Whales Pump Nearly $70K into Bitcoin Hyper as the Token Presale Hits $16.4M

Big buys of Bitcoin Hyper ($HYPER) tokens amounting to $69.8K since Monday have propelled the crypto fundraiser into the limelight, setting it up as one of this year’s hottest presales.

Why Bitcoin Needs a Layer 2 Blockchain

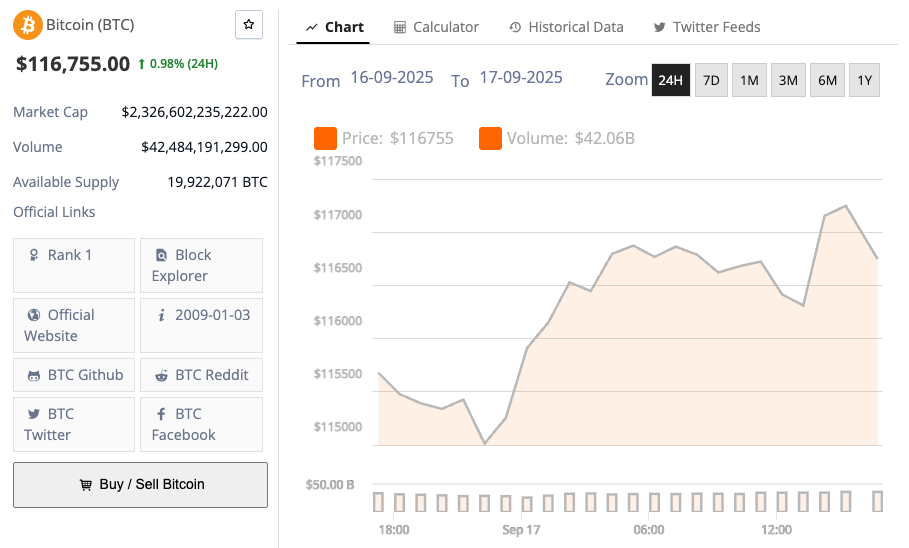

Since launching in 2009, Bitcoin has cemented itself as the world’s premier cryptocurrency. It continues to dominate with its over $2.3T market cap and price that recently reached as much as $124K.

Institutional investors have also begun stockpiling Bitcoins, with corporate treasuries holding over 1M $BTC, or 4.7% of the total supply. In other words, Bitcoin remains the top choice for anyone looking to invest in digital assets.

But despite its status, Bitcoin has been bogged down by issues such as slow and expensive transactions.

Part of this is due to its underlying code, which has been simplified to make it one of the most secure cryptocurrencies. However, this severely limits the coin’s utility, which is why you can’t use it for smart contracts, dApps, DeFi protocols, and NFTs.

Plus, it can only handle up to seven transactions per second (TPS). Blockchains that came after it can do significantly more, with Solana able to handle up to 65K TPS, for example.

Fixing these issues requires more than just rewriting the code; doing so would compromise Bitcoin’s robust security.

The solution? A Layer 2 blockchain for Bitcoin.

Bitcoin Hyper: Building the Bitcoin Fast Lane

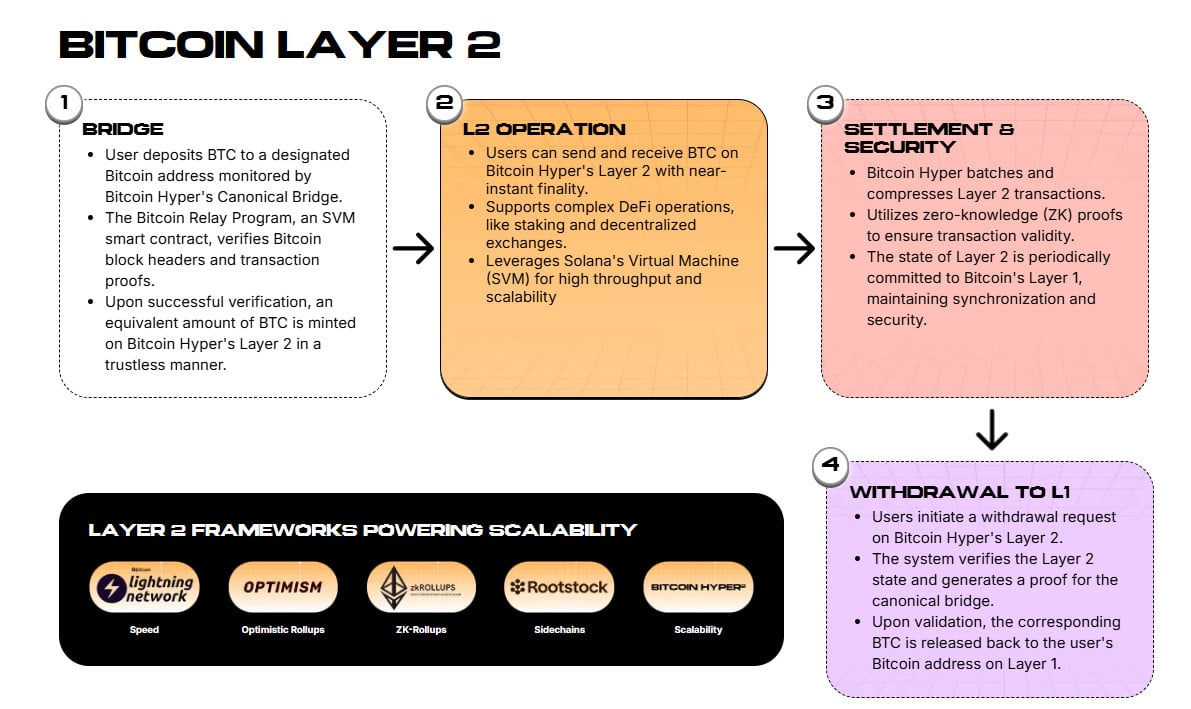

The Bitcoin Hyper ($HYPER) project, now in presale, is raising funds to develop a Layer 2 that will make Bitcoin transactions faster and cheaper, and expand what a regular Bitcoin can do, all without sacrificing security.

When launched, the Bitcoin Hyper will unlock unlimited applications for $BTC, such as interacting with dApps and staking.

The L2 will run on a Solana Virtual Machine, which delivers Solana-level speeds and significantly lower transaction costs.

You can deposit and withdraw your $BTC between layers securely, whenever you want, thanks to a non-custodial bridge.

Here’s a quick look at how the Bitcoin Layer 2 works:

The Bitcoin Hyper project has generated a lot of buzz in the market. It has already raised over $16.4M, with recent whale buys amounting to nearly $70K since Monday, including today’s $11.2K purchase.

Join the Bitcoin Hyper Presale and Help Write the Next Chapter in Bitcoin’s Story

You don’t have to be a whale to participate in the Bitcoin Hyper presale. With its $HYPER token priced at only $0.012935, you can easily invest without breaking the bank and be part of the liberation of Bitcoin.

To get started, go to the official Bitcoin Hyper presale page, connect your crypto wallet (e.g., Best Wallet app) to the presale widget, and purchase $HYPER with your credit/debit card or crypto.

For a more detailed guide on purchasing $HYPER tokens, read our ‘How to Buy Bitcoin Hyper’ page.

Whether you buy outright or stake, you can claim your $HYPER tokens once the presale concludes.

There’s less than two days before the next price increase, so the sooner you get your $HYPER, the better.

Be a part of one of this year’s biggest crypto presales. Join the Bitcoin Hyper presale today.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Scaramucci Says Trump Memecoins Drained Altcoin Market, Yet Sees Bitcoin Reaching $150,000 by Year-End