DeFi Autopsy Report: A Deep Dive into How Stream xUSD Went From "Stablecoin" to Off-Chain Ponzi Scheme

Author: Trading Strategy

Compiled by: Tim, PANews

Stream xUSD is a "tokenized hedge fund" masquerading as a DeFi stablecoin, claiming to operate using a delta-neutral strategy. Currently, this project is insolvent. Over the past five years, several projects have followed this model, attempting to drive their token growth through returns from delta-neutral investments. Successful examples include MakerDAO, Frax, Ohm, Aave, and Ethena.

Unlike many of its more purist DeFi competitors, Stream lacks transparency regarding its strategies and holdings. Portfolio tracking platform DeBank shows that only $150 million of its claimed total locked value is visible on-chain. In reality, Stream invested in off-chain trading strategies run by its proprietary traders, some of whom suffered margin calls, reportedly resulting in a $100 million loss.

1. CCN report points out

It should be noted that the $120 million hack that Balancer DEX suffered this Monday is unrelated to this.

Rumors suggest (which we cannot verify as Stream has not publicly disclosed this information) that the incident allegedly involves an off-chain trading strategy of "shorting volatility." In quantitative finance, "shorting volatility" refers to profiting when market volatility decreases, remains stable, or the actual volatility is lower than the implied volatility in the pricing of the financial instrument. If the price of the underlying asset fluctuates smoothly (i.e., in a low-volatility environment), the option may expire, allowing the seller to retain the premium as profit. However, this strategy is significantly risky; a sudden surge in volatility can trigger huge losses, often described as "picking up coins in front of a steamroller."

2. Detailed Explanation of Shorting Volatility:

We experienced such a surge in volatility on "Red Friday," October 10th. As market fervor surrounding Trump-related developments in 2025 continued to build, systemic leverage risk gradually accumulated in the crypto market. When Trump announced his new tariff policy on Friday afternoon, October 10th, panic gripped all markets, quickly spreading to the crypto market. In the midst of this panic, those who rushed to sell their available assets often gained an advantage. This sell-off ultimately triggered a chain reaction of liquidations.

Due to the long-term accumulation of leverage risk, systemic leverage has reached a high level, and the perpetual futures market lacks sufficient market depth to smoothly unwind and liquidate all leveraged positions. Under these circumstances, the automatic liquidation mechanism is activated, beginning to distribute losses among profitable traders. This further distorts an already volatile market.

3. What is an automatic position reduction mechanism ?

The market volatility triggered by this event is considered a once-in-a-decade event for the crypto market. While not unprecedented—a similar crash occurred in the early 2016 crypto market—most algorithmic traders' strategies were built on recent data of "stable fluctuations" due to a lack of reliable data at that time. Given the market's long absence of such dramatic volatility, even moderately leveraged positions of around 2x were not spared, ultimately resulting in numerous liquidations.

Maxim Shilo provides an in-depth analysis of the impact of this "Red Friday" event on algorithmic traders and the potential fundamental shift in trading patterns in the crypto market:

4. Shilo discusses how October 10th will change algorithmic trading in the crypto market.

Now, the first bodies of victims have emerged from the "Red Friday" attacks, and Stream is among them.

The fundamental definition of a delta-neutral fund is that it will not incur losses. If losses occur, it cannot be considered delta-neutral by definition. Stream promised to adopt a delta-neutral strategy, but secretly invested in proprietary, opaque, off-chain operational strategies. Delta-neutral strategies are not always black and white; hindsight is always 20/20. Many experts might argue that these strategies are too risky to be considered truly delta-neutral because they could be counterproductive, and this has proven to be true.

When Stream lost its principal in these failed trades, the platform became insolvent.

The DeFi sector is high-risk, and some losses are acceptable. As long as you eventually break even and achieve a 15% annual return, a 10% drop in account balance is not fatal. However, the problem lies in the fact that Stream has pushed leverage to the extreme through a "recursive loop" lending strategy with another stablecoin, Elixir.

