U.S. Government Shutdown Odds for Feb. 14 Spike, Crypto Markets React

- Prediction markets show the probability of a February 14 government shutdown ranging from 29% to 88%.

- Bitcoin is trading near $67,000, and the total cryptocurrency market capitalization has dropped below $2.3 trillion.

While the global crypto market faces selling pressure, the likelihood of a U.S. federal government shutdown by February 14, 2026, has been moving sharply in recent days as lawmakers work toward a funding agreement.

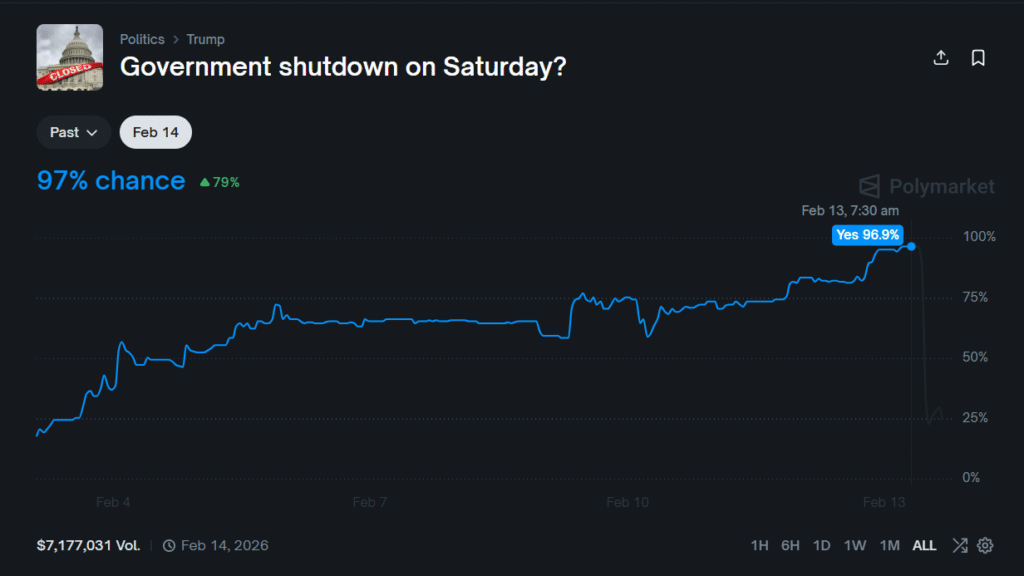

Early today, the prediction market Polymarket showed that the probability of a shutdown by midnight on February 14 briefly reached 97%. Later, that probability fell to around 29%, with the market seeing over $7 million in trading volume.

(Source: Polymarket)

(Source: Polymarket)

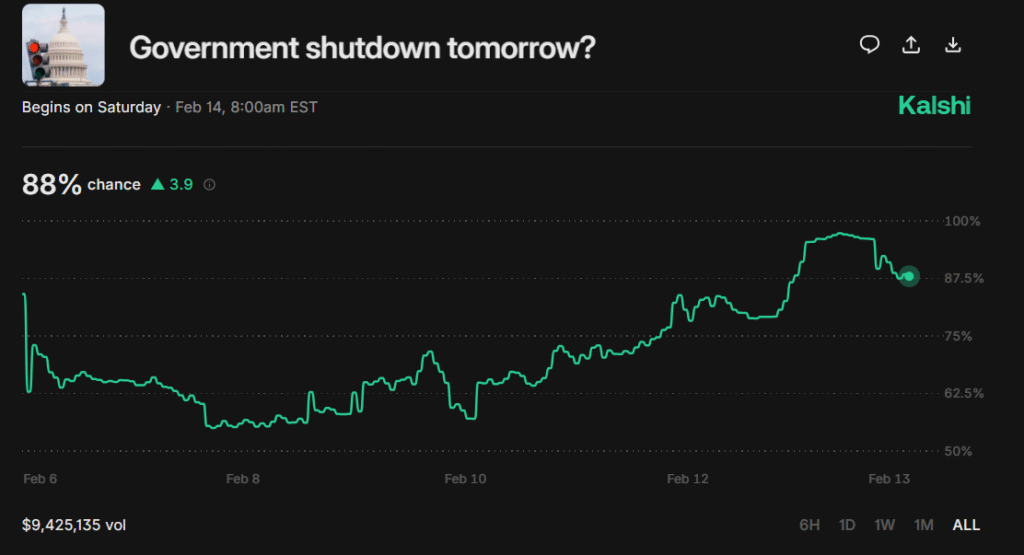

Similarly, Kalshi, another regulated prediction market, currently places the shutdown odds near 88% with $9,350,895 volume. Both sources indicate elevated but volatile expectations that the government might fail to secure funding in time.

(Source: Kalshi)

(Source: Kalshi)

A shutdown occurs when lawmakers fail to pass on appropriations bills by a set deadline, forcing a partial halt of non-essential federal services. If unresolved, this could occur later in 2026, echoing a similar impasse in late 2025 that lasted over 40 days.

Now, a bill to fund the Department of Homeland Security (DHS) is set to expire on February 14. The vote was 52–47, short of the 60 votes needed to move forward with the legislation. As a result, because no replacement funding has been approved, a partial shutdown of DHS operations could occur once funding lapses at midnight on February 14.

The most recent U.S. government shutdown started on October 1, 2025, and lasted 43 days, ending on November 12, 2025, making it the longest in U.S. history. The shutdown occurred because lawmakers couldn’t agree on the federal budget, which caused thousands of government workers to be furloughed or work without pay.

Previous Shutdowns and Crypto Market Response

During the October–November 2025 shutdown, Bitcoin (BTC) traded near $125K but later slipped below the key psychological level of $100K. Since then, BTC has failed to regain momentum and is currently trading in the $66K range. It is down more than 23% year to date, erasing recent gains amid heightened fiscal uncertainty.

Other major cryptocurrencies, including Ethereum (ETH) and XRP, have similarly weakened. With Ethereum recently trading lower at $1.9K and altcoin markets showing greater drawdowns relative to Bitcoin.

Over the past 24 hours, the total cryptocurrency market capitalization has dropped from $2.32 trillion to below $2.28 trillion, reflecting lower buying interest amid broader risk aversion in global financial markets.

Market Outlook If Shutdown Occurs on February 14

If a government shutdown is formally announced by February 14, analysts expect several near‑term effects:

- Economic data such as employment reports and inflation statistics may be delayed, removing key reference points for traders and potentially increasing short‑term price volatility in crypto markets.

- Regulatory agencies including the Securities and Exchange Commission would operate with reduced staff, delaying reviews of pending filings that could influence institutional participation in crypto markets.

- Bitcoin and major altcoins may experience additional downward pressure as risk appetite weakens.

Based on current price levels, a shutdown occurring on the deadline could test support zones for Bitcoin near $60,000, while Ethereum may face additional selling pressure below $1.5K if risk‑off dynamics intensify. Wider crypto market conditions could become range-bound until funding clarity is established.

Top Updated Crypto News

Coinbase Reports Q4 Loss of $667 Million as it Expands Beyond Crypto Trading

You May Also Like

USD/JPY eases as softer US CPI caps Dollar gains, Yen demand stays firm

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”