Crypto Markets Bled $900 Billion as Bitcoin Dumped to 3-Month Low: Weekend Watch

Bitcoin’s price went through a sudden and painful crash on Friday evening and Saturday morning, dropping to its lowest position since early July.

As this became the single-largest daily liquidation event with more than $19 billion wrecked, the total market cap plunged by $900 billion at one point.

BTC’s Crash

What a week it has been for the primary cryptocurrency. It all started on the right foot, with a surge past $124,000 last Sunday and up to $126,000 on Monday, which became a new all-time high.

The asset lost some traction in the following days, but remained steady above $120,000 and even $122,000 on Friday. Then came the Trump warning against China, and all hell broke loose.

At first, the POTUS alleged China was deceitful in certain cases, which is why he brought up the old-fashioned tariffs in play. Later, though, he doubled down by confirming that the US will impose a 100% tariff on Chinese products starting from November 1.

The effects on the over-leveraged crypto markets were profound. In just several hours, bitcoin plummeted from $122,000 to just over $101,000 on some exchanges, and $105,000 on others. This became its lowest price tag in over three months. The move south was followed by most altcoins, but more on that later.

The overall liquidations set a record at more than $19 billion in a day, with over 1.6 million traders getting wrecked.

BTC has recovered some ground and now sits around $112,000, but it’s still 8% down on the day. Its market cap has plunged to $2.235 trillion, while its dominance over the alts is at 58%.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

Alts’ Meltdown

While BTC’s crash was massive, it pales in comparison to what happened to some altcoins. Cardano’s ADA, for instance, nosedived by over 65% from top to bottom, dumping to a yearly low of under $0.30. Although most have moved off the lows marked earlier today, they are still down by substantial percentages.

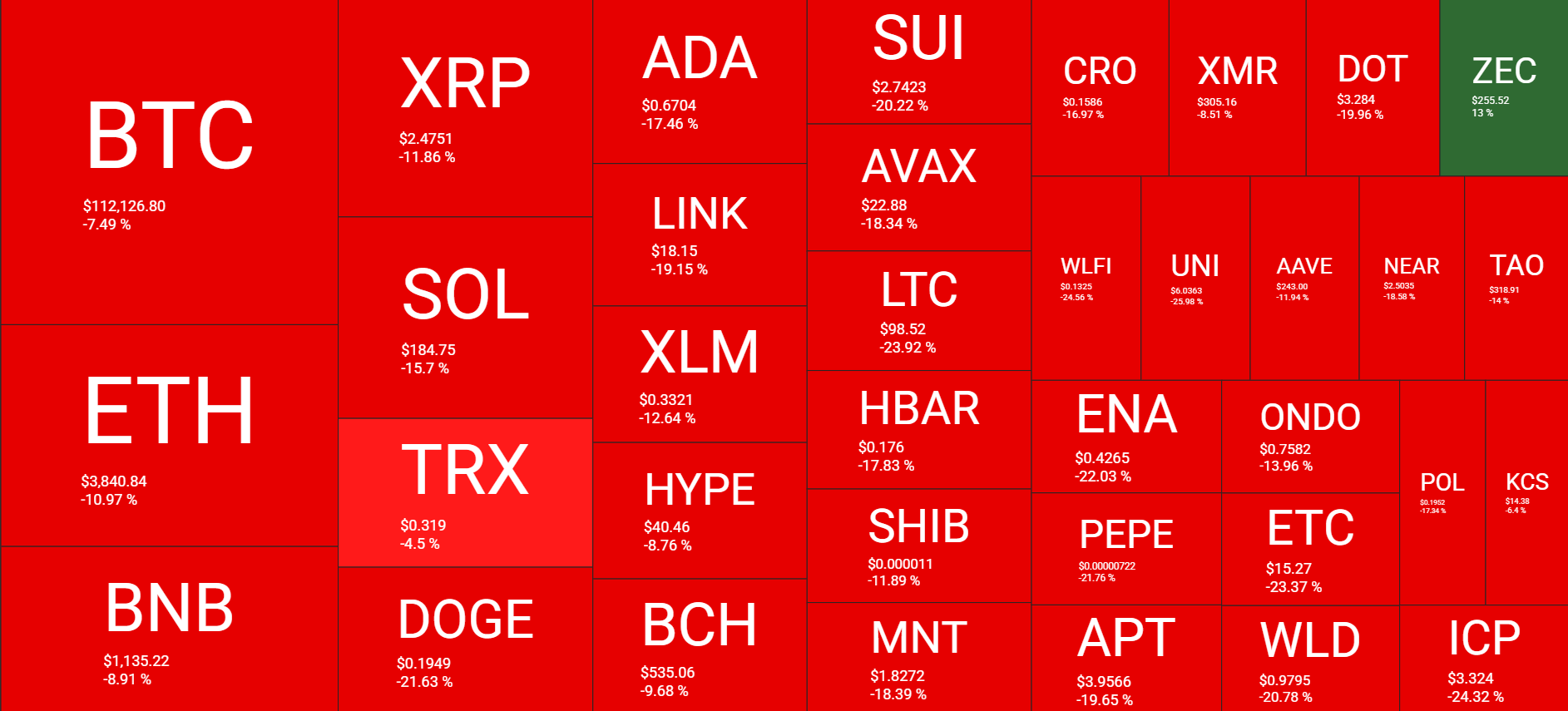

ETH (-11%), XRP (-12%), SOL (-16%), DOGE (-22%), LINK (-19%), XLM (-12.6%), and SUI (-21%) are some of the double-digit examples. ZEC is the only exception, having surged by 12% to $255.

The cumulative market cap of all crypto assets plunged by $900 billion during the darkest hours of the crash, dropping to $3.3 trillion. It has recovered a lot of ground to over $3.8 trillion now, but it’s still down by $400 billion since yesterday.

Cryptocurrency Market Overview Daily. Source: QuantifyCrypto

Cryptocurrency Market Overview Daily. Source: QuantifyCrypto

The post Crypto Markets Bled $900 Billion as Bitcoin Dumped to 3-Month Low: Weekend Watch appeared first on CryptoPotato.

You May Also Like

The Channel Factories We’ve Been Waiting For

Fed Decides On Interest Rates Today—Here’s What To Watch For