecosystem

Aptos is expanding across DeFi, NFTs, gaming, RWAs, identity, and consumer apps

What Does an Aptos RPC Node Do?

One of the most important roles of an Aptos node is exposing RPC (Remote Procedure Call) access, which is how every wallet, dApp, explorer, bot, and backend system interacts with the Aptos blockchain.

Through the RPC API, nodes provide developers with real-time and historical blockchain data, allowing them to build reliable applications without running their own infrastructure.

What RPC Access Allows Developers to Do

Aptos RPC endpoints enable you to:

- Query on-chain account stateFetch balances, Move resources, and module data.

- Submit and simulate transactionsSend signed transactions to the network or dry-run them before execution.

- Retrieve events and logsEssential for indexers, explorers, analytics, and automation tools.

- Fetch block and ledger metadataAccess block heights, timestamps, versions, and chain health metrics.

- Access historical stateRequired for dashboards, analytics platforms, trading systems, and archival queries.

Why Public Aptos RPC Isn’t Enough for Production

Public RPC endpoints are shared and rate-limited, making them ideal for learning Move or running small scripts - not for production workloads.

They struggle when you need:

- High request throughput

- Real-time transaction monitoring

- Fast access to historical data

- Guaranteed uptime

- Low-latency response times

As builders deploy higher-volume applications - explorers, trading bots, gaming engines, and dashboards - a dedicated Aptos node or private RPC becomes essential.

High-Performance Aptos RPC by OnFinality

OnFinality provides globally distributed, production-grade Aptos RPC endpoints, giving builders the scalability and speed needed for serious Aptos blockchain development.

Zero Rate Limits (Ultimate plan)

No throttling - ideal for explorers, bots, analytics, and indexers.

Low Latency via Global Distribution

Fast response times for users and systems around the world.

Fully Compatible with Aptos APIs

Supports all common operations:

- Account queries

- Move resources

- Transactions

- Events

- Ledger info

- Blocks and metadata

Optimized for Heavy Workloads

Perfect for:

