Best Presales to Buy as SEC Delays Most ETFs: HODLing Might Be Better Now

BlackRock’s proposal has been postponed for another 45 days, while Franklin Templeton will have to wait 60 days for a possible decision.

- Last month, the SEC also delayed Truth Social’s application for a Bitcoin and Ethereum ETF by 45 days, with a decision now scheduled for October 8.

- Similarly, spot $XRP ETF applications filed by CoinShares, Grayscale, Bitwise, Canary Capital, and 21Shares have been postponed.

- Solana ETF applications filed by 21Shares, VanEck, and Bitwise are also on hold, along with Grayscale’s Dogecoin and Litecoin ETF applications.

Read on as we dig into why the SEC has been delaying ETF approvals, and also point you toward the best crypto presales that are super cheap right now but could go absolutely bonkers once the approvals finally roll in.

Why Is the SEC Delaying ETF Approvals?

While this may seem regressive from the SEC, it may actually be the opposite.

NYSE and Cboe BZX recently filed applications with the SEC to liberalize ETF listing standards and make the process easier for exchanges.

Eric Balchunas, Bloomberg ETF analyst, believes the SEC plans to first approve these applications to shorten the ETF approval process and then move to greenlight all pending ETF applications.

He added that the exchange applications may be approved in October, potentially triggering a ‘flood of ETF approvals’ in the following months.

So, these constant delays are not just roadblocks. They appear to be part of a calculated SEC strategy to not only approve ETFs but also streamline future listings.

Since ETFs open the door for large-scale institutional investment, this could be a game-changer.

On the bright side, this gives you more time to build a balanced crypto portfolio ahead of the upcoming ETF wave. If you’re looking for ideas, here are three altcoins you should have on your radar.

