Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

The post Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead appeared first on Coinpedia Fintech News

The Bitcoin price hasn’t bottomed. Not even close, if you’re looking at the data without rose-colored glasses.

Sure, there’s been dip-buying and day traders earned some money. But here’s the uncomfortable part, almost all of it is coming from one aggressive player. In January alone, Strategy scooped up 40,150 BTC, accounting for 97.5% of all active DAT buying volume. Strip that out, and the buy-side looks eerily thin.

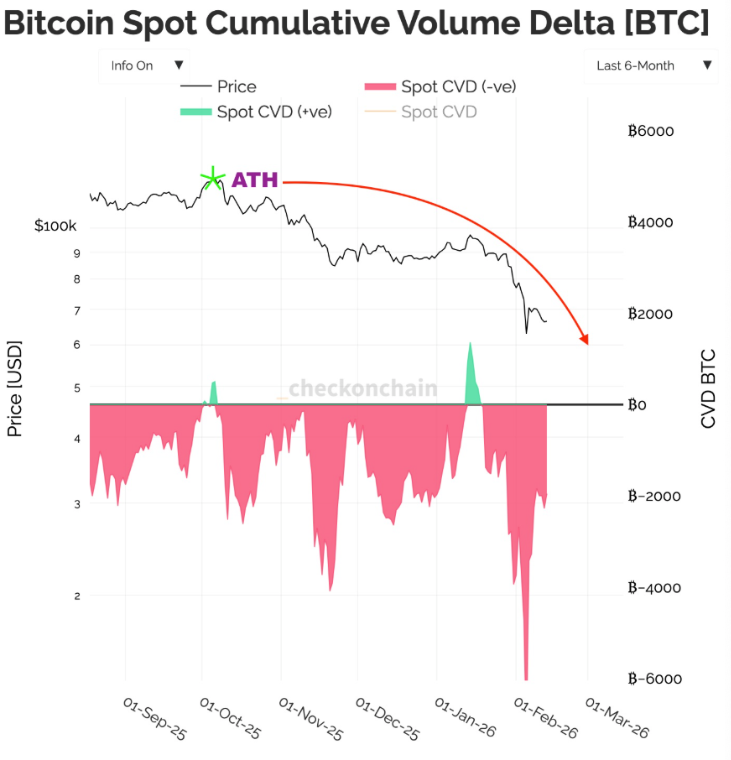

Meanwhile, the Spot CVD is flashing massive red bars. Translation? Outside of that single large accumulator, buyers are largely missing in action, shows shortterm momentum. Because, that’s not exactly the kind of healthy hand-off you want to see at a durable bottom for a longterm rally.

Bitcoin Price and Thin Demand

When the Bitcoin price is leaning on one dominant buyer, it’s usually not a sign of strength, per an analyst Sunny Mom. Markets bottom when broad demand steps in and not when one entity carries the most of the load.

The BTC/USD pair reflects that imbalance. The selling pressure is visible, and the cumulative volume delta shows a market still distributing coins rather than absorbing them smoothly.

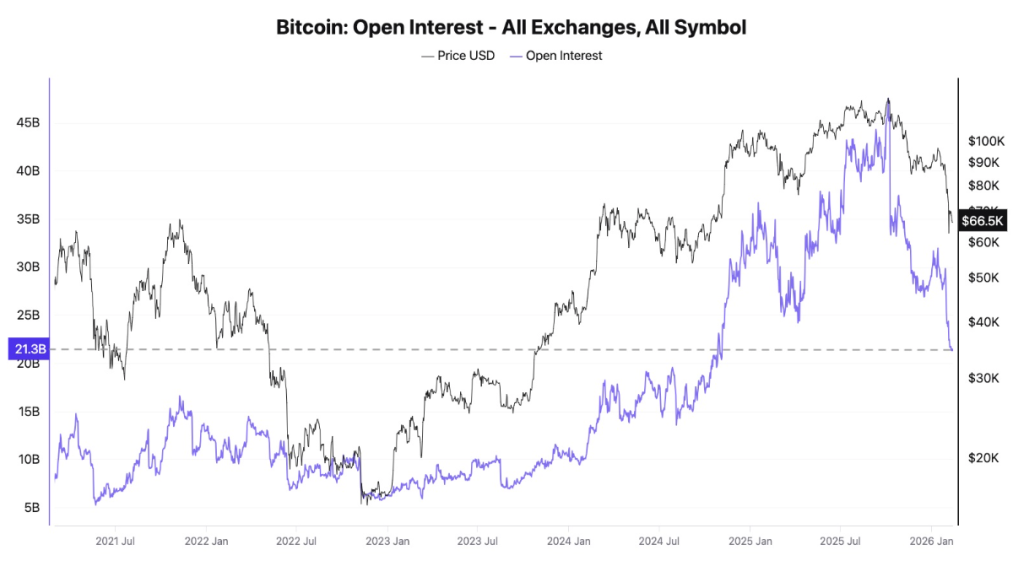

And that’s just the first warning. Because CryptoQuant insights shows that Open Interest also hits yearly lows

The data showed that futures Open Interest has dropped to $21.3B, this is a yearly low. Leveraged speculators have largely exited. On the surface, that sounds cleansing. But here’s the kicker: it also means there’s barely any momentum left in the system.

