Best Memecoins to Buy Today, January 28 – DOGE, PENGU, FARTCOIN

Highlights:

- Dogecoin, Pudgy Penguins, and FARTCOIN are the best memecoins to buy today, showing strong market potential and growth.

- Dogecoin’s price could surge once traditional markets cool off, following its cyclical behavior with gold.

- FARTCOIN’s strong momentum signals a potential bullish breakout, especially with recent price action above key support.

The crypto market is rallying as traders await the interest rate decision from the U.S. Federal Reserve today. The total market capitalization and the 24-hour trading volume have surged to $3.01 trillion and $112 billion, respectively. Bitcoin has retraced above the $89K level while major altcoins record modest gains. Meanwhile, memecoins are exhibiting classical rotation behavior following a duration of broader market consolidation. In this article, we will discuss the best memecoins to invest in today, such as Dogecoin, Pudgy Penguins, and FARTCOIN.

Best Memecoins to Buy Today

1. Dogecoin (DOGE)

Dogecoin is up by 2.50% over the last 24 hours following the broader market resurgence. The memecoin has been trading on a descending channel over the past month, dropping from highs of $0.15 to seek support at $0.11. Its market cap and trading volume have also surged to $21 billion and $1.14 billion, respectively.

Source: CoinMarketCap

Source: CoinMarketCap

Crypto analyst Trader Tardigrade has shared an insightful analysis comparing the price trend of gold and Dogecoin. On the chart, he points out the cyclical relationship between these two assets. During the gold mania phase, Dogecoin remains stagnant, failing to record much traction. But when the price of gold peaks and goes into a stagnation phase, the price of DOGE skyrockets into its own mania phase.

These market cycles could be useful to investors interested in the best memecoins to buy today. This trend between gold and DOGE indicates that the major price movement for DOGE might occur after the traditional markets cool off.

2. Pudgy Penguins (PENGU)

Pudgy Penguins has continued its uptrend with a surge of 6% over the last 24 hours. Currently, the price is hovering around $0.001015. Moreover, its trading volume has surged by 35%, pushing the value to $135 million.

Source: CoinMarketCap

Source: CoinMarketCap

PENGU has been consolidating in a tight range since 19th January. The price has bounced off the support level around $0.008936 and formed a steady upward pattern, and faced resistance at the $0.010540 level. Should the current trend hold, PENGU could break above this point and look to challenge the next significant level at $0.012398.

Source: TradingView

Source: TradingView

Additionally, technical indicators such as the MACD and the 14-day RSI suggest that PENGU could continue its rally. The MACD line has climbed to the positive region with green bars forming further on the histogram. Meanwhile, the RSI is steadily climbing toward the overbought region at 61 levels, indicating increased buying pressure.

3. FARTCOIN

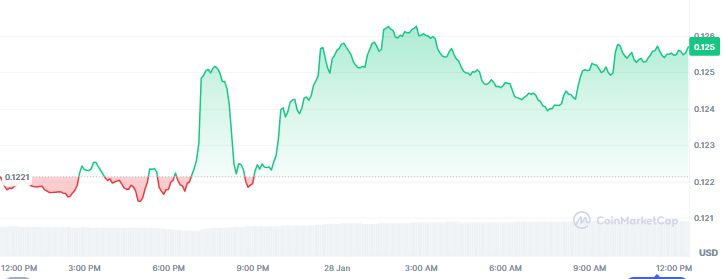

FARTCOIN displays a robust momentum today as the price climbed above the $0.300 mark after the recent pullback. As of this writing, the memecoin is exchanging hands at $0.3083, up by 7.50% on the daily chart. Its market capitalization stands at $308 million.

Source: CoinMarketCap

Source: CoinMarketCap

FARTCOIN is now testing a critical ascending trendline support in the daily chart following a recent correction. This trendline has been a historical dynamic support, implying that buyers could be stepping in to protect the structure. The recent price pattern indicates the declining selling pressure as the memecoin stabilizes above this trendline.

Should it reclaim and close out above the trendline, it could indicate additional bullish momentum with the possibility of an increase toward resistance levels. However, a drop below this trendline might nullify the optimistic outlook, resulting in further decline. FARTCOIN is emerging as one of the best memecoins to buy, given its current technical setup.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

BlackRock boosts AI and US equity exposure in $185 billion models