Bitwise Spot Solana ETF Sets 2025 Record With $56M Debut Trading Volume

The Bitwise spot Solana ETF (exchange traded fund) debuted yesterday with the highest first-day trading volume of any ETF in 2025.

Bitwise’s Solana Staking ETF (BSOL) recorded $56 million in debut trading, outpacing the launches of REX Osprey’s XRP and Solana staking ETFs.

Bloomberg ETF analyst Eric Balchunas noted in a post on X that BSOL’s volumes could have reached around $280 million if the fund’s total seed capital had been invested on the first day, surpassing even the first-day activity of BlackRock’s spot Ethereum ETF (ETHA) last year.

The strong start underscores how institutional interest in digital assets is broadening beyond market leaders Bitcoin and Ethereum. BSOL had already attracted $223 million in assets ahead of its launch, highlighting growing confidence in smaller-cap crypto products.

BSOL also posted more first-day trading activity than the Canary Capital Litecoin and Hedera ETFs, which also launched yesterday. Canary’s Hedera (HBAR) ETF recorded $8 million in debut trading activity with its Litecoin ETF recording only $1 million.

Despite the strong start, BSOL’s activity was unable to boost the price of Solana. Amid a broader market pullback in the last 24 hours, SOL retraced over 2% to trade at $195.22 as of 1:35 a.m. EST.

Spot Ethereum ETFs Still Hold The Lead

BSOL’s volumes on its debut were still only a fraction of the $1.08 billion activity seen across the nine spot Ethereum ETFs that launched last year.

Most of that volume was outflows from Grayscale’s converted Ethereum Trust, which accounted for $458 million of the activity on the day. Meanwhile, BlackRock’s iShares Ethereum Trust ETF (ETHA) pulled in $248.7 million on its first day.

Bitwise’s spot Ethereum ETF also saw $94.3 million when it launched.

US spot Ethereum ETFs posted $202.4 million in net daily inflows yesterday, according to data from Farside Investors.

BSOL And Other Crypto ETF Listings Caught Analysts By Surprise

BSOL’s first day of trading came after the New York Stock Exchange (NYSE) posted listing notices for the fund and other crypto spot ETFs on Monday.

The timing of the listings had caught analysts by surprise, given that the US Securities and Exchange Commission (SEC) had signaled that it would not approve new products while it operates under reduced staff amid the ongoing government shutdown.

Related Articles:

You May Also Like

Privacy is ‘Constant Battle’ Between Blockchain Stakeholders and State

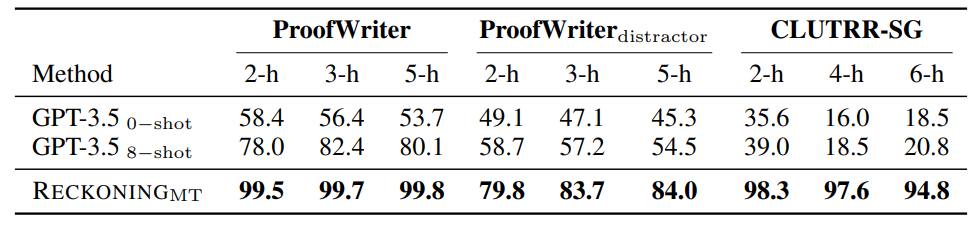

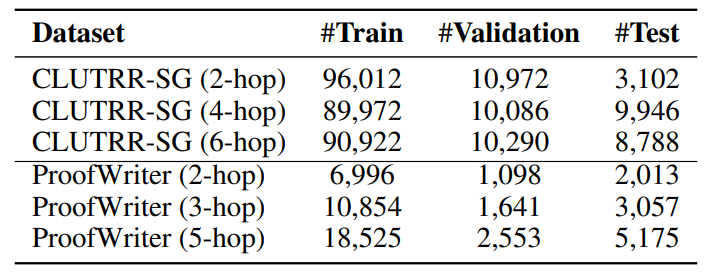

Technical Setup for RECKONING: Inner Loop Gradient Steps, Learning Rates, and Hardware Specification