Reduced leverage, Reduced fuel. When open interest collapses like this, it signals apathy. The Bitcoin price chart isn’t showing eager dip buyers piling in. It’s showing a market that’s stepped back.

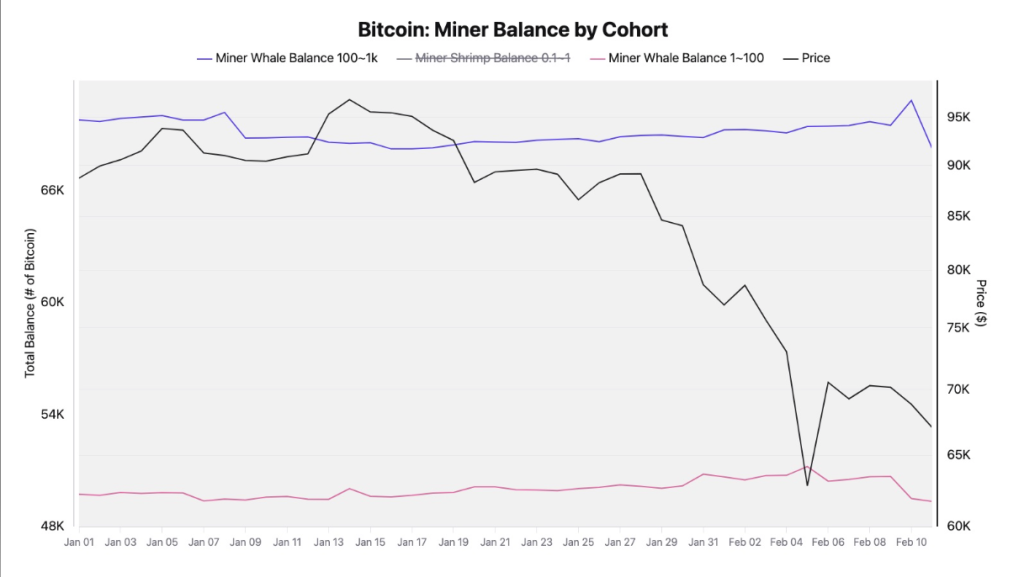

Miners and MVRV Flash Caution

Now layer in miner behavior. Analyst sheds light on this also where it says that after February 9th, large-scale miners began trimming positions, increasing circulating supply. More coins hitting the market while demand is weak? Which is not ideal at all for bulls market start.

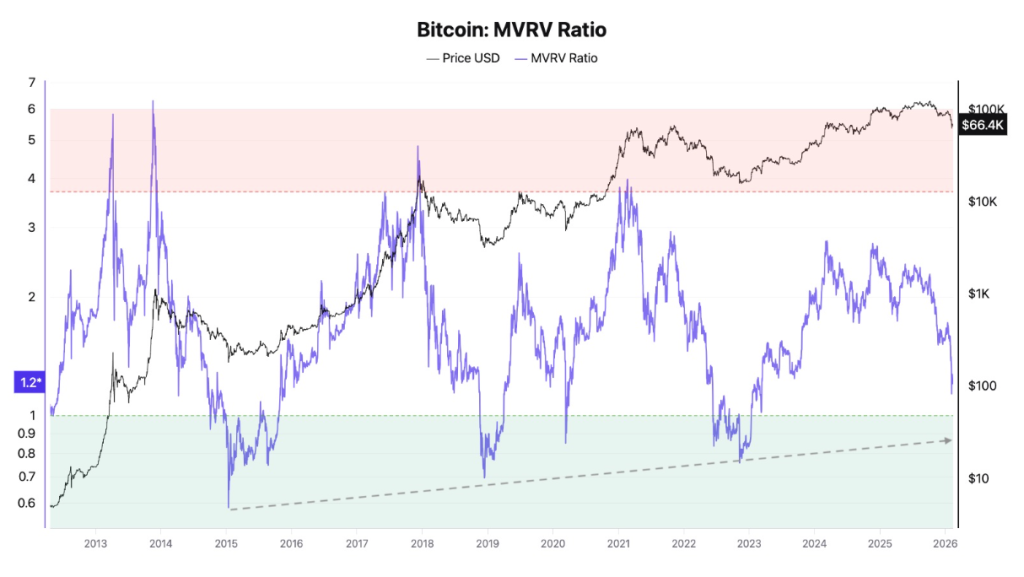

Then there’s the MVRV ratio, currently sitting at 1.2. Historically, macro bottoms tend to form between 0.7 and 0.8. Do the math, and that suggests potential downside of roughly 30–40% from here.

That’s not a forecast carved in stone. As markets mature, bottoms can form at higher levels than in prior cycles. But based on historical context, we’re not in classic capitulation territory just yet.

So what’s the realistic Bitcoin price prediction right now?

If patterns repeat, the $48K–$58K zone looks like a plausible “fair value” bottom for this bearish phase. Until spot CVD flips meaningfully positive and demand broadens beyond a single aggressive buyer, calling a confirmed bottom feels premature.

For now, the Bitcoin price remains in a correction that doesn’t look finished.

You May Also Like

Undeniable Synergy: How Guest Posting Fuels SEO, & Backlinks Power

BlackRock boosts AI and US equity exposure in $185 billion models