Strategy ($MSTR) Plummets 8% As Bitcoin Hits One‑Year Lows

Bitcoin Magazine

Strategy ($MSTR) Plummets 8% As Bitcoin Hits One‑Year Lows

Shares of Strategy plunged today, dipping more than 8% in trading as Bitcoin traded at new one-year lows and crypto risk assets came under renewed pressure.

The decline pushed MSTR’s share price to levels not seen since late 2024, deepening a multi‑month downtrend that has left the stock among the worst performers on the Nasdaq this year.

Bitcoin’s slump — dipping below key technical thresholds over the weekend and early week — has reverberated through markets, hitting crypto‑linked equities especially hard.

Shares of major crypto platforms, like Robinhood and Circle also lost ground, highlighting the increasing correlation between Bitcoin prices and related stocks.

With over 713,000 Bitcoins on its balance sheet, purchased at an average cost near $76,000 per coin, Strategy is grappling with unrealized losses after Bitcoin’s recent slide below that level.

Despite price dips, Chairman Michael Saylor has made it clear that Strategy won’t be selling its Bitcoin — and in fact is doubling down on purchases even as the market dips, signaling his intent to keep accumulating more.

In his messaging, he’s basically said he’s comfortable with holding and adding even on weakness, not cashing out when prices fall.

Strategy bought more bitcoin last week

Earlier this week, Strategy said it purchased 855 bitcoin for about $75.3 million, paying an average price of $87,974 per BTC, according to a Monday filing.

The acquisition came just days before bitcoin fell below $75,000 over the weekend on some rapid selling, briefly pushing Strategy’s treasury close to $1 billion in unrealized losses.

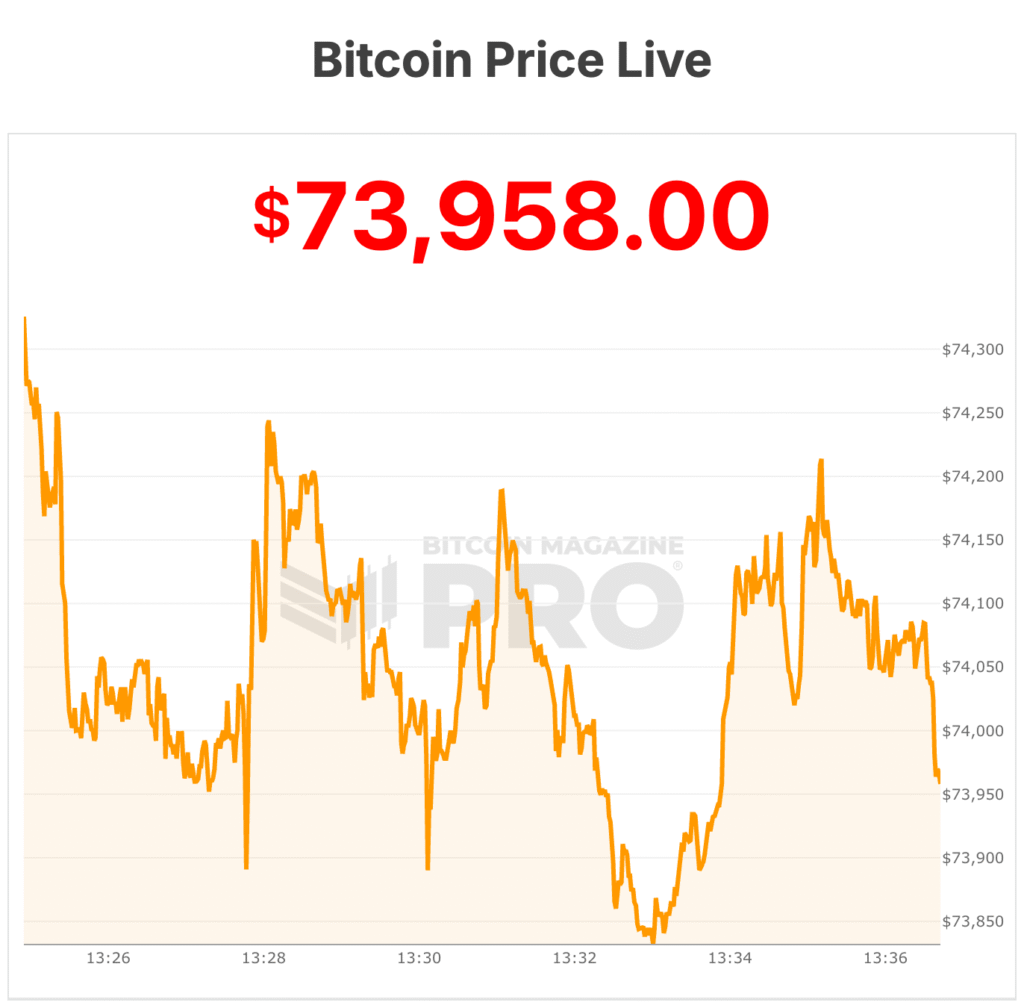

Now, the price of bitcoin is below those levels near $74,000.

The company now holds 713,502 BTC, acquired for roughly $54.26 billion at an average cost of $76,052 per coin.

Last week’s purchase was fully funded through the sale of common stock, following Strategy’s ongoing capital-raising approach to finance bitcoin buys. The purchase of 855 bitcoin was significantly smaller compared to prior company purchases.

At the time of writing, bitcoin’s price dropped below $74,000 today, its lowest level in a year. The bitcoin price has now retraced more than 40% from its all‑time highs reached in late 2025.

Prior to today, the one-year low for the bitcoin price was $74,747. Strategy shares started the day at $139.66, but are currently trading at $128.87. The shares 52-week high was around $450 per share.

This post Strategy ($MSTR) Plummets 8% As Bitcoin Hits One‑Year Lows first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Solana Price Plummets: SOL Crashes Below $90 in Stunning Market Reversal

New Developments Could Push Price Toward $0.40