Cardano Price Forecast: Whales offload 230 million ADA bought this week, raising risks of further decline

- Uncertainty among top Cardano whales risks further losses, with 230 million ADA caught and released this week.

- Charles Hoskinson emphasizes his $100 million investment plan, divided between Cardano-native stablecoins and Bitcoin, in the David Gokhshtein podcast.

- The technical outlook indicates a potential risk that Cardano may test $0.50, marking a new year-to-date low.

Cardano (ADA) ticks lower by over 1% at press time on Friday, marking its fifth consecutive bearish day. Amid a declining trend, Charles Hoskinson’s $100 million investment plan raises uncertainty among Cardano whales, resulting in a 230 million ADA shift in just three days. The technical outlook indicates a bearish momentum spike, suggesting further losses ahead.

Cardano whales offload recently acquired 230 million ADA

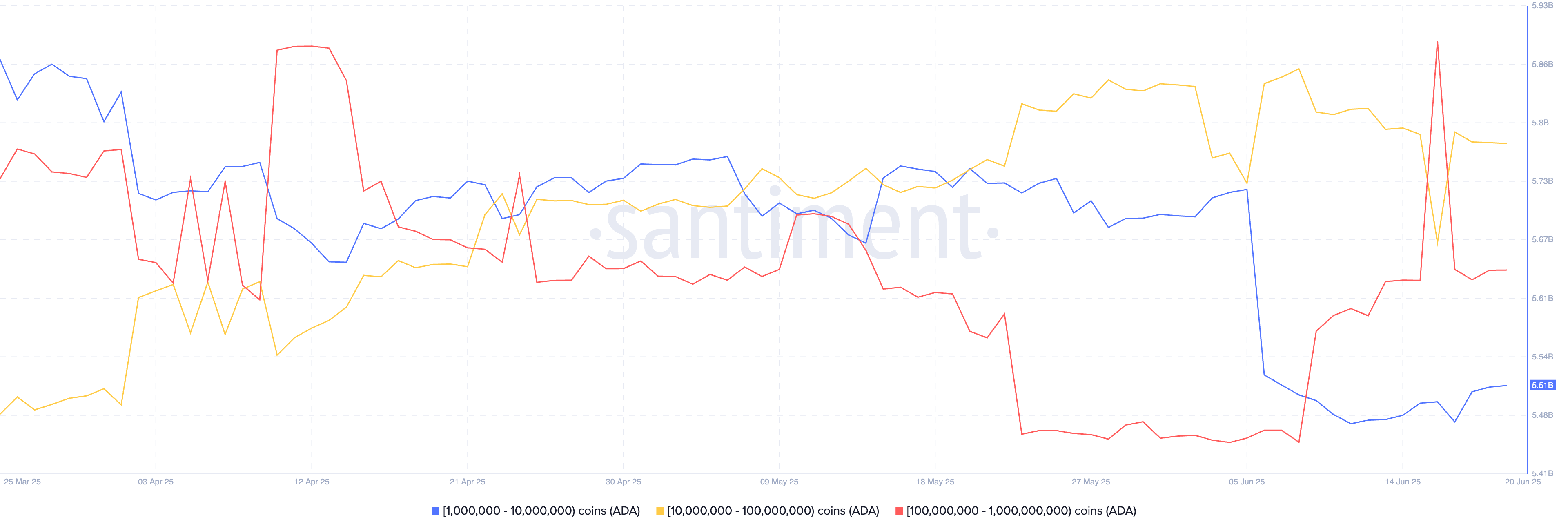

Santiment data shows that investors with 100 million to 1 billion ADA acquired a total of 230 million ADA on Monday, boosting the total to 3.40 billion ADA from 3.17 billion ADA. However, in a quick sell-off, investors offloaded the acquired 230 million ADA by Wednesday. As of Friday, the holdings of these large investors total 3.18 billion ADA.

Notably, the holdings of investors with more than 1 billion ADA have increased by 180 million ADA so far in June. The increased volatility in Cardano whale holdings suggests shaken confidence.

Charles Hoskinson plans to transform the Cardano treasury

In a podcast with David Gokhshtein, Charles Hoskinson, the founder of Cardano, emphasized his plan to boost the stablecoin supply on the network. The founder said,

The plan advances to utilize the yield generated from the investment to purchase ADA and donate it to Cardano’s treasury. Charles advises that this will boost the treasury, transforming it from an unmanaged single-asset on-chain system to a managed off-chain treasury with out-of-band governance.

Cardano Price Forecast: ADA eyes further losses

Cardano drops by over 1% at the time of writing on Friday, printing its fifth consecutive bearish candle on the daily chart. Following a triangle breakdown, ADA slides below the $0.5946 support level marked on April 16.

A closing below $0.5946 could increase the downside risk of testing the $0.5110 year-to-date low. Investors could witness the declining ADA trend approaching the $0.50 psychological support level.

The Moving Average Convergence/Divergence (MACD) further declines into negative territory alongside its signal line, indicating a sustained rise in bearish momentum.

The Relative Strength Index (RSI) at 31 edges closer towards the oversold zone, suggesting an increase in selling pressure.

On the contrary, if ADA sustains above $0.5946, sidelined investors could witness Cardano reverse towards the weekly opening of $0.6333.

You May Also Like

Financing Weekly Report | 13 public financing events; Privacy blockchain Miden completes $25 million seed round, led by a16z Crypto and others

Best Altcoins That Can Turn a $1,000 Investment into $10,000