Aptos Price Prediction 2025: Can APT Repeat ICP’s Explosive Rally from $3 zone?

The post Aptos Price Prediction 2025: Can APT Repeat ICP’s Explosive Rally from $3 zone? appeared first on Coinpedia Fintech News

As the Aptos price prediction 2025 gains momentum, investors are revisiting APT’s long-term value following a period of significant price decline. With Aptos crypto trading above $2.50, alongside strong fundamentals such as rising revenue, good TPS performance, and other positive user metrics, the project appears primed for a significant recovery as fundamentals strengthen across the ecosystem.

APT’s Current Scenario Mirrors ICP’s Recent Breakout

Recent market attention has shifted toward base-layer protocols that operate as foundational infrastructure for decentralized applications. Following ICP’s explosive early-November rally from $2, many now expect Aptos crypto to follow a similar trajectory, given its comparable utility as a high-performance base layer.

Similarly, in another post shared on October 31, sentiment pointed to a clear disconnect between fundamentals and valuation. APT price is currently sitting at its lowest valuation in the past four years, despite continuous ecosystem expansion. The post suggests that sentiment could recover soon.

Based on this, the post stated, a move toward $5–$6 in the coming sessions could be possible if momentum persists. Additionally, a price of $8-$10 is a possibility if a similar price recovery is observed, as ICP has recently demonstrated.

Fundamental Growth Signals the Early Phase of a Comeback

Another post highlights recent data that suggests that APT’s fundamentals are strengthening at an impressive pace. Application revenue has climbed steadily throughout the year, peaking in October, with expectations of hitting a new all-time high by mid-November.

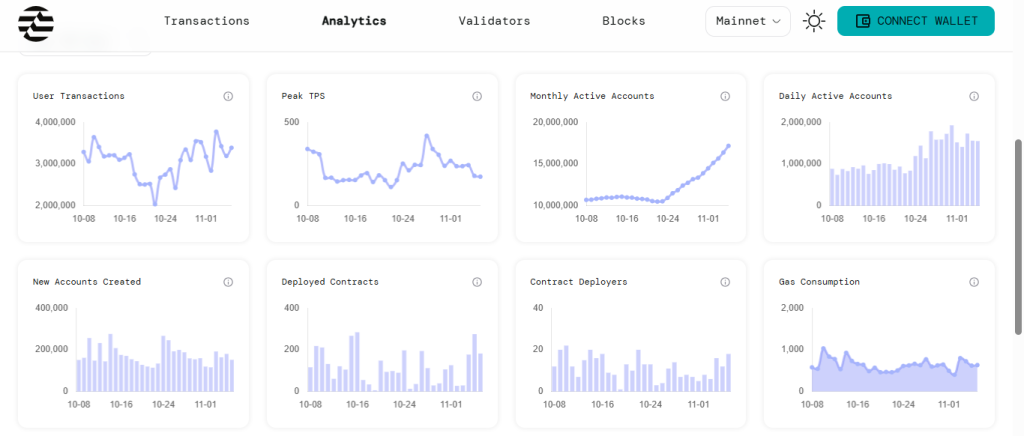

Meanwhile, other on-chain activity continues expanding like user transactions rose from 2 million to 3.3 million over the past 30 days.

Similarly, the Monthly active accounts jumped from 10.5M to 17.17M, demonstrating powerful user growth. Also, daily active accounts remain above 1.5M, reflecting strong network engagement.

This level of user activity is rarely seen in tokens trading in a continuous multi-month downtrend.

High TPS Ranking Enhances Long-Term Outlook

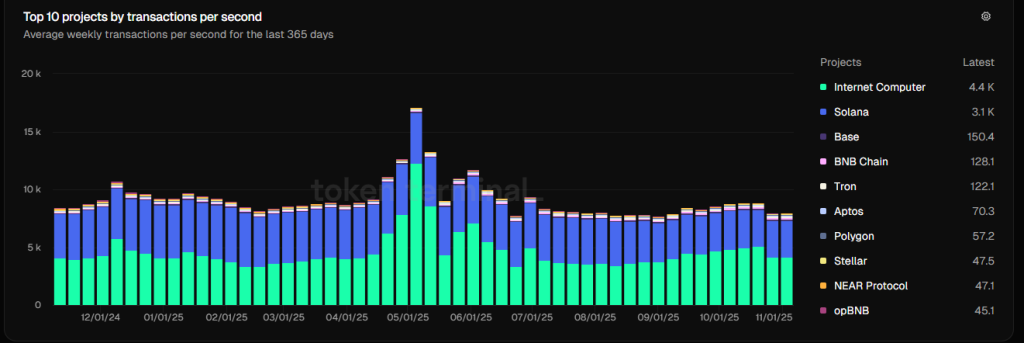

Moreover, the Token Terminal’s data places Aptos among the top 10 blockchains by transactions per second (TPS). Ranked 6th globally at 74.1 TPS, APT crypto stands among the most efficient smart contract platforms based on average weekly throughput over the last year.

This performance underscores why many believe the current Aptos price chart does not reflect the project’s true strength. High TPS, growing adoption, and rising revenue create a compelling backdrop for the Aptos price forecast heading into 2025.

With APT consolidating near $2.50- $3.00, it shows similarities to ICP before its explosive run. According to the Aptos price prediction 2025 outlook, the market may be approaching a turning point where fundamentals are outweighing short-term sentiment.

You May Also Like

Pakistan Considers Digital Rupee to Tap $25B Crypto Growth

Highlights: Pakistan is considering a digital rupee and CBDC to cut remittance costs. The crypto market in Pakistan could unlock $25B in new economic growth. The CBDC pilot phase is in development with World Bank and IMF support. Pakistan is moving forward with plans to integrate blockchain technology into its financial system. The nation is considering introducing a rupee-backed stablecoin and central bank digital currency (CBDC). The objectives of these efforts are to reduce remittance costs, modernize access to finances, and promote economic growth. At the Sustainable Development Policy Institute (SDPI) Conference, leading financial authorities outlined the massive growth potential of crypto. They estimate Pakistanis holding up to $30 billion in crypto holdings. The annual crypto trading might soon reach $300 billion, which is nearly equivalent to the total GDP of the country. Zafar Masud, the president of the Pakistan Banks Association, pointed out the booming global stablecoin market. According to him, the nation is capable of exploiting $20-25 billion in the adoption of digital assets. He confirmed that Pakistan is “actively exploring a rupee-backed stablecoin” to increase access and efficiency. A digital rupee would enhance secure cross-border payment and financial inclusion. More than 100 million Pakistani adults are still unbanked, and the innovation is a pressing case. Pakistan Considers Rupee-Backed Stablecoin Amid $25B Loss Warnings Pakistani regulators are actively exploring the development of a sovereign-backed digital currency amid growing recognition of the transformative potential of cryptocurrencies and bloc…https://t.co/CVr2s8UeoU pic.twitter.com/Fma8WTIGP3 — Crypto Breaking News (@CryptoBreakNews) November 8, 2025 CBDC Prototype Underway The State Bank of Pakistan is proceeding with the development of its digital currency. Faisal Mazhar, the Deputy Director of Payments, revealed that a prototype of CBDC is underway. Additionally, the World Bank and International Monetary Fund are assisting this initiative. He further added that there would be a pilot phase before the full rollout of the currency. The CBDC is expected to make remittances cheaper and financial services more accessible across the country. According to the global specialist Yara Wu, such technology would make remittances faster, secure, and cheaper. Sajid Amin of SDPI emphasized the necessity of having proper regulation. He noted the relevance of cybersecurity, digital literacy, and risk management to safeguard consumers and investors. Fintech Innovation Fuels Growth The fintech industry in Pakistan is also on the rise. ZAR, a start-up that provides dollar-backed stablecoins, recently raised $12.9 million. Top investors, such as Andreessen Horowitz, Coinbase Ventures, and Dragonfly Capital, were the source of funding. ZAR has raised $12.9 million to bring ROCK. SOLID. DOLLARS. to the Global South Led by @a16zcrypto, with @dragonfly_xyz, @vaneck_us, @cbVentures, and Endeavor Catalyst. pic.twitter.com/0DKOlWMwSO — ZAR (@zardotapp) October 28, 2025 ZAR is dedicated to making stablecoins accessible to underserved populations in Pakistan. Their mission focuses on bridging the financial gap in emerging markets. Moreover, the firm is seeking to assist millions of people who have yet to access traditional banking services. In addition, this move matches government-led digital finance initiatives. The increased adoption is a positive sign of increasing cryptocurrency interest in Pakistan. Pakistan moved to the third position globally in the 2025 Global Crypto Adoption Index by Chainalysis. To build further on this momentum, Pakistan established a regulatory framework regarding virtual asset services. Licensing and supervision are being managed by the Pakistan Virtual Asset Regulatory Authority (PVARA). Firms have to comply with stringent compliance criteria under the Virtual Assets Ordinance 2025. These include the anti-money laundering (AML), know-your-customer (KYC), and counter-terrorism financing measures. This goal is to create a regulated, safe digital economy. Furthermore, PVARA also encouraged international crypto exchanges and service providers to apply for licenses in September. eToro Platform Best Crypto Exchange Over 90 top cryptos to trade Regulated by top-tier entities User-friendly trading app 30+ million users 9.9 Visit eToro eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Microsoft Corp. $MSFT blue box area offers a buying opportunity