Almanak Delivers Verifiable Strategies Through The AI Swarm

DeFi was built on the promise of permissionless innovation, but most of it still runs on spreadsheets, Discord calls, and manual effort. It’s slow, fragmented, dominated by closed teams… and not really Web3. Almanak changes that!

They are building the core infrastructure for AI-native DeFi. A system where autonomous agents handle research, testing, optimization, and execution in minutes, not weeks. No bottlenecks, no gatekeeping — just verifiable, intelligent automation coordinating and deploying capital at scale.

This is zero-code, cross-chain DeFi designed for performance and composability. The architecture is built for scale and speed, secured by the best in crypto. AI codes faster… AI reasons faster.

Almanak is backed by Delphi, HashKey, Bankless, NEAR, Shima, and more. The community is already aligned, with early builders entering through a curated KOL round on Legion.

At the centre of Almanak is the AI Swarm. It functions like a fully autonomous quant team that does researching, coding, testing, optimizing, and deploying on your behalf. Strategies move from prompt to mainnet without ever needing a dev team!

There’s a strategy team that turns ideas into working contracts: alpha-seeking agents that surface opportunities across the DeFi landscape. Then an optimization team ensures that your strategies survive real volatility.

You May Also Like

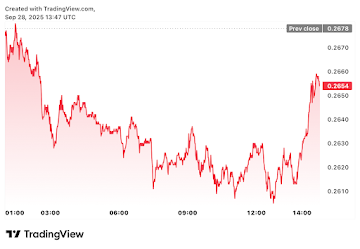

Bitcoin Holds $115K Support as Fed Cuts Rates by 25 Basis Points

Edges higher ahead of BoC-Fed policy outcome