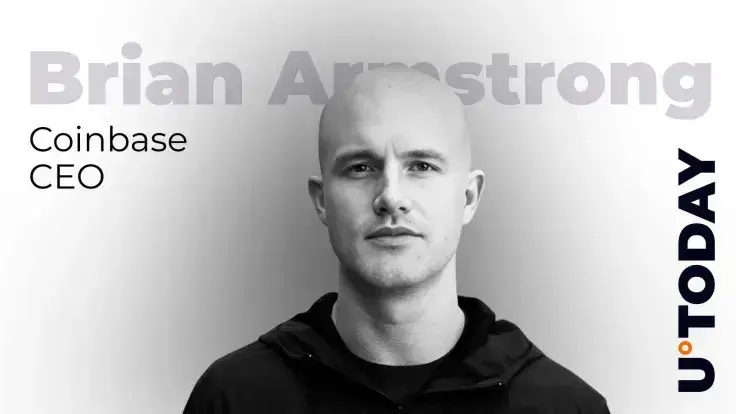

The Coinbase CEO claims that it is not too late to invest in crypto after predicting that the price of the leading cryptocurrency could surge all the way to $1 million The Coinbase CEO claims that it is not too late to invest in crypto after predicting that the price of the leading cryptocurrency could surge all the way to $1 million

Coinbase CEO Says It’s 'Never Too Late' to Enter Crypto

2025/10/20 13:09

The Coinbase CEO claims that it is not too late to invest in crypto after predicting that the price of the leading cryptocurrency could surge all the way to $1 million

The Coinbase CEO claims that it is not too late to invest in crypto after predicting that the price of the leading cryptocurrency could surge all the way to $1 million

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

Share Insights

You May Also Like

The Channel Factories We’ve Been Waiting For

The post The Channel Factories We’ve Been Waiting For appeared on BitcoinEthereumNews.com. Visions of future technology are often prescient about the broad strokes while flubbing the details. The tablets in “2001: A Space Odyssey” do indeed look like iPads, but you never see the astronauts paying for subscriptions or wasting hours on Candy Crush. Channel factories are one vision that arose early in the history of the Lightning Network to address some challenges that Lightning has faced from the beginning. Despite having grown to become Bitcoin’s most successful layer-2 scaling solution, with instant and low-fee payments, Lightning’s scale is limited by its reliance on payment channels. Although Lightning shifts most transactions off-chain, each payment channel still requires an on-chain transaction to open and (usually) another to close. As adoption grows, pressure on the blockchain grows with it. The need for a more scalable approach to managing channels is clear. Channel factories were supposed to meet this need, but where are they? In 2025, subnetworks are emerging that revive the impetus of channel factories with some new details that vastly increase their potential. They are natively interoperable with Lightning and achieve greater scale by allowing a group of participants to open a shared multisig UTXO and create multiple bilateral channels, which reduces the number of on-chain transactions and improves capital efficiency. Achieving greater scale by reducing complexity, Ark and Spark perform the same function as traditional channel factories with new designs and additional capabilities based on shared UTXOs. Channel Factories 101 Channel factories have been around since the inception of Lightning. A factory is a multiparty contract where multiple users (not just two, as in a Dryja-Poon channel) cooperatively lock funds in a single multisig UTXO. They can open, close and update channels off-chain without updating the blockchain for each operation. Only when participants leave or the factory dissolves is an on-chain transaction…

Share

BitcoinEthereumNews2025/09/18 00:09

Share

Markets Eye a Data-Heavy Week Ahead With Inflation, PMI Data and Fed Crypto Conference Heading Into November

The post Markets Eye a Data-Heavy Week Ahead With Inflation, PMI Data and Fed Crypto Conference Heading Into November appeared on BitcoinEthereumNews.com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process—not noise. 👉 Sign up → By COINOTAG crypto market outlook: in the near term, Bitcoin and major altcoins are testing key levels as macro data shows inflation cooling and policy signals gaining clarity. The Fed’s Payments Innovation Conference underscores growing institutional interest in tokenized payments, supporting a cautious but constructive crypto market outlook. Regulatory signals from the Fed conference map a clear path for stablecoins and tokenized payments as the next growth drivers Bitcoin and major altcoins show price sensitivity to PMI and CPI data, with volatility likely around key macro releases On-chain metrics point to rising stablecoin demand and improving liquidity across DeFi, suggesting renewed institutional engagement crypto market outlook: data-driven analysis, macro context, and actionable insights for investors. Stay informed with COINOTAG’s timely coverage today. COINOTAG recommends • Professional traders group 💎 Join a professional trading community Work with senior traders, research‑backed setups, and risk‑first frameworks. 👉 Join the group → COINOTAG recommends • Professional traders group 📊 Transparent performance, real process Spot strategies with documented months of triple‑digit runs during strong trends; futures plans use defined R:R and sizing. 👉 Get…

Share

BitcoinEthereumNews2025/10/20 16:11

Share

What is HumidiFi? New DEX Tops Solana Charts with $1.1B Volume

With the Solana blockchain gaining traction in recent times, it has become a fertile ground for many new and innovative crypto projects to thrive. One of these new entrants is HumidiFi, which has only been in existence for a few months but has gained attention in the market as the top choice for many Solana users. What is HumidiFi? Launched in mid June 2025, HumidiFi is a decentralized exchange (DEX) platform on Solana with a few features that make it stand out from its competitors. Unlike many traditional Automated Market Makers (AMMs) with public liquidity pools, HumidiFi functions as a “dark pool” using proprietary (Prop AMMs or Dark AMMs) to execute trades privately. Solana Prop AMMs operate privately, using vault-based liquidity managed by a single market maker, without public interfaces or front ends available online. As a result, HumidiFi offers tighter spreads for users and reduced slippage, especially for large trades. It also integrates with aggregators like Jupiter. Hence, many large traders on Solana who do not want to reveal their moves on public order books have adopted HumidiFi as their go-to DEX for transactions. Over $1.1B 24-Hour Trading Volume Remarkably, the few-month-old decentralized exchange has made headlines as a significant force in Solana’s liquidity market. According to data from DefiLlama, HumidiFi has become the leading DEX on the Solana blockchain within the past 24 hours, with $1.103 billion in trading volume. It has surpassed many famous exchanges, including Meteora, which ranks second on the list with $1.07 million in trading volume. Raydium and Orca combined were unable to reach the same 24-hour trading volume as HumidiFi, as they only recorded about $921 million daily volume. Notably, this is not the first time HumidiFi has hit this milestone. In September 25, it witnessed its busiest trading day with approximately $2 billion in trading volume. According to Dune data, approximately one million traders have placed over 41.05 million trades on HumidiFi. Moreover, HumidiFi has also emerged as the leading DEX on Solana within the past seven days with $9.7 billion weekly volume. On the monthly side, activity by various traders on the platform has surpassed $30 billion. The post What is HumidiFi? New DEX Tops Solana Charts with $1.1B Volume appeared first on CoinTab News.

Share

Coinstats2025/10/20 16:15

Share