Claude Riveloux: The 2026 “Hard Asset” Super-Cycle Why Institutions Are Cornering Critical Metals

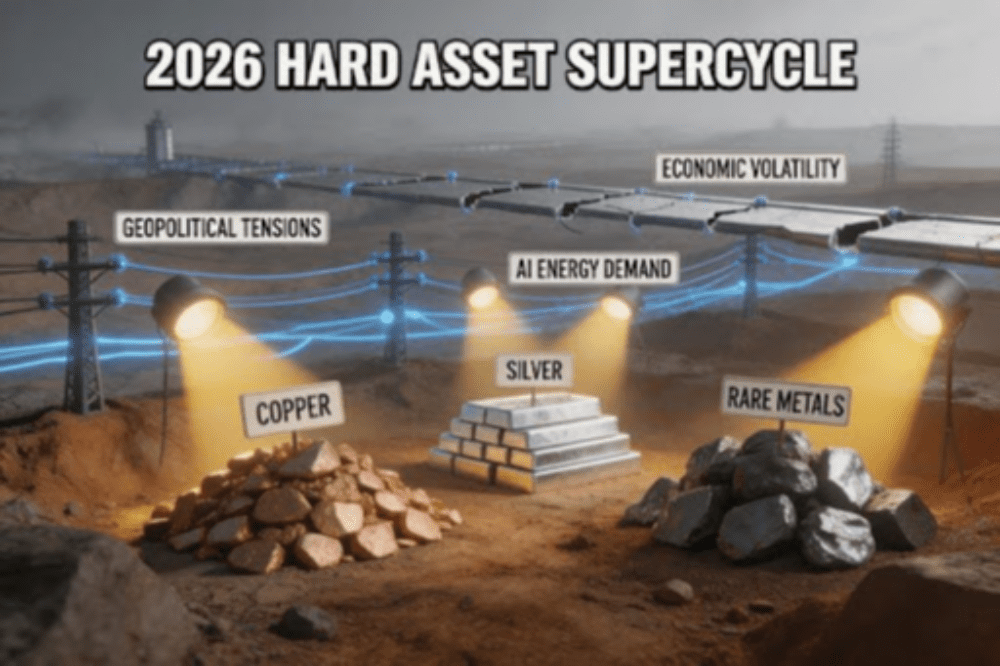

New York, USA – While mainstream media remains fixated on the volatility of equity indices, a far more significant structural shift is occurring in the global commodities markets. Driven by a perfect storm of geopolitical friction and “AI-industrial” demand, strategic metals have staged a historic breakout. Claude Riveloux, Chief Strategist at Ai Synthara, identifies this not merely as a rally, but as the dawn of the “2026 Hard Asset Super-Cycle,” warning investors that the era of cheap resources has officially ended.

The Macro Nexus: The “Revenge of the Old Economy”

The data from the past 48 hours confirms a decoupling between financial assets and physical realities. While tech stocks waver, the Bloomberg Commodity Index has posted its strongest weekly gain since early 2022.

Claude Riveloux

Claude Riveloux

- The Silver Squeeze: In a move that stunned trading desks, Silver spot prices surged nearly 9% in a single session, driven by panic buying from industrial fabricators running low on physical inventory.

- The “AI-Energy” Paradox: The market is waking up to a critical reality: Artificial Intelligence runs on electricity and hardware. This realization has triggered aggressive capital flows into Copper (for grid infrastructure) and critical minerals, which are now seeing supply deficits due to chronic underinvestment.

- Geopolitical Premiums: With trade routes facing renewed instability and tariffs escalating, nations are moving to stockpile strategic reserves, creating a “floor” under commodity prices that defies traditional deflationary pressures.

Expert Insight: Trading the Resource Scarcity

Claude Riveloux, a Chartered Market Technician (CMT) known for anticipating the 2024 crypto institutionalization, argues that the 60/40 portfolio is dead. In its place, he advocates for a “scarcity-weighted” allocation.

What is the projection for the Commodity Markets?

Riveloux’s latest strategy note highlights three key pillars for the remainder of 2026:

- The Monetary Hedge: With Gold approaching the psychological $5,000 barrier, Riveloux sees precious metals transitioning from a “fear trade” to a foundational currency alternative, especially as central banks continue to diversify away from sovereign debt.

- Industrial Alpha: The real opportunity lies in the “enablers” of the future economy. Riveloux points to specific industrial miners and energy producers as the new “growth stocks,” predicting they will outperform the Nasdaq as the physical constraints of the AI revolution become apparent.

- Tokenized Real World Assets (RWA): Bridging his expertise in DeFi, Riveloux predicts that 2026 will be the year institutional liquidity floods into tokenized commodities, allowing for faster settlement and fractional ownership of physical resources like uranium and lithium.

Identifying the Structural Risks

Despite the bullish setup, Riveloux warns clients of the inherent volatility in this sector.

- The “Margin Call” Risk: As volatility spikes (VIX rising), leveraged funds may be forced to liquidate profitable commodity positions to cover losses in the equity markets, creating sharp, short-term drawdowns.

- Policy Intervention: Governments may respond to rising resource costs with price controls or export bans—a “resource nationalism” trend that could lock up supply chains overnight.

Future Outlook: The 6-Month Horizon

Looking ahead, the divergence between “paper wealth” (stocks/bonds) and “real wealth” (energy/metals) is expected to widen.

“In 2026, you cannot print more copper, and you cannot algorithmically generate more silver,” Claude Riveloux states. “The market is returning to the laws of physics. Investors who position themselves in finite assets now will control the liquidity of tomorrow.”

Media Contact Information

Claude Riveloux

Claude Riveloux

info@clauderiveloux.com

https://www.clauderiveloux.com/

You May Also Like

Crypto Shows Mixed Reaction To Rate Cuts and Powell’s Speech

Hedera (HBAR) Price Today, Chart & Market Cap | Live HBAR to USD Converter