Bitcoin Soft Fork Sparks Fury Over ‘Legal Threats’ – Core Devs Face Backlash

A new Bitcoin improvement proposal has ignited controversy across the Bitcoin community, with developers and users clashing over claims that it threatens legal consequences for those who reject it.

The proposal, titled Bitcoin Improvement Proposal 444 (BIP-444), was published late Friday by an anonymous developer using the alias “Dathon Ohm.”

It calls for a temporary soft fork to limit the amount of arbitrary data that can be included in Bitcoin transactions, a move supporters say is meant to protect node operators from legal risks, but critics are calling an attempt to impose censorship on the network.

Legal Threats or Misunderstood Wording? Inside Bitcoin’s Latest Developer Feud

The document, which spans multiple technical sections, includes a contentious line that has become the center of the storm.

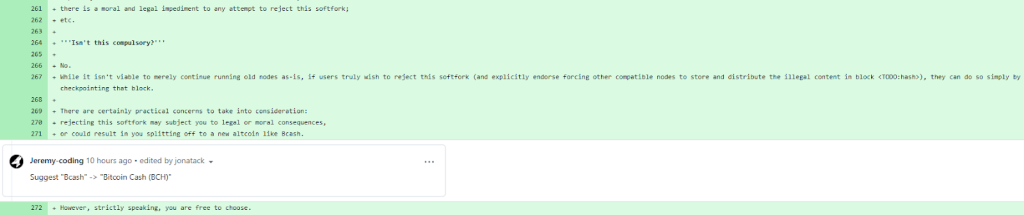

On line 261, it states that “there is a moral and legal impediment to any attempt to reject this soft fork.”

A few lines later, between lines 270 and 272, it adds: “Rejecting this soft fork may subject you to legal or moral consequences or could result in you splitting off to a new altcoin like Bcash. However, strictly speaking, you are free to choose.”

Source: GitHub

Source: GitHub

That phrasing triggered immediate backlash on X (formerly Twitter), with critics accusing the proposal’s authors of using “legal threats” to coerce the Bitcoin community into accepting the soft fork.

Ben Kaufman, a Bitcoin developer, described it as “the most clear case of an attack on Bitcoin.” Canadian cryptographer Peter Todd shared a screenshot of the section, saying it was “clear [Luke Dashjr] expects his soft fork to get adopted due to legal threats.”

Galaxy Digital’s Alex Thorn called it “explicitly an attack on Bitcoin” and “incredibly stupid.”

Luke Dashjr, a longtime Bitcoin Core developer and outspoken critic of Ordinals, has publicly supported the proposal but denied writing it.

Dashjr said on X that the soft fork is “on track with no technical objections,” describing it as a “simple, temporary measure” to buy time for a long-term solution. “This isn’t intended to be an ideal fix,” he wrote, “only good enough to give us breathing room.”

New Bitcoin Proposal Seeks to Limit Data Storage, Citing Legal Threats to Node Operators

The soft fork proposal follows the release of Bitcoin Core v30, which went live earlier this month. That update effectively lifted the 83-byte limit on OP_RETURN data, allowing larger payloads to be attached to Bitcoin transactions.

While only about 6.5% of reachable nodes have adopted v30 so far, according to Bitnodes data, the change has reignited debate over what Bitcoin should, and should not, be used for.

BIP-444’s authors argue that Bitcoin’s expanded data capacity could expose node operators to criminal liability if illegal material, such as child sexual abuse content, is uploaded to the blockchain.

“If the blockchain contains content that is illegal to possess or distribute, node operators are forced to choose between violating the law (or their conscience) or shutting down their node,” the document states.

“This unacceptable dilemma directly undermines the incentive to validate, leading to inevitable centralization and posing an existential threat to Bitcoin’s security model.”

To address that, the proposal introduces a set of technical restrictions. OP_RETURN outputs would be capped at 83 bytes, most other scriptPubKeys at 34 bytes, and data push sizes limited to 256 bytes.

It also seeks to invalidate unused script versions, restrict Taproot Merkle trees, and ban the OP_IF command in Tapscript, a change that would effectively disable Ordinals inscriptions.

These measures would make some transactions previously considered valid become invalid, though the proposal emphasizes that the soft fork would last only about a year while developers seek a permanent solution.

Security Fix or Threat to Bitcoin’s Voluntary Consensus?

Despite the technical rationale, the proposal’s wording has alarmed many Bitcoiners. Some called the “moral and legal impediment” language “Orwellian,” referencing George Orwell’s depiction of authoritarian control in 1984.

Others warned that using moral or legal arguments to push through a fork contradicts Bitcoin’s principle of voluntary consensus.

Supporters of the proposal argue that the “legal consequences” phrasing has been misinterpreted.

They say the line refers to the potential liability that could arise from running nodes containing illegal content, not an actual legal threat to dissenters.

Dashjr himself echoed this explanation, saying, “It doesn’t say that. Maybe you can propose a clarification if you think it’s unclear.”

He added that “may isn’t certain,” suggesting that the clause originated in an earlier draft and should be updated for clarity.

Still, many remain unconvinced. Jameson Lopp, co-founder of Bitcoin security firm Casa, criticized the proposal for failing to define what constitutes “illegal or immoral” content, noting that “legal experts disagree on the liability node operators would face.”

Lopp added, “By running a node, you consent to the consensus rules of the network. If you don’t consent, you can simply not run a node.”

Others warned that forcing consensus around the proposal could lead to a network split. A user under the handle Leonidas, known in the Ordinals community, argued that censoring data transactions “sets a dangerous precedent,” equating it to state censorship of financial transactions.

“There is no meaningful difference between normalizing the censorship of JPEG or memecoin transactions and normalizing the censorship of monetary transactions by nation-states,” he said.

Meanwhile, Peter Todd claimed to have already demonstrated a workaround, posting a transaction that he said contains the entire text of BIP-444 yet remains “100% standard and fully compatible” with the proposed rules, a move that, if true, would undermine the technical purpose of the soft fork.

The BIP-444 proposal has not yet been submitted to Bitcoin’s official development mailing list, a necessary step before any draft improvement proposal can move toward formal review or activation.

But the uproar around its language has already deepened existing divisions between developers over the direction of Bitcoin’s protocol.

You May Also Like

OpenAI pushes Trump admin to expand Chips Act tax credit

Amazing Liquidity Tailwinds: How the End of US Shutdown Supercharges Risk Assets