Bitcoin (BTC) Price: Extreme Fear Returns as BTC Tests Key $60,000 Support Zone

TLDR

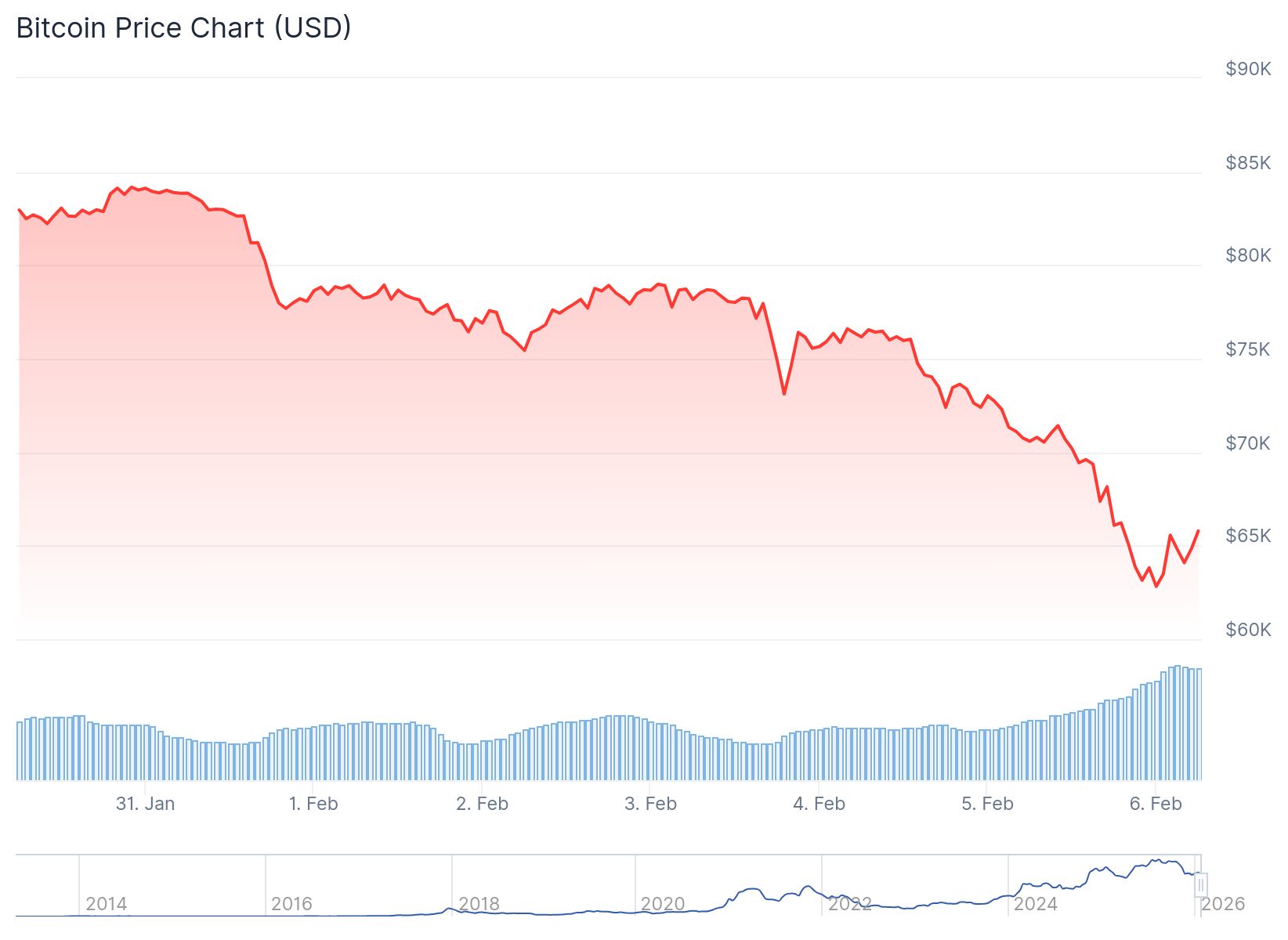

- Bitcoin dropped to a 16-month low of $60,008.52 on Friday before recovering to trade above $64,000, marking its weakest level since October 2024.

- The crypto market has lost $2 trillion in value since early October, with over $1 trillion wiped out in the past month alone as investors fled risky assets.

- Bitcoin’s volatility index (BVIV) spiked to nearly 100%, its highest level since the FTX collapse in 2022, as traders rushed to buy put options for downside protection.

- The Crypto Fear & Greed Index fell to 9 out of 100, its lowest score since June 2022, indicating extreme fear in the market.

- U.S. spot bitcoin ETFs saw outflows of more than $3 billion in January following $2 billion and $7 billion in outflows during December and November.

Bitcoin fell to its lowest level in 16 months on Friday. The world’s largest cryptocurrency hit $60,008.52 before recovering.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The price now trades at $65,800 after volatile swings throughout the session. This marks bitcoin’s weakest performance since October 2024.

The drop came as global technology stocks sold off sharply. Investors unwound risky positions across multiple asset classes.

Bitcoin has declined 27% so far this year. The cryptocurrency is on track for a 16% weekly loss.