5. What is a recursive loop?

6. How does Stream increase leverage and its leverage size ?

To make matters worse, Elixir, through an off-chain protocol, claims priority in recovering the principal of Stream in the event of its bankruptcy. This means that Elixir will recover more funds, while other DeFi investors in Stream will only recover less (or even lose everything).

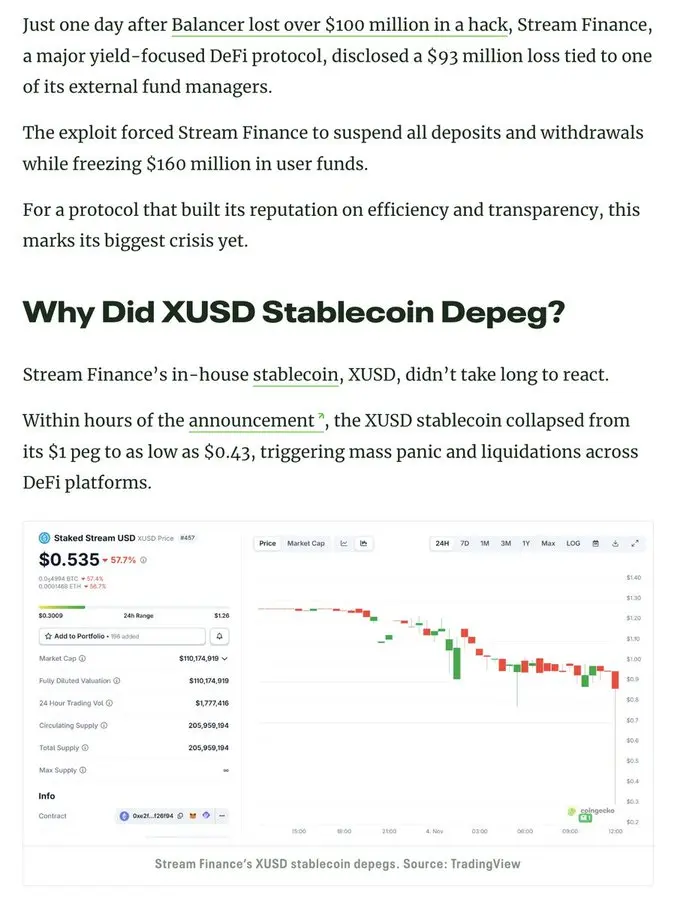

Due to a lack of transparency, the existence of recursive loops, and proprietary strategies, we are unable to know the actual scale of losses suffered by Stream users. Currently, the price of Stream's xUSD stablecoin has fallen to $0.6 per unit.

Because this matter was not disclosed to these DeFi users, many users are now extremely indignant towards Stream and Elixir: they not only suffer financial losses, but are also forced to share the losses to ensure that wealthy Americans with Wall Street backgrounds can preserve their profits.

This incident also impacted the loan agreement and its management:

"Everyone who thinks they are taking out a secured loan on Euler is actually participating in unsecured lending through a proxy," says Rob from infiniFi.

Furthermore, given Stream's lack of transparency regarding its positions and profit/loss status, or the absence of on-chain data, users have begun to question whether Stream has fraudulently misappropriated user profits for its management team. Stream's xUSD stakers rely on self-reported "oracle" data to generate returns, and third parties cannot verify the accuracy or fairness of these calculations.

How to deal with it?

Such Stream events could have been avoided, especially in emerging industries like DeFi. While "high risk, high reward" is a timeless principle, the key is to understand that risk is not homogeneous, and some risks are simply unnecessary. Several reputable liquidity mining, lending, and stablecoin (essentially tokenized hedge funds) protocols already maintain transparency in their risk exposure, investment strategies, and positions, making them worthy of market attention.

Stani, founder of Aave, discussed the timing of DeFi governance and excessive risk-taking, and shared his views on recent events that have brought DeFi risks to the forefront:

You May Also Like

Fetch has sued Ocean and its founders, accusing them of undermining DAO governance by selling 263 million FET tokens without authorization.

The Elite Advisory Board Raising the Bar for Crypto Credibility!