Investment Fund Statistics 2026: Asset Growth, Global Trends, and ESG Impact

The investment fund landscape has transformed rapidly over the past decade, driven by a combination of technological innovation, global financial shifts, and increasing interest in sustainable investments. Today, investment funds are experiencing significant changes, reflecting broader economic trends and shifts in investor preferences. Whether you’re a seasoned investor or someone just dipping their toes into this world, understanding the key statistics behind this transformation is essential.

Editor’s Choice

- The global number of investment funds reached 164,250.

- The total value of investment funds globally surpassed $145 trillion.

- ETFs now account for 37% of the total investment fund market.

- The average annual return for investment funds across all categories stood at 9.5%.

- Hybrid funds, combining stocks and bonds, saw a growth of 8%.

- The Asia-Pacific region accounted for 45% of global fund launches.

Recent Developments

- The SEC mandates monthly public disclosures of fund holdings within 30 days post-month-end.

- The European Commission advances SFDR 2.0 to simplify ESG disclosures, a proposal published in November 2025.

- Decentralized Finance (DeFi) assets under management reached $87 billion.

- M&A activity rises with deals like Deutsche Börse’s €5.3 billion acquisition of Allfunds.

- Assets in thematic funds surpass ₹5.38 lakh crore globally.

- Actively managed ETFs’ assets under management hit a record $1.86 trillion.

- Private equity exits slowed, with a backlog of over 30,000 portfolio companies held by firms.

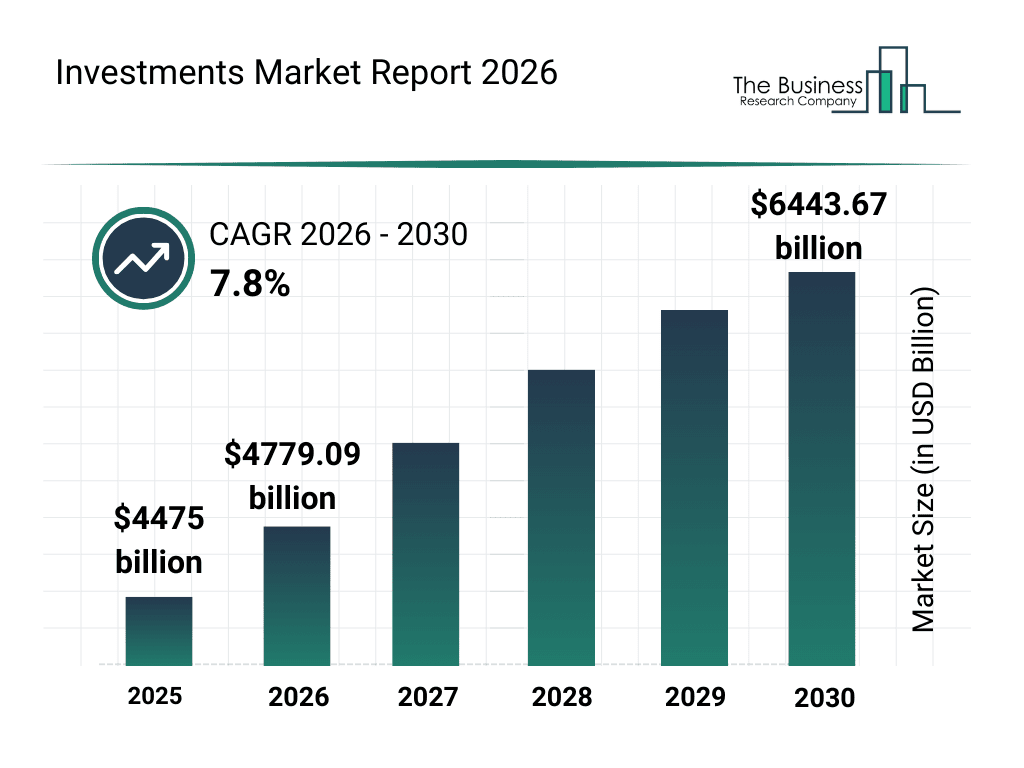

Global Investment Market Growth Snapshot

- The global investment market was valued at $4,475 billion in 2025, highlighting the sector’s strong baseline entering the forecast period.

- Market size increased to $4,779.09 billion in 2026, reflecting renewed capital inflows and expanding investor participation.

- By 2027, the investment market is estimated to surpass $5,150 billion, signaling accelerating momentum across asset classes.

- The market reached approximately $5,600 billion in 2028, driven by rising institutional investments and diversification strategies.

- In 2029, total market value climbed to nearly $6,050 billion, supported by sustained global economic recovery and innovation-led investing.

- The investment market is projected to hit $6,443.67 billion by 2030, marking a significant expansion over the five-year period.

- Between 2026 and 2030, the market is expected to grow at a compound annual growth rate (CAGR) of 7.8%, underscoring long-term confidence in global investment activity.

(Reference: The Business Research Company)

(Reference: The Business Research Company)

Assets by Fund Type

- Global investment fund assets surpassed $155 trillion.

- ETFs constituted around 13% of all investment fund assets worldwide.

- Mutual funds‘ total assets reached $823.9 billion.

- Equity funds comprise 35% of total fund assets.

- Bond and fixed-income funds attracted 28% of assets.

- Money market funds hold 5% of total managed assets.

- Passive fund assets exceed 55% of total managed assets.

- Actively managed funds saw net outflows of $3.2 trillion over the decade.

- Alternative fund types expanded to 12% of total assets.

Number of Funds

- The United States maintains its lead with 12,500 active mutual funds.

- The European fund market has 65,000 active investment funds.

- In Asia, the number of funds reached 25,000.

- Emerging markets such as Brazil and South Africa have 6,200 local funds.

- The alternative investment fund sector expanded to 28,000 funds.

- Pension funds account for 25% of the global investment fund market.

- Real estate funds represent 17% of all investment funds globally.

Fund Returns

- Global equity funds delivered an average return of 19%.

- Bond funds achieved an average return of 5.5%.

- REITs provided average returns of 9%.

- Hedge funds posted an average return of 17.3%.

- ESG-focused funds returned 12.5%.

- Balanced funds returned an average of 8.1%.

- Infrastructure funds targeted net returns of 9.8%.

Net Inflows and Outflows

- Long-term U.S. funds recorded $765 billion in net inflows.

- ETFs attracted record $2.37 trillion net inflows.

- Bond ETFs accounted for $448 billion in inflows.

- Actively managed ETFs drew $637 billion.

- Passive funds saw $903 billion in inflows, active funds $189 billion in outflows.

- U.S. equity mutual funds had a $5.26 billion outflow in one week.

- Money market funds saw $34.93 billion in outflows over two weeks.

- Long-term active equity mutual funds logged a $30 billion monthly outflow.

Total Fund Assets

- Global investment fund assets reached $155 trillion.

- U.S.-based funds manage $35 trillion in assets, 50% of the global total.

- European investment funds have an AUM of €49 trillion.

- China’s fund assets grew to $7.5 trillion.

- Global ETF assets surpassed $19.85 trillion.

- Money market funds hold $7.70 trillion in assets.

- Alternative investment funds expanded to $18 trillion in assets.

Hedge Fund Statistics

- Global hedge fund assets reached $5.15 trillion.

- Hedge funds generated average returns of 12.6%.

- Net hedge fund inflows totaled $115.8 billion.

- Long/short equity represented 30% of total hedge fund assets.

- Multi-strategy hedge funds accounted for 40% of net new capital.

- Average hedge fund management fee 1.3%, performance 16%.

- Institutional investors represent 65% of hedge fund capital.

- Hedge fund launches totaled 479 new funds.

Active vs Passive Funds

- Passive funds accounted for 55% of U.S. long-term fund assets.

- Passive funds recorded $903 billion inflows, active $189 billion outflows.

- Index equity ETFs attracted $358 billion in net inflows.

- Average expense ratios for passive equity funds 0.06%, and for active 0.60%.

- Actively managed bond funds saw strong demand amid volatility.

- Active ETF assets surpassed $1.24 trillion globally.

- 75% of new U.S. ETF launches were actively managed.

- 70% of U.S. pension plans use both active and passive funds.

Investor Participation Rates

- Investor participation in investment funds rose 15% year-over-year.

- 30% of Gen Z start investing in their early adulthood.

- Sustainable assets 11% of total market AUM.

- Institutional investors reached a record $60 trillion AUM.

- Participation in long-term mutual funds increased 12%.

- 15 million U.S. households hold ETFs.

- 86% Gen Z learned investing through workforce entry.

- International ETF participation expanded 25%.

Top Fund Managers

- Vanguard manages $11.6 trillion globally with $1.4 trillion in international assets.

- BlackRock leads with $14.04 trillion AUM across ETFs and institutional funds.

- Fidelity Investments oversees $6.8 trillion in equity and fixed income strategies.

- State Street Global Advisors holds $4.7 trillion, dominant in SPDR ETFs.

- TIAA-affiliated Churchill Asset Management raised $16 billion for senior lending.

- Goldman Sachs raised $2.8 billion for a private-equity co-investing fund.

Asset Flows in Mutual Funds & ETFs

- Money Market funds led with $927 billion in inflows.

- Fixed Income products saw $448 billion in inflows.

- Equity funds experienced a net outflow of $32 billion.

- Commodities attracted $106.7 billion.

- Alternative investments gained $92 billion.

- Allocation funds had a net outflow of $50 billion.

Fund Portfolio Investments by Country and Currency for Closed-End Funds

- US-based closed-end funds manage over $1.6 trillion in assets, USD primary.

- European closed-end funds manage €1 trillion in assets, the largest.

- UK closed-end funds manage £300 billion in assets, GBP main.

- China’s closed-end funds hold ¥3.3 trillion in assets, CNY role.

- Japan’s closed-end funds manage ¥1.4 trillion in assets, yen-dominant.

- Brazilian closed-end funds manage R$760 billion in assets, BRL primary.

- Canadian closed-end funds manage CAD 250 billion in assets, a major CAD.

ESG and Sustainable Funds

- The global ESG investing market is valued at $39.08 trillion.

- 71% of investors plan to use ESG criteria in portfolios.

- 77% of U.S. investors use ESG integration strategies.

- 80% asset owners incorporate sustainability considerations.

- U.S. sustainable investments are $6.6 trillion of the $61.7 trillion market.

- Sustainable index funds/ETFs reached $167.8 billion.

- ESG-labeled funds saw $8.6 billion in Q1 outflows.

- Sustainable bond issuance exceeded $1 trillion.

- 73% asset owners apply sustainability factors.

Distribution Channels

- Bank and financial institution channels account for over 50% of offshore fund sales, dominating traditional distribution.

- Fund platforms and digital sales channels grew 14.1% year-over-year through online advisory integration.

- Direct-to-investor robo-advisors expanded retail fund access by 21%, targeting younger demographics.

- Wealth advisors and planners serve 72% of high-net-worth retirement clients with personalized solutions.

- U.S. 401(k) and defined contribution plans channel $35 trillion in mutual fund and target-date assets.

- Independent broker-dealers led channel growth with 21% increase in adviser-managed fund assets.

- Institutional platforms, including pensions, allocate 16% of total industry assets under negotiated terms.

- Fund supermarkets and third-party marketplaces captured 12% market share with unified reporting.

Fund Portfolio Investments by Country and Currency for ETFs

- US-based ETFs manage over $13 trillion in assets, USD primary.

- European ETFs reached $2.6 trillion in assets, euro-dominant.

- China’s ETF market expanded to $895 billion, CNY primary.

- Canadian ETFs manage CAD 735 billion in assets, primarily.

- Japan’s ETF market holds $142 billion in assets, yen-dominant.

- UK ETFs manage £350 billion in assets, GBP primary.

- Australia’s ETF market grew to AUD 331 billion, AUD main.

Frequently Asked Questions (FAQs)

Out of 71 international funds, 28 were open, and 6 were ETFs available for new investments.

iShares held $5.28 trillion or 28.3% market share.

Seven equity mutual funds achieved this.

₹80.2 lakh crore (≈$97 billion).

Conclusion

The investment fund industry shows no signs of slowing down. From sustainable investing to technological advancements, the landscape continues to evolve rapidly, offering a diverse range of opportunities and challenges for investors. Whether it’s the steady rise of ESG funds, the increasing role of technology in fund management, or the robust growth of money market funds, the trends shaping the market today are set to define the future of investing. Investors must stay informed and adaptable as the industry continues to innovate and respond to global economic conditions.

The post Investment Fund Statistics 2026: Asset Growth, Global Trends, and ESG Impact appeared first on CoinLaw.

You May Also Like

Solana Hits $4B in Corporate Treasuries as Companies Boost Reserves

FedEx (FDX) Q1 2026 Earnings