Analog Devices ( $ADI) Stock: Q3 2025 Earnings Beat, Dividend Declared, Strong Q4 Outlook

TLDR

- Q3 2025 EPS of $2.05 vs. $1.93 expected, revenue of $2.88B vs. $2.79B estimate

- Stock trades at $240.37, up 4.31% during earnings release on Aug 20, 2025

- Returned $1.6B to shareholders via dividends and buybacks in Q3

- Declared quarterly dividend of $0.99 per share, payable Sept 16, 2025

- Forecasting Q4 revenue of $3.0B with adjusted EPS around $2.22

On August 20, 2025, Analog Devices, Inc. (NASDAQ: ADI) stock was trading at $240.37, up 4.31% midday as the company reported fiscal third-quarter results that exceeded expectations.

Analog Devices, Inc. (ADI)

Earnings per share came in at $2.05, beating the Zacks Consensus Estimate of $1.93. This compares to $1.58 per share a year earlier. Revenue rose to $2.88 billion, ahead of the $2.79 billion projection, representing double-digit year-over-year growth across all end markets.

The results marked the fourth consecutive quarter of topping EPS and revenue estimates, reflecting strong demand in the semiconductor space despite global trade uncertainties.

Management Commentary

CEO Vincent Roche highlighted that tariffs and trade fluctuations are adding uncertainty, but demand for ADI’s products remains robust. He emphasized the company’s focus on innovation and its ability to capture growth opportunities at the intelligent physical edge.

CFO Richard Puccio noted that backlog growth and healthy bookings were particularly strong in the Industrial segment, reinforcing confidence for continued momentum heading into Q4.

Shareholder Returns and Cash Flow

Analog Devices generated $4.2 billion in operating cash flow and $3.7 billion in free cash flow over the trailing twelve months, representing 40% and 35% of revenue, respectively.

In Q3 alone, the company returned $1.6 billion to shareholders, including $0.5 billion in dividends and $1.1 billion in share repurchases. The Board of Directors also declared a $0.99 per share quarterly dividend, payable on September 16, 2025, to shareholders of record as of September 2.

Q4 2025 Outlook

For the fiscal fourth quarter, ADI forecasts revenue of $3.0 billion, plus or minus $100 million. At the midpoint, reported operating margin is expected to be around 30.5%, with adjusted operating margin near 43.5%. Adjusted EPS is projected at $2.22, plus or minus $0.10.

This guidance signals continued growth momentum as ADI closes out fiscal 2025.

Performance Overview

Year-to-date, ADI shares have gained 14.64%, outperforming the S&P 500’s 8.58% return. Over a three-year horizon, ADI has delivered 51.64%, closely aligned with the S&P 500’s 51.03%. On a five-year basis, ADI has returned 124.77%, well ahead of the index’s 88.63%, underscoring its long-term strength.

Conclusion

Analog Devices delivered another strong quarter, beating expectations on both earnings and revenue, while boosting shareholder value through dividends and buybacks. With a solid Q4 outlook and proven resilience in volatile markets, ADI continues to demonstrate long-term growth potential for investors.

The post Analog Devices ( $ADI) Stock: Q3 2025 Earnings Beat, Dividend Declared, Strong Q4 Outlook appeared first on CoinCentral.

You May Also Like

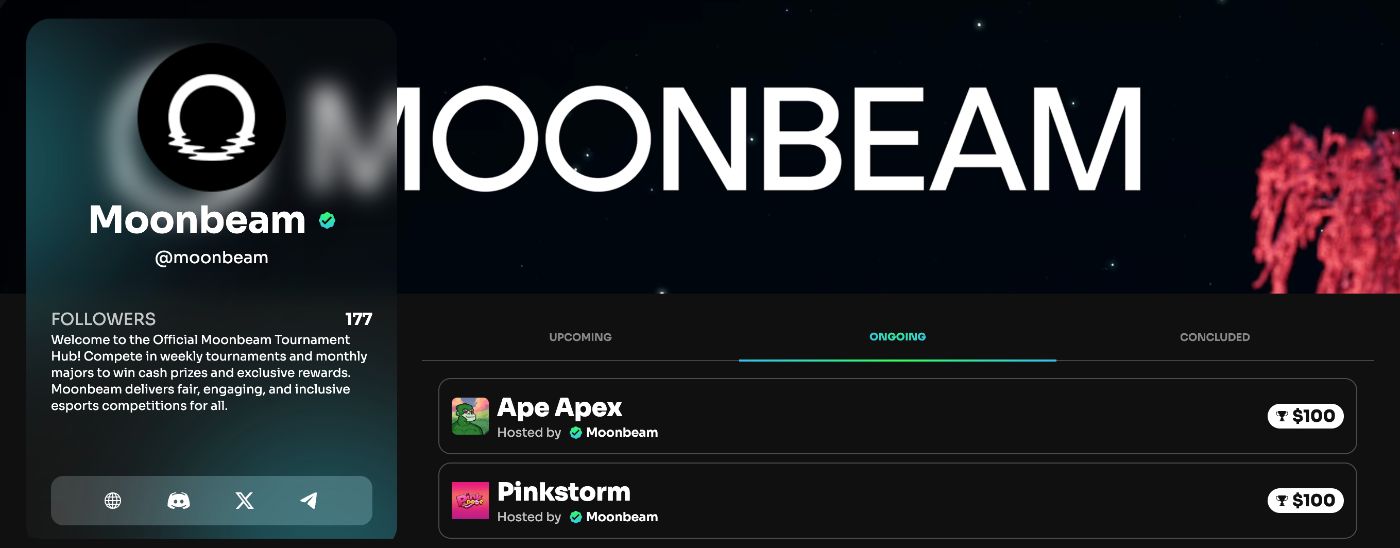

Why Web3 Gamers Are Rushing To Moondrop, Moonbeam’s GLMillionaire With 1,000,000 GLMR On The Line

Solana ETF Decision Delayed, Giving Mutuum Finance (MUTM) More Room to Eat into SOL’s Market Share