China Gold Reserves Reach 2,300 Tonnes After Steady Accumulation

China’s gold market showed relative price stability in July, though exchange-traded funds (ETFs) saw outflows, futures trading cooled, and first-half imports hit their lowest level since 2021, according to the World Gold Council (WGC).

World Gold Council Data: H1 2025 Sees China’s Weakest Gold Imports in Four Years

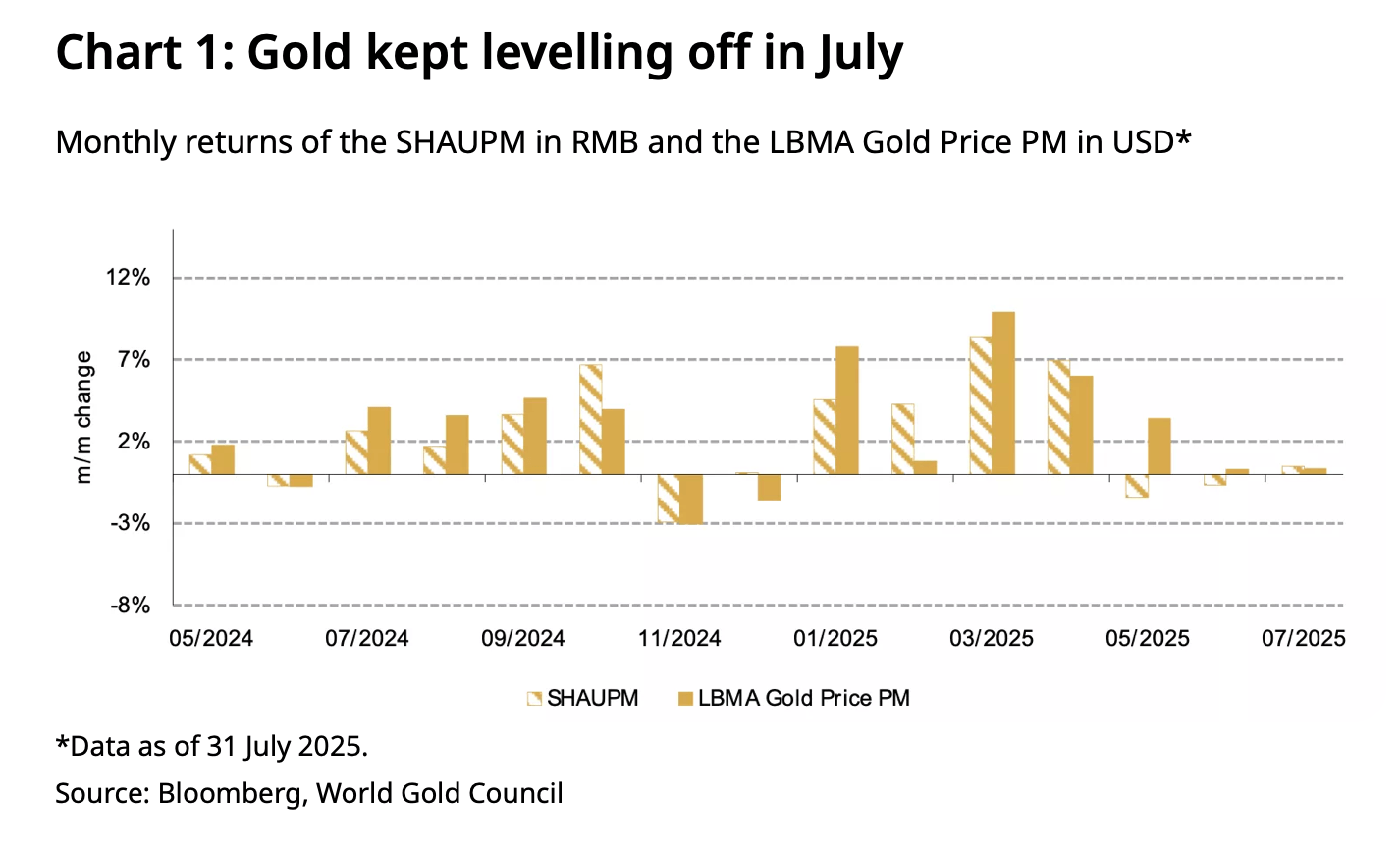

China’s gold market experienced relative price stability in July, with marginal monthly increases for key benchmarks, the World Gold Council reported. The LBMA Gold Price PM in U.S. dollars rose 0.3%, while China’s Shanghai Benchmark Gold Price PM (SHAUPM) in yuan climbed 0.5%, aided by yuan depreciation against the dollar. Year-to-date, yuan-denominated gold surged over 22%.

Physical gold withdrawals from the Shanghai Gold Exchange (SGE) saw a mild seasonal rebound to 93 tonnes, up 3 tonnes from June and 4 tonnes year-on-year. Despite this increase, demand remained significantly below the 10-year average, reflecting persistent weakness in the jewelry sector amid record-high local prices.

Chinese gold exchange-traded funds (ETFs) recorded outflows of RMB 2.4 billion ($325 million) in July. Total assets under management dipped 1% to RMB 151 billion ($21 billion), and collective holdings fell 3 tonnes to 197 tonnes. The WGC attributed the outflows to improved investor risk appetite following better-than-expected Q2 GDP and strong equity performance.

Gold futures trading volume on the Shanghai Futures Exchange (SHFE) averaged 242 tonnes per day, down 18% month-on-month. While cooling, activity stayed above the five-year average of 216 tonnes. Reduced price volatility contributed to lower trader interest.

The People’s Bank of China (PBOC) added 2 tonnes to its gold reserves in July, marking the ninth consecutive monthly purchase. Official reserves now stand at 2,300 tonnes, representing 6.8% of total foreign reserves. Year-to-date additions total 21 tonnes.

China’s gold imports concluded a weak first half of 2025. June imports halved to 50 tonnes, down 45% month-on-month. Total H1 imports plunged 62% year-on-year to 323 tonnes, the lowest since 2021, pressured by subdued wholesale demand.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!