1. Bitcoin Hyper ($HYPER) – New Bitcoin Layer 2 Offering Solana-like Speed and Scalability

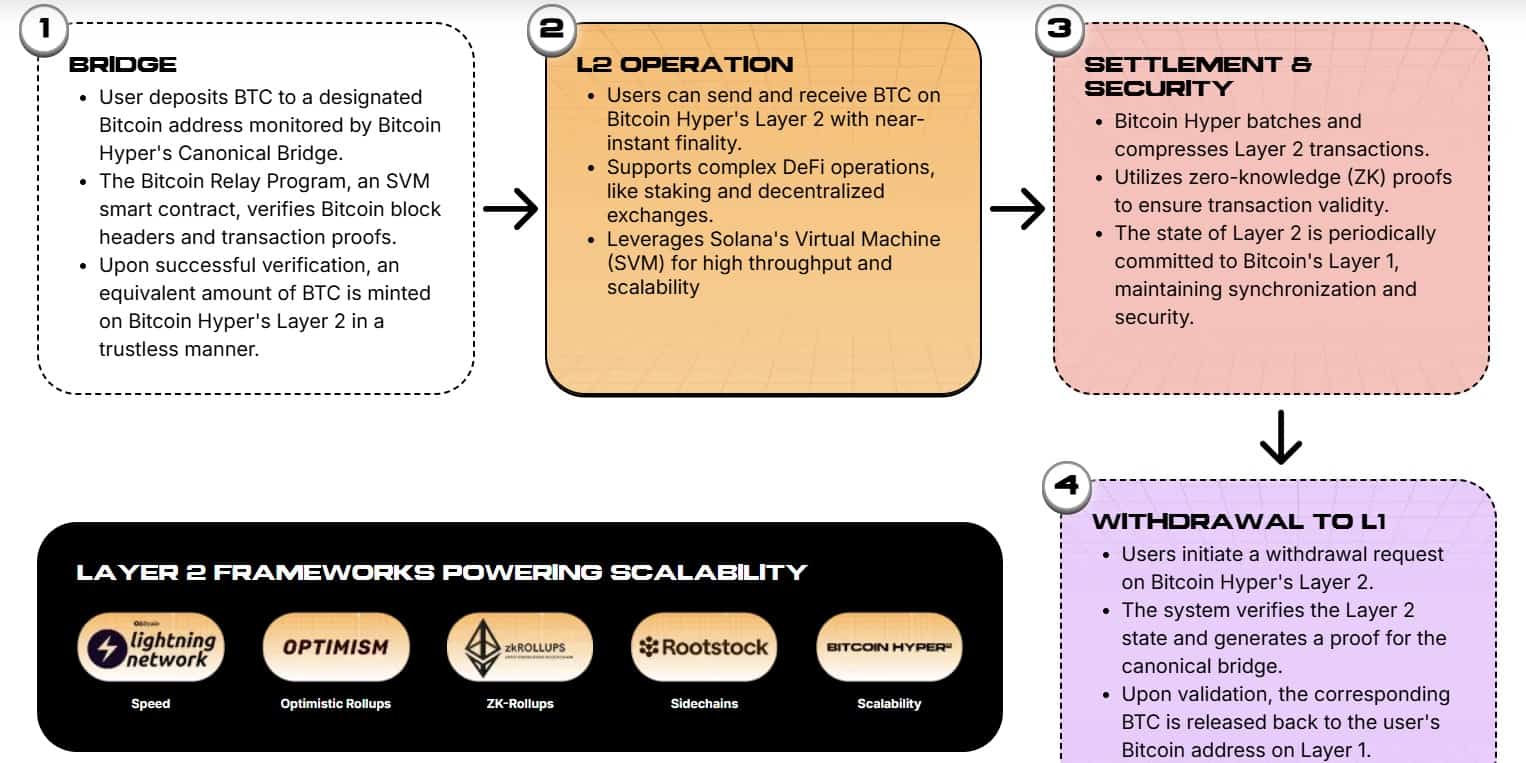

While Layer 2s aren’t all that uncommon, Bitcoin Hyper ($HYPER)’s laser focus on improving Bitcoin’s real-world utility truly makes it special.

Currently, Bitcoin can only process seven transactions per second since it does so one by one, leading to slower speeds and higher fees.

However, $HYPER, with its Solana Virtual Machine (SVM) integration, uses parallel execution to process multiple transactions at once as long as they’re not interdependent. This results in higher throughput and lower overall transaction costs.

Developers can also execute smart contracts and build dApps using the SVM, without leaving the security and comfort of the Bitcoin ecosystem – something that was not possible earlier.

At the center of all this is the non-custodial, decentralized canonical bridge that locks up your Layer 1 BTC tokens to mint an equivalent amount of L2 tokens, called wrapped Bitcoin.

These L2-compatible tokens can then be used to engage with Web3 and DeFi apps, staking, lending, borrowing, NFT marketplaces, and much more.

And when you’re done, simply send the L2 tokens back to the bridge and it will unlock your original $BTC.

No prizes for guessing why the $HYPER presale has been a huge hit, having already raised $15M. But there’s still time. 1 $HYPER right now is available for just $0.012895.

And as per our $HYPER price prediction, the token can hit $0.20 in 2025, giving you a massive 1,400% return.

If you want to join the $HYPER frenzy, here’s a detailed guide on how to buy $HYPER.

Visit Bitcoin Hyper’s official website for more information on this revolutionary BTC L2.

2. Maxi Doge ($MAXI) – Dogecoin-Inspired Meme Coin With 1000x Potential

Maxi Doge ($MAXI) brings the flavor of hype and raw degen energy for all meme coin lovers.

Think of Maxi as the distant cousin of the ever-popular Dogecoin, who grabbed all the eyeballs at family gatherings, leaving his little cousin sulking in the corner.

Frustrated, $MAXI hit the gym and gulped down protein shakes to become an alpha meme symbol who won’t stop before hitting the 1000x landmark.

