Ethereum Whales Double Holdings: $2.5B Accumulation Sparks Supply Shock

The post Ethereum Whales Double Holdings: $2.5B Accumulation Sparks Supply Shock appeared first on Coinpedia Fintech News

Ethereum whales have quietly launched their most aggressive buying spree in years. Data from Glassnode and Lookonchain shows that wallets holding between 1,000 and 10,000 ETH added 818,410 ETH worth $2.5 billion in just four months, effectively doubling their holdings. This is the largest accumulation campaign since the 2018 bear market bottom.

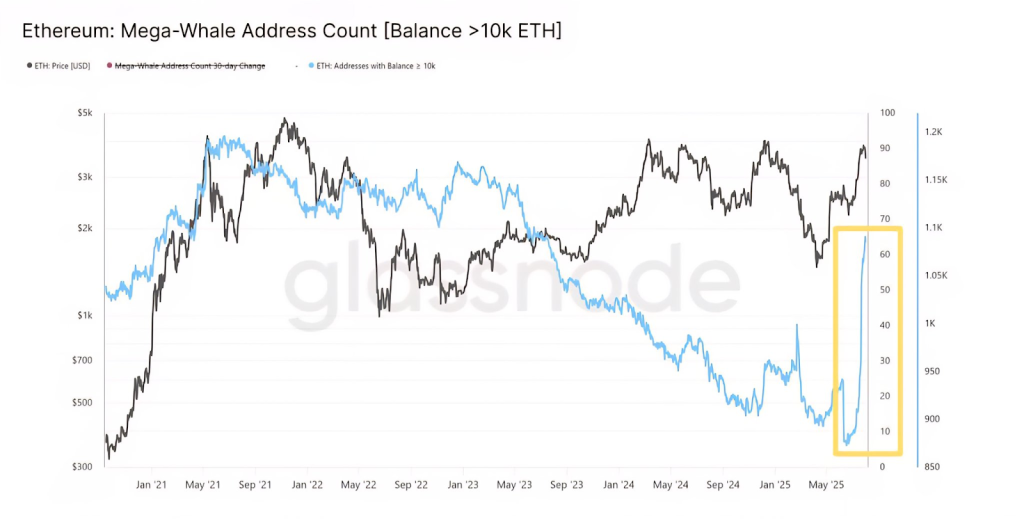

Not only mid-tier wallets but also mega-whale wallets holding over 10,000 ETH have grown to ~1,200 addresses, a level not seen since the 2021 bull run. This suggests long-term investors and institutions are preparing for a new phase of growth.

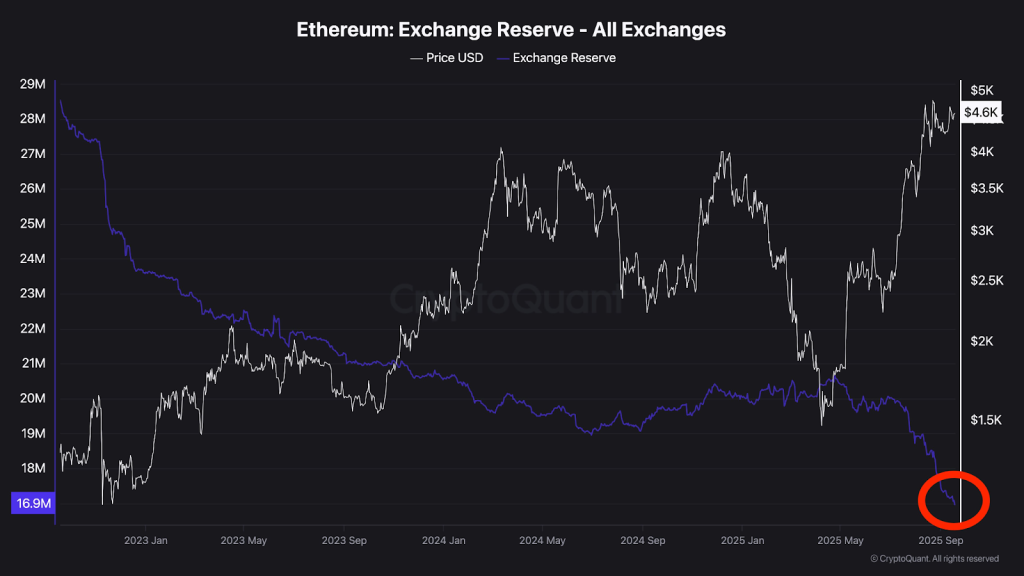

Ethereum Exchange Reserves at Multi-Year Lows

On-chain data shows Ethereum exchange reserves have fallen to their lowest level in years, creating what experts call a real supply shock. With fewer coins available on exchanges and steady buying pressure from whales and institutions, scarcity is building into the market.

The trend mirrors the 2018 cycle, when Ethereum whales heavily accumulated at the market bottom. That phase preceded ETH’s meteoric rise from $80 to $4,800. Current behavior suggests whales are once again betting on a similar outcome.

- Also Read :

- Major ‘Solana Season’ Milestones: Is $300 in Sight for SOL?

- ,

Institutional Inflows Add Momentum

Ethereum ETFs have already recorded over $1 billion in net inflows, confirming growing institutional interest. Combined with whale buying, regulatory clarity, and Ethereum’s fundamentals, the setup points toward major price discovery.

Can Ethereum Break Into Five Digits?

Ethereum is currently priced around $4,410, just 9% below its all-time high. Analysts suggest that if whale activity follows the 2018 pattern, ETH could surge into five-digit territory, with Tom Lee predicting the ETH Price to range between $15,000 and $25,000 by 2025.

Ethereum whales and institutions are accumulating at their fastest pace since 2018. With exchange reserves shrinking and demand surging, the stage may be set for an explosive rally similar to past cycles.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The data shows this is the largest accumulation since 2018. Whales and institutions are likely betting on a new growth phase, driven by low exchange reserves and rising institutional interest.

Analysts suggest that if the current accumulation trend follows the 2018 pattern, ETH could surge into a new price range. Tom Lee has predicted a range of $15,000 to $25,000.

You May Also Like

5 Best Crypto Investments for Small Budgets: Why Ozak Al at $0.012 Is the Hottest Pick Under $0.01

Coinbase’s CEO Armstrong Highlights Support for Crypto Clarity Act