Best Crypto to Buy Now? Bitcoin Hyper Presale Crosses $18.5 Million Milestone

Bitcoin Hyper is being hailed by many analysts as potentially the best crypto to buy now. Their reasons are rooted in the token’s ability to establish its own identity while still giving users a sense of familiarity.

A meme coin with a superhero Pepe as the mascot, Bitcoin Hyper aims to take the Bitcoin network in a more utility-centric direction. It envisions an ecosystem within Bitcoin that could handle smart contracts and develop its own decentralized applications. Now that the project has raised upwards of $18.5 million already, analysts say that Bitcoin Hyper could bring novelty to the cryptocurrency market.

That being said, the current market conditions are shifting rapidly. In this case, does HYPER have the staying power to remain a strong asset?

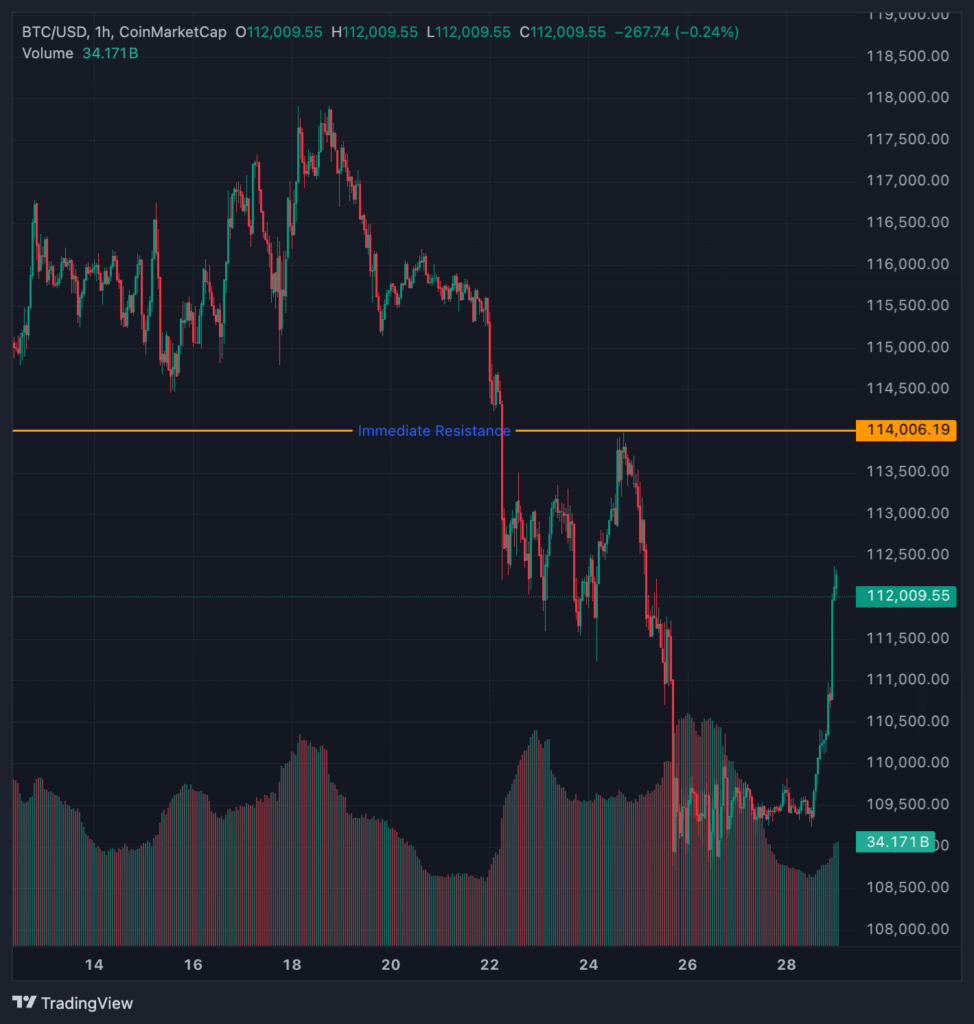

Bitcoin Price is Up Again, But the Volatility Isn’t Going Away

After days of struggling to stay above the $109K level, Bitcoin was able to make a 2.3% jump in the last 24 hours, moving above the $112K mark. However, this pivot from bearish momentum is just further evidence that the market continues to be volatile.

One analyst, Crypto Ape, highlighted that the latest momentum is just because of the “Uptober FOMO.”

Highlighting that Bitcoin is going through a supply shock, the analyst tweeted that OTC desks are running dry and exchange reserves are at record lows.

What does this indicate? The Bitcoin price could run up to new highs in October. However, given the market conditions and the constantly changing geopolitical ecosystem, it is not certain.

Meanwhile, Bitcoin Hyper has been able to amass a large community and raise closer to $20 million thanks to its sharp focus on utility.

Bitcoin Hyper: Utility-Centric Bitcoin

Bitcoin is known as the king coin for a reason. It was the first true decentralized asset to emerge, institutions are aping toward it, and retail investors dream of owning it. However, now that it has gone mainstream, its price action has become predictable.

Parabolic movements no longer exist, and the focus of the entire ecosystem is too much on how much one can own. Since institutions are winning the ownership race, there is an air of hegemony hanging over BTC, which means there may come a time when it is no longer decentralized.

To change that, Bitcoin Hyper comes with its own brand of solution. The Bitcoin-inspired meme coin is a low-cap asset whose main goal is reportedly to inject the Bitcoin ecosystem with more utility.

Multiple technologies have been adopted by this ecosystem to turn Bitcoin into a multichain and utility-centric experience:

- It has integrated the Solana Virtual Machine to support decentralized applications.

- Ethereum’s security will enforce data protection for all users.

- Lightning Network has been integrated to enhance Solana’s speed.

- A canonical bridge has been designed to establish a network between Bitcoin and Bitcoin Hyper.

- An L2 scaling solution has been adopted to run in parallel with the main ecosystem for better protection.

The project’s whitepaper makes it clear that the makers know what they are doing, as they have highlighted all the core aspects of the meme coin ecosystem properly and provided technical details on how they will accomplish their goals.

Furthermore, Bitcoin Hyper hasn’t lost touch with its memetic appeal despite being so focused on utility, which could be the reason why many highlight that it could be the best crypto to buy now.

Why Bitcoin Hyper Could be the Best Crypto to Buy Now?

Listed below are the reasons Bitcoin Hyper could be considered a top pick among multiple investors.

Memetic Approach

The current market has clearly communicated that low-cap meme coins are seen as more valuable than other assets. This makes Bitcoin Hyper a near-perfect asset for investors to focus on. It is a meme coin with a familiar appeal. It caters to the meme coin crowd through its Pepe-themed imagery and to the Bitcoin crowd through its name.

Utility-Centric Ecosystem

Bitcoin Hyper has created a utility-driven ecosystem around itself. While the scribbled drawings do give it a comedic approach, it is the utility that provides the project with long-term upsides. The fact that it aims to make Bitcoin more utility-centric is the reason it has generated the most interest.

Positive Reviews

Most in the market have reviewed the project positively. Sites like Bitcoinist, NewsBTC, and more have already stated that Bitcoin Hyper could be the next big thing on the market. Their reasons are valid, and most of them focus on how Bitcoin Hyper is less hype-driven despite being a meme coin.

Regular Updates

Bitcoin Hyper has consistently updated users about the developments happening behind the scenes. By ensuring that users receive constant updates, Bitcoin Hyper maintains engagement and ensures the community always has something to discuss.

Conclusion

Bitcoin Hyper has become a leading pick among investors looking for something different but still familiar. Now that it has raised over $18.5 million to date, it is gaining momentum among ICO seekers. Therefore, those looking for the best crypto to buy now should consider checking it out.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

AVAX and XRP Drift Lower, While BullZilla’s Progressive Price Engine Fuels the Best Crypto Presale to Buy For 2025