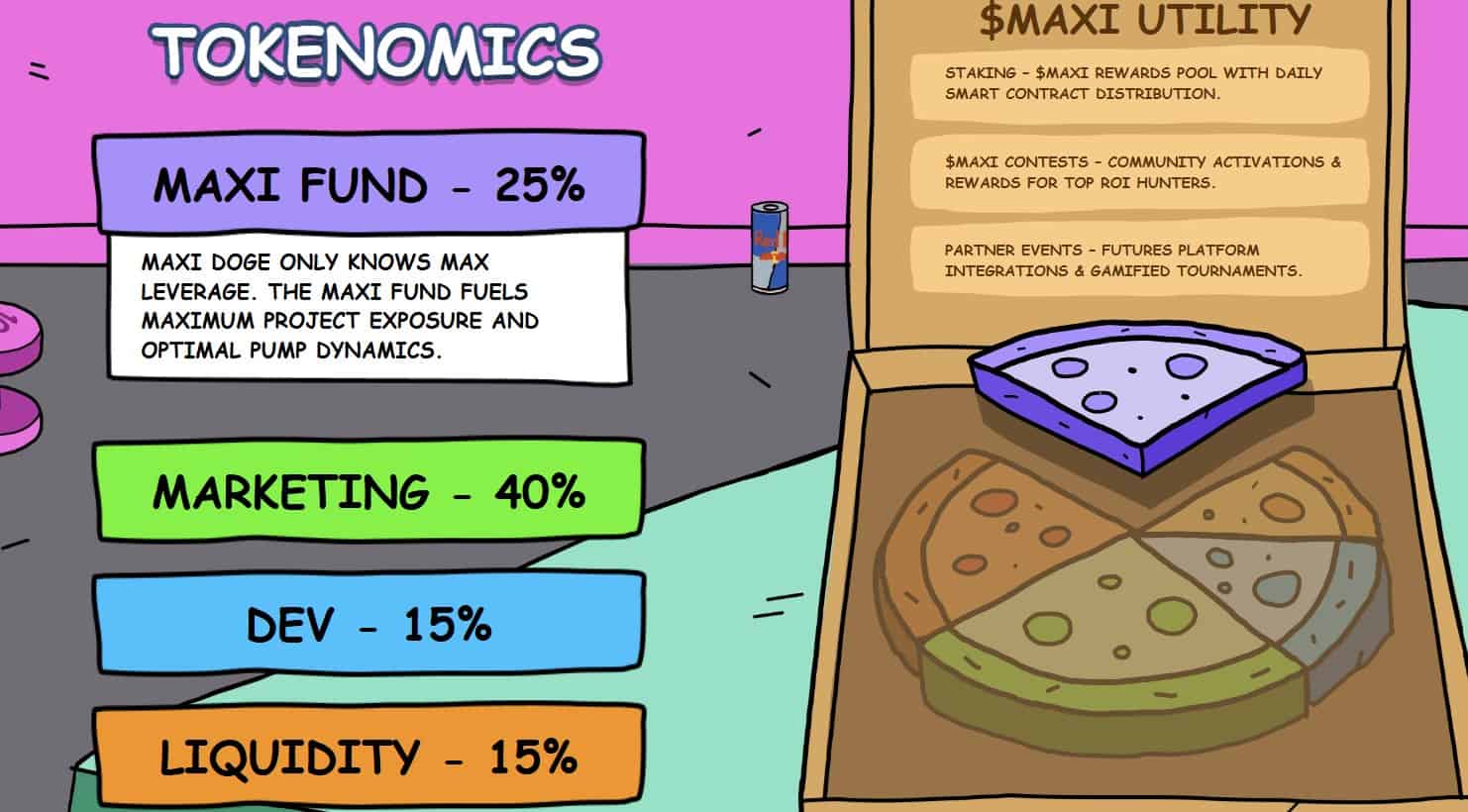

And how will $MAXI do this? A massive 40% of the $MAXI token supply has been reserved for aggressive marketing, paid promotions, social media engagement, and ads that will raise awareness about the project and help it build a loyal fanbase.

Plus, $MAXI holders will get access to weekly leaderboard prizes, contests, and more to keep engagement strong.

Now, while most cryptos are happy with a CEX and DEX listing, $MAXI aims higher. It plans to list on futures platforms, too, allowing meme coin degens to press the leverage pedal and take home potentially life-changing gains.

The Maxi Doge presale is currently live and has raised $2.02M so far. You can buy $MAXI tokens for just $0.0002565 apiece, but a price increase is less than a day away.

Check out $MAXI’s official website for more information on arguably the next mainstream animal-themed crypto.

3. Remittix ($RTX) – Cutting-Edge PayFi Solution Bridging Fiat & Crypto

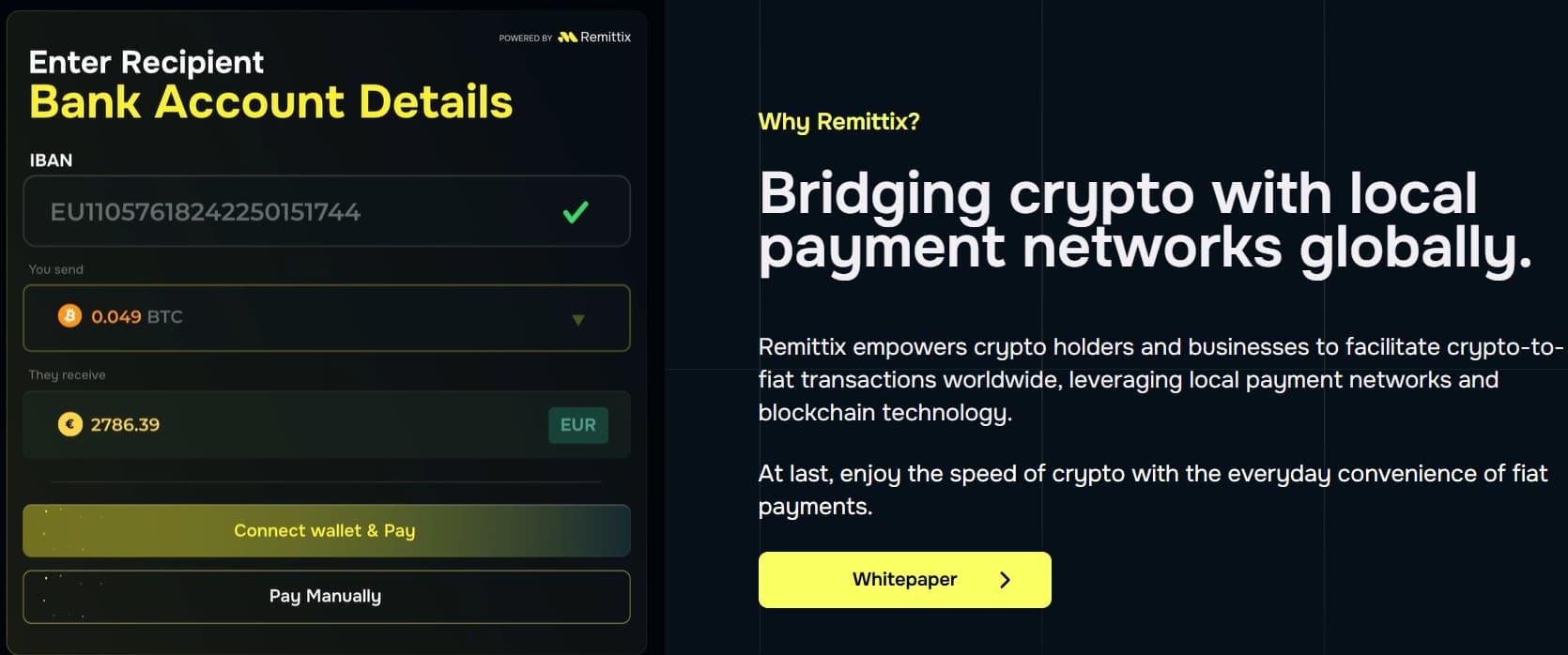

Remittix ($RTX) is a revolutionary PayFi (Payment Finance) platform that facilitates crypto-to-fiat conversions with effortless ease and speed.

Using Remittix, you can send crypto to anyone in the world and they’ll receive it as fiat currency in their bank accounts within the same day. The receiver won’t even know that the transfer began as a crypto payment in the first place.

Unlike traditional methods, where you have to dish out hefty forex fees, Remittix charges zero FX fees for cross-border transfers, offering a scalable payment method.

Remittix currently supports 30 fiat currencies – a limit that’s expected to grow as the platform progresses.

Even better, using Remittix is also straightforward: simply enter the recipient’s bank details along with your own wallet address, and the funds will be transferred within minutes.

While traditional cross-border transfers can take 2-3 business days, Remittix offers a superfast unified solution that doesn’t burn a hole in your pocket.

The Remittix presale has drawn a lot of attention, having raised $25M so far. And each $RTX is currently priced at just $0.1080.

The platform is also hosting a $250K giveaway, where participants need to complete certain quests and refer Remittix to friends for a chance to win $25K worth of $RTX.

Today’s top suggestions include Bitcoin Hyper ($HYPER), Maxi Doge ($MAXI), and Remittix ($RTX). Together, they offer a solid mix of coins with real-world utility and raw, degen-powered hype.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

United States Building Permits Change dipped from previous -2.8% to -3.7% in August