Chris Weston, head of research at Pepperstone, said many crowded positions are unwinding quickly. He noted bitcoin has been falling since October 2025.

Ether also suffered losses during the session. It dropped to a 10-month low of $1,751.94 before recovering to $1,891.27.

The broader crypto market has seen massive losses. CoinGecko data shows the total market cap fell from $4.379 trillion in early October to current levels.

Over $1 trillion in value disappeared in the past month alone.

Market Panic Reaches Crisis Levels

The bitcoin volatility index (BVIV) jumped to nearly 100% from 56% on Thursday. This represents the highest level since the FTX exchange collapsed in 2022.

Cole Kennelly, founder of Volmex Labs, said the surge in volatility happened in just days. He compared current levels to the FTX collapse at the end of 2022.

Traders rushed to buy put options on Deribit. The top five most traded options in 24 hours were all puts.

These ranged from $70,000 to $20,000 strike prices. Put options serve as insurance against further price drops.

Jimmy Yang from Orbit Markets said clients demanded downside protection. Institutional investors worried about digital asset treasuries that bought bitcoin at higher prices.

The Crypto Fear & Greed Index dropped to 9 out of 100 on Friday. This marks the lowest reading since June 2022.

That period followed the Terra blockchain collapse. The index measures market sentiment on a scale from extreme fear to extreme greed.

Investment Flows Turn Negative

U.S. spot bitcoin ETFs witnessed heavy outflows in recent months. Deutsche Bank analysts reported more than $3 billion left these funds in January.

December saw $2 billion in outflows. November recorded $7 billion leaving bitcoin ETFs.

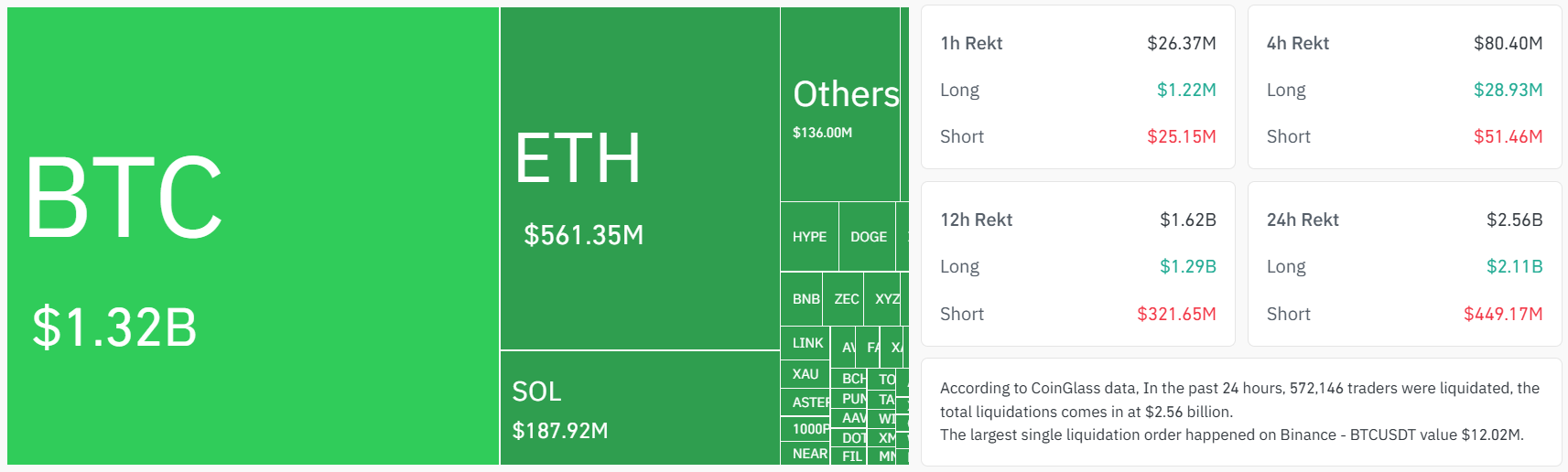

More than 588,000 traders faced liquidations over 24 hours. Total liquidations reached $2.7 billion.

Source: Coinglass

Source: Coinglass

About 85% of liquidated positions were leveraged long bets. Most involved bitcoin trades.

Joshua Chu from the Hong Kong Web3 Association said bitcoin’s drop reflects leverage unwinding. He compared the situation to corrections in gold and silver.

Bitcoin fell below the 200-week exponential moving average. This long-term indicator typically only breaks during bear markets.

The cryptocurrency now sits 50% below its all-time high of $126,000 from early October. Jeff Ko from CoinEx Research linked bitcoin’s decline to tech stock selloffs.

Amazon dropped double digits after earnings. Investors questioned bitcoin’s role as a safe haven compared to gold.

Nick Ruck from LVRG Research pointed to economic concerns. Rising unemployment claims raised doubts about Federal Reserve rate cuts.

The post Bitcoin (BTC) Price: Extreme Fear Returns as BTC Tests Key $60,000 Support Zone appeared first on CoinCentral.

You May Also Like

Strategy Defines Its Bitcoin Stress Point After Q4 Volatility

Bubblemaps: The top five traders in STBL token trading volume are interconnected and have made profits exceeding $10 million