Bitcoin Whale Wallets Add $7.3B in September as ETH and SOL Attract Capital

TLDR

- Bitcoin whales added $7.3B in September, controlling 18% of total BTC supply.

- Solana received a $1.1B investment from Pantera Capital this month.

- Ethereum’s stable ETH/BTC ratio indicates balanced capital flows.

- Smaller tokens are gaining traction as capital shifts from Bitcoin and ETH

Bitcoin whales have been making major moves in September, with wallet addresses holding between 100 and 1,000 BTC accumulating a total of $7.3 billion. This surge in buying is stirring speculation on what might happen next in the crypto market. Ethereum and Solana are also seeing increased attention from investors, as both altcoins experience higher capital inflows. Meanwhile, smaller tokens are gaining interest as traders look to diversify their portfolios.

Bitcoin Whale Wallets See Massive Accumulation

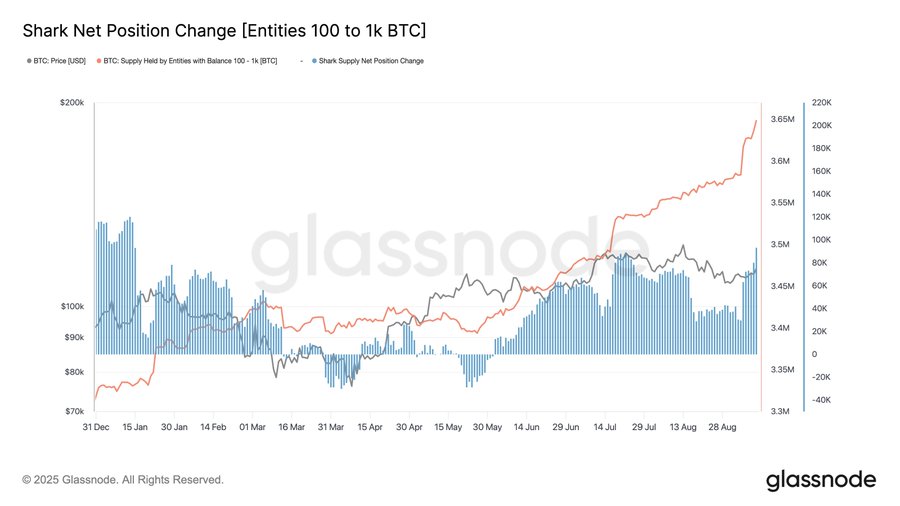

Bitcoin whale wallets, also known as “sharks,” have shown considerable activity in September. According to data from Glassnode, wallets holding between 100 and 1,000 BTC have accumulated roughly 65,000 BTC over the past seven days, which is worth about $7.38 billion. These wallets now control a total of 3.65 million BTC, which represents around 18% of the total Bitcoin supply.

This accumulation points to growing confidence among mid-sized investors. By purchasing large amounts of Bitcoin, these whales are reducing the available supply in the market. This often leads to upward pressure on Bitcoin’s price. Many analysts suggest that these moves may signal expectations of higher valuations in the coming months, with some predicting Bitcoin could reach between $150,000 and $200,000 by the end of the year.

Whale Selling Resumes After a Short Pause

While many Bitcoin whales have been buying, some large holders are taking profits. A wallet linked to a long-term holder recently moved over 1,100 BTC, worth about $136 million, to the exchange Hyperliquid. This transaction comes just weeks after a different wallet moved $4 billion worth of Bitcoin to Ethereum.

Such large transactions often lead to market speculation, especially when a well-established whale chooses to sell. These moves may create short-term price fluctuations but also present opportunities for new investors to accumulate Bitcoin at lower prices. However, it’s clear that some whales are strategically repositioning their assets, which could influence the market in the coming weeks.

Ethereum and Solana Attract Institutional Interest

Ethereum and Solana have been drawing notable institutional interest in recent weeks. Pantera Capital, a major investment firm, recently revealed a $1.1 billion position in Solana, making it its largest single investment. Solana’s speed, efficiency, and growing presence in decentralized exchanges and NFT markets have made it an attractive investment for institutions.

Ethereum, meanwhile, continues to dominate in the realm of decentralized applications and smart contracts. Despite the rise of newer blockchains, Ethereum remains a core asset for institutional investors. The ETH/BTC ratio has remained stable, showing that investors are balancing their portfolios between the two major cryptocurrencies. Both Ethereum and Solana are expected to remain key players as more capital flows into these networks.

Smaller Tokens Begin Gaining Traction

While Ethereum and Solana are seeing large inflows, some analysts are also focusing on smaller, undervalued tokens. As larger whales accumulate Bitcoin and major altcoins, there is an ongoing rotation of capital into lesser-known cryptocurrencies. These smaller tokens could benefit from increased investor interest as the focus shifts to new opportunities.

The continued rise of Ethereum and Solana is influencing market sentiment and making traders more likely to explore altcoins with growth potential. As Bitcoin’s whale activity suggests possible price increases, some traders are looking for alternatives to diversify their holdings, making this a dynamic period for smaller tokens.

The movement of large sums of money into both Bitcoin and altcoins shows how institutional and whale actions can shape broader market trends. While Bitcoin’s dominance continues, the increasing attention on Ethereum and Solana suggests a shift in investor preferences, particularly in decentralized applications and smart contract platforms.

The post Bitcoin Whale Wallets Add $7.3B in September as ETH and SOL Attract Capital appeared first on CoinCentral.

You May Also Like

Wormhole’s W token enters ‘value accrual’ phase with strategic reserve

Bitcoin Beats Gold in Financial Gains