- Aptos block explorers

- DeFi protocols

- Trading and arbitrage bots

- On-chain analytics

- Full-chain indexers

- Historical data pipelines

- Real-time gaming dApps and engines

Get your OnFinality Private Aptos API Endpoint

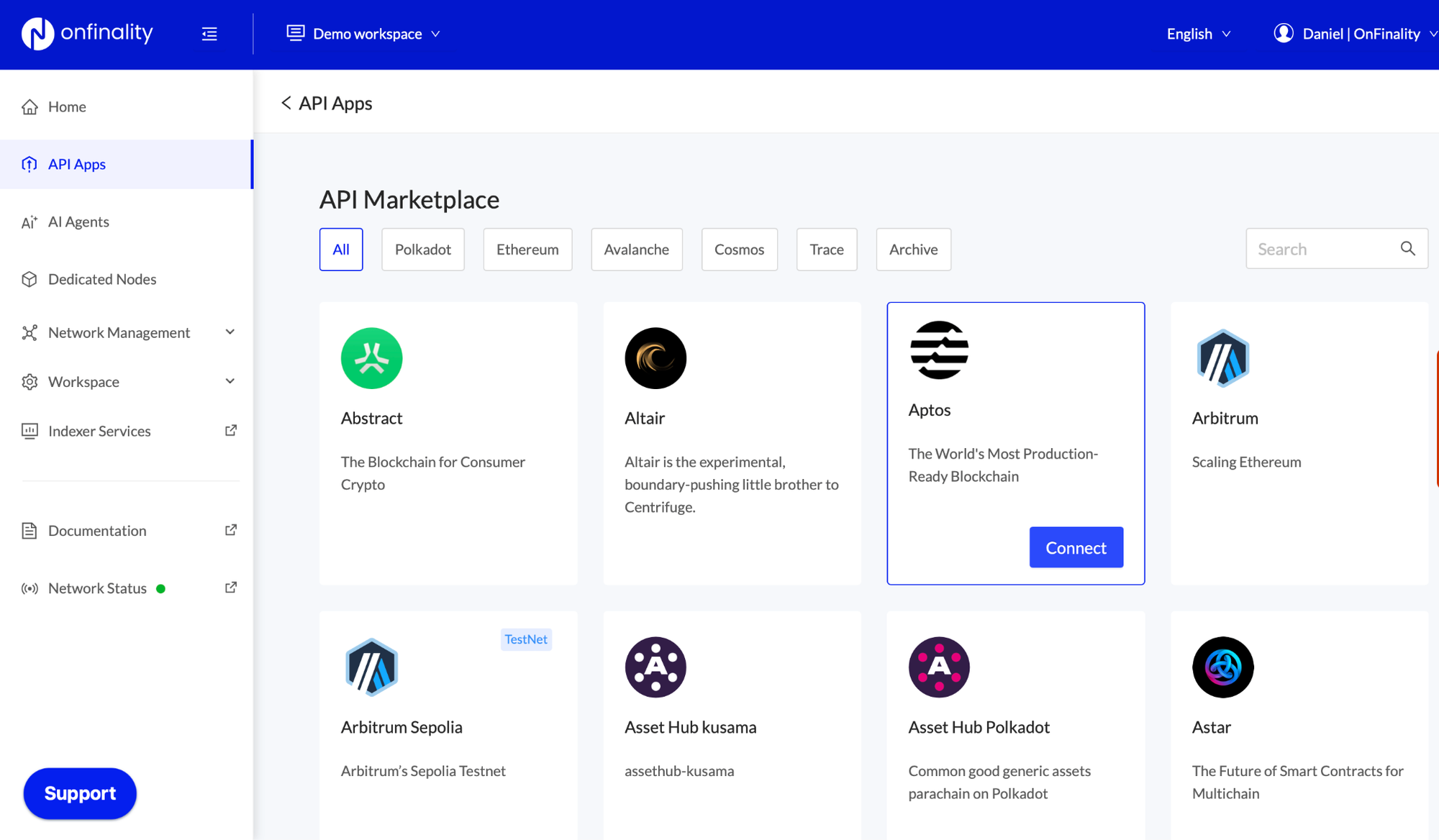

Developers can connect to Monad using OnFinality’s Dashboard and public RPC endpoints

Step 1: Sign up to app.onfinality.io/signup

Step 2: Open API Apps - Network Explorer and select Aptos

Step 3: Copy the Https endpoint

OnFinality Public Hyperliquid API Endpoints

Aptos RPC Endpoint - HTTPS: https://aptos.api.onfinality.io/v1/public

Make your First Request

CURL

curl -H 'Content-Type: application/json' 'https://aptos.api.onfinality.io/v1/public'

Helpful Aptos Development Resources

- Aptos developer documentation: https://aptos.dev

- Move & Aptos architecture: https://aptos.dev/concepts/

- Aptos ecosystem overview: https://coinmarketcap.com/academy/article/what-is-aptos-the-ultimate-guide-to-the-aptos-ecosystem

Final Thoughts

Aptos delivers unmatched performance - parallel execution, fast finality, and strong safety guarantees through Move. But none of that matters if your RPC layer can’t keep up.

With OnFinality’s high-performance Aptos RPC, developers gain reliable, scalable access to the Aptos network - unlocking real-time trading systems, analytics engines, explorers, and next-gen consumer apps.

About OnFinality

OnFinality is a blockchain infrastructure platform that serves hundreds of billions of API requests monthly across more than 130 networks, including Avalanche, BNB Chain, Cosmos, Polkadot, Ethereum, and Polygon. It provides scalable APIs, RPC endpoints, node hosting, and indexing tools to help developers launch and grow blockchain networks efficiently. OnFinality’s mission is to make Web3 infrastructure effortless so developers can focus on building the future of decentralised applications.

App | Website | Twitter | Telegram | LinkedIn | YouTube

You May Also Like

Three dormant wallets, suspected to belong to the same entity, purchased 5,970 ETH eight hours ago.

BlackRock Increases U.S. Stock Exposure Amid AI Surge