Circle Caves to Political Pressure, Reverses USDC Gun Purchasing Ban

Circle, the issuer of the world’s second-largest stablecoin, USDC, has reversed a controversial policy that prohibited firearm purchases, following weeks of political pressure and public criticism from gun rights groups and Republican lawmakers.

The company confirmed that it has updated its terms of service to permit lawful transactions involving firearms, after the National Shooting Sports Foundation (NSSF), a major firearms trade association, challenged what it described as “financial discrimination” against lawful commerce.

“Circle has clarified our Terms to reflect that USDC may be used for the lawful purchase and sale of firearms, as protected under the Second Amendment,” a Circle spokesperson told the NSSF. “We have not and will not deny the use of USDC for legally permissible transactions involving firearms.”

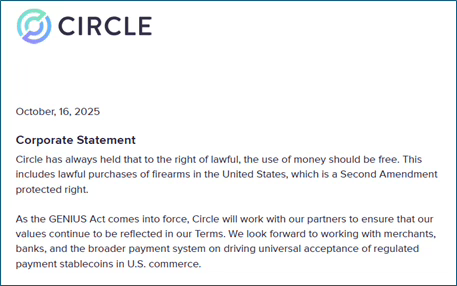

Source: NSSF

Source: NSSF

Circle Aligns USDC Policy With GENIUS Act Stablecoin Framework

The reversal comes after Americans for Tax Reform (ATR), a conservative advocacy group, published a report last month revealing that Circle’s terms prohibited transactions involving “weapons of any kind, including firearms, ammunition, knives, or explosives.”

ATR argued that the ban highlighted the risk of private financial intermediaries restricting lawful transactions based on political bias. The group also pointed to campaign donations made by Circle CEO Jeremy Allaire to Democratic politicians, including Rep. Jake Auchincloss (D-MA), who has sponsored gun control legislation.

The clause, which went largely unnoticed until recently, stated that using USDC for “weapons of any kind” violated the company’s prohibited transactions policy.

Circle reserved the right to monitor and block such activity, potentially suspending accounts that violated the terms.

Following ATR’s report, the NSSF accused Circle of engaging in “ideological enforcement” against gun owners and retailers. “Freedom cannot survive if your financial tools are turned against you and your Second Amendment rights,” the organization said in a statement.

The group compared Circle’s actions to historical “Operation Choke Point”-style practices, in which U.S. regulators were accused of pressuring banks to deny services to politically disfavored industries.

The policy quickly drew attention in Washington, with several Republican lawmakers citing it as evidence of “financial weaponization.”

Senator Bill Hagerty (R-TN), author of the recently enacted GENIUS Act stablecoin framework, said the reversal marked “a victory against Choke Point-inspired mechanisms to achieve partisan goals.”

“America will no longer tolerate discrimination against citizens who are exercising their constitutional rights.”

Senator Cynthia Lummis (R-WY), another co-sponsor of the GENIUS Act, praised Circle’s decision, saying it “aligns its terms of service with existing legal requirements and ensures financial systems cannot be used against law-abiding gun owners.”

Circle’s Policy U-Turn Exposes a Key Stablecoin Dilemma

Circle’s update, which now only prohibits weapons purchases “in contravention of applicable laws,” comes at a time when stablecoins are gaining unprecedented influence in the U.S. financial system.

With USDC’s market capitalization hovering around $75 billion, Circle has become one of the most significant players in digital finance. The company went public in June, raising over $1 billion through its initial public offering on the New York Stock Exchange.

Stablecoins have also surged in mainstream adoption since President Donald Trump signed the GENIUS Act into law in July, establishing a federal framework for their issuance and oversight.

The law’s passage triggered a wave of new stablecoin initiatives from major financial institutions, including Bank of America, Morgan Stanley, and Robinhood.

Yet Circle’s controversy has drawn parallels to the same issues critics have raised about government-backed digital currencies.

ATR’s report compared Circle’s original restrictions to potential central bank digital currency (CBDC) controls, warning that private firms could similarly “monitor and censor” transactions under political influence.

The NSSF called Circle’s reversal “a welcome sign” that private companies are beginning to recognize the dangers of financial bias.

You May Also Like

Privacy Coins Rally Driven by Technicals, Narrative

‘Survival Mode’ Activated: Bitcoin Miners Struggle As Hashprice Collapses