Can XRP Overcome Bearish October History With Key Catalysts Ahead?

September proved to be a volatile month for XRP (XRP) and the broader crypto market. Still, the altcoin rose 3.66%, a notable reversal from August’s 8.15% decline.

As October begins, seasonality skews bearish. Over the past 12 years, XRP has closed in the red during seven Octobers. Even so, several potential catalysts could challenge that pattern in 2025.

Seasonality vs Catalysts: XRP Sets up for a Pivotal October

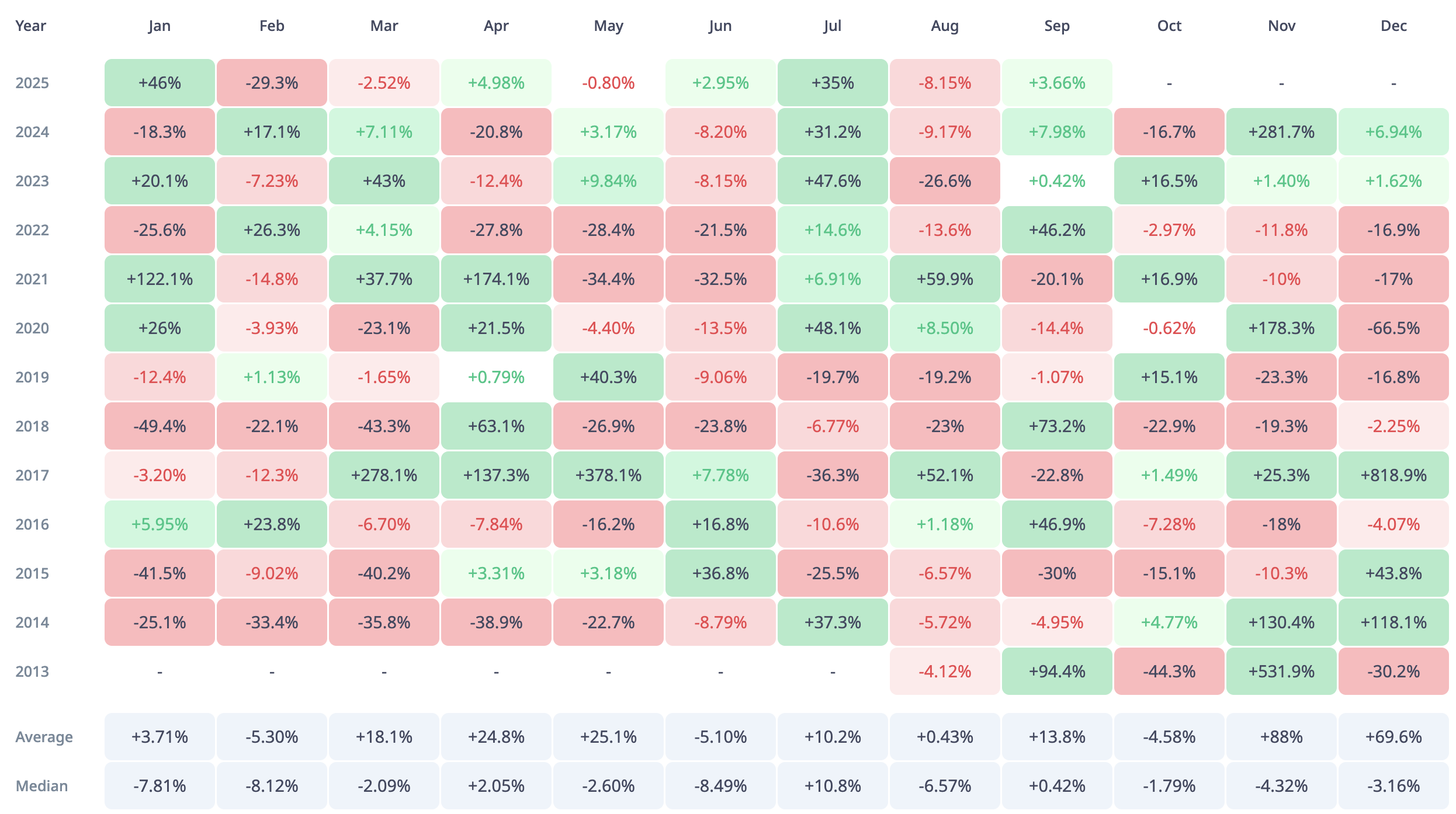

According to data from CryptoRank, XRP’s average October return stands at -4.58%, making it one of the weakest months for the altcoin besides February and June.

This year, the pattern held in February, when XRP fell 29.3%. However, the coin defied seasonality in June, rising 2.95% and breaking a seven-year red streak.

XRP Monthly Returns. Source: CryptoRank

XRP Monthly Returns. Source: CryptoRank

With ‘Uptober’ approaching, analysts see a chance that XRP could once again buck the trend and deliver gains. Central to this potential shift are impending decisions by the US Securities and Exchange Commission (SEC) on multiple spot XRP exchange-traded fund (ETF) applications.

The SEC is scheduled to rule on ETF filings from several asset managers between October 18 and 25. These include Grayscale, 21Shares, Bitwise, Canary Capital, WisdomTree, CoinShares, and Franklin Templeton.

These deadlines follow a wave of applications, with many issuers vying for approval. If approved, it could unlock significant institutional inflows, potentially propelling XRP’s price higher. Furthermore, the recent success of the REX-Osprey XRP ETF has fueled optimism for the potential of spot ETFs.

Beyond ETFs, advancements in the XRP Ledger (XRPL) ecosystem are accelerating adoption. In late September, Securitize integrated with XRPL to enhance utility and access.

Furthermore, Ripple and Securitize launched a smart contract that lets holders of BlackRock’s BUIDL and VanEck’s VBILL instantly swap their shares for Ripple USD (RLUSD) 24/7 on-chain—creating a stablecoin off-ramp and deeper liquidity.

In the decentralized finance (DeFi) space, Flare Network’s fXRP, a DeFi-compatible one-to-one representation of the XRP, launched on the mainnet. Notably, its week-1 minting cap of 5 million FXRP was completely utilized before the timeline, a clear signal of early demand and utility.

Similarly, Midas’ mXRP liquid staking token, issued on XRPL’s EVM sidechain via Axelar, amassed $26 million in total value locked (TVL) within six days, highlighting untapped DeFi potential.

Thus, despite October’s historically weak XRP trends, 2025 brings credible upside catalysts: clustered SEC spot-ETF deadlines, growing XRPL adoption, and early DeFi traction.

If the SEC greenlights spot XRP ETFs, October could mark a pivotal transition from regulatory uncertainty to mainstream integration, potentially reshaping XRP’s trajectory. However, downside volatility could likely return if denials or delays arrive or macro tightens.

You May Also Like

Why This New Trending Meme Coin Is Being Dubbed The New PEPE After Record Presale

How Bitcoin Options Traders Are Positioning Amid the Crypto Market Rout