Bitcoin Price Crashes 9% Amid Historic $19B Liquidation, What’s Next?

The post Bitcoin Price Crashes 9% Amid Historic $19B Liquidation, What’s Next? appeared first on Coinpedia Fintech News

The crypto market endured its most dramatic setback yet, as total market capitalization nosedived by 8.92% overnight to $3.76 trillion. Successively, CoinMarketCap’s CMC20 index mirrored this plunge, setting at $239.42 as panic swept the industry.

The Crypto Fear & Greed Index is slumping to a fear-driven 35, and the average crypto RSI is falling into an oversold region at 25.97. As a result, the investor confidence faded almost instantly. At the center of this storm, the Bitcoin price crashed steeply, facing intense selling pressure. Further amplifying the sense of crisis and fueling a wave of heavy liquidations that left both traders and long-term holders reeling.

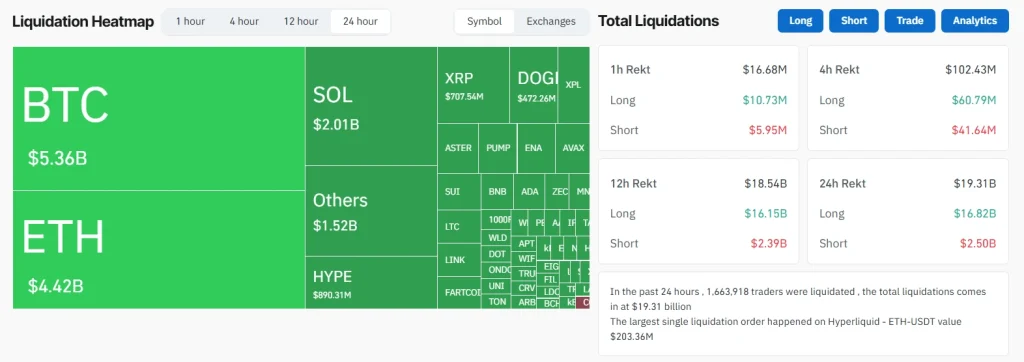

Liquidations Surge Past $19.31 Billion

In what marketers are calling the largest crash in crypto history, a staggering $19.31 billion in positions were liquidated within 24 hours. As per CoinGlass, Bitcoin led the tally with $5.36 billion shed, followed closely by Ethereum at $4.42 billion. Over 1.66 million traders were wiped out as the market underwent a historic leverage flush.

What set this event apart was the convergence of macroeconomic panic and overleveraged derivatives exposure. The catalyst? President Trump’s aggressive stance on Chinese tariffs sent shockwaves across global markets. Including stocks and digital assets.

Bitcoin Price Analysis:

Bitcoin price tumbled 6.91% in a single day to $112,759.64, marking an 8.02% loss over the past week. The market cap dipped by 6.85% to $2.24 trillion, although trading volume soared 141% to $179.86 billion. BTC’s price action saw a dramatic drop below critical moving averages, breaching the psychologically key $113K level and touching a 24-hour low of $104,582.

Technically, watch for price defenses around $109,200, the 78.6% Fibonacci retracement. Consequently, an oversold RSI at 24.85 suggests relief might be due. But the overall backdrop remains clearly risk-off until macro uncertainty fades and ETF inflows broaden beyond a single provider.

FAQs

The primary drivers were U.S.-China tariffs, record derivatives liquidations, and a sharp swing in investor sentiment, with Bitcoin’s correlation with stocks exposing it to broader market panic.

While the RSI signals an oversold setup and some institutions are buying, overall fear remains high. Risk is elevated until support at $109,208 holds.

Key signals include U.S. economic data clarity, stabilization in ETF flows, and Bitcoin holding the $109,208 support.

You May Also Like

Deribit's trading volume exceeded $22.8 billion in 24 hours, setting a new record high

Smart investors earn $6,875 daily on ProfitableMining, the leading cloud mining platform.