CleanSpark's BTC reserves exceeded $1 billion in Q3, with revenue increasing 91% year-on-year.

PANews reported on August 8th that according to The Block, Bitcoin mining company CleanSpark announced its third-quarter results for fiscal year 2025 (ending June 30th). Revenue surged 91% year-over-year to $198.6 million, with adjusted EBITDA reaching $377.7 million (compared to a loss of $12.6 million in the same period last year). CleanSpark's net profit was $257.4 million, primarily driven by a 26% quarterly increase in Bitcoin prices and the expansion of its operations.

This quarter, CleanSpark's hash rate reached 50 exahashes per second (5.8% of the total network), and its Bitcoin holdings exceeded $1 billion in value, with total assets reaching $3.1 billion (including $1.08 billion in Bitcoin, $985 million in mining equipment, and $34.6 million in cash), and total liabilities reaching approximately $1 billion. The company sold 578.51 Bitcoins in June, down from 401.39 in April but up from 293.5 in May.

You May Also Like

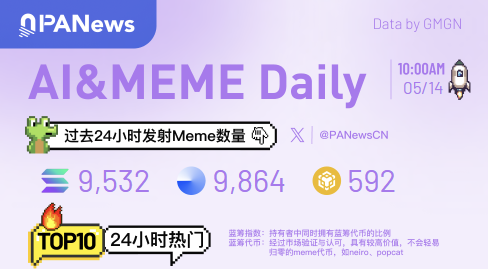

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.5.14)

Vitalik Buterin backs Ethereum treasury firms but warns of